U.S. LNG FOR EUROPE

PLATTS - 31 Oct 2023 - As war and geopolitical tensions continue to top the global agenda, European officials are looking to US LNG supplies to help meet their energy security needs while also working to hit emissions reduction targets.

The global oil and natural gas markets remain marked by the loss of large quantities of Russian supplies, tight market balances and volatile prices, with the Israel-Hamas war and related Middle East tensions threatening further disruptions. Though the European energy situation has improved greatly from the early days of Russia's invasion of Ukraine, the region's short- and medium-term future continues to be characterized by great uncertainty, European officials said while speaking at events in Washington.

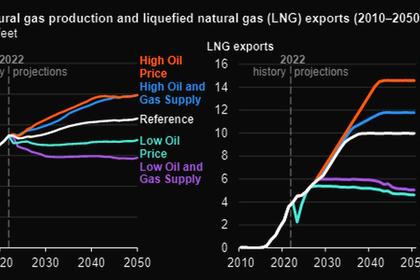

"Europe's import needs are expected to remain high for years to come, as the gas production in Europe is expected to decline further," Norwegian Minister of Petroleum and Energy Terje Aasland said Oct. 31 at an event hosted by the Center for Strategic and International Studies.

"Together with Norwegian gas, American LNG has proven to be a reliable and steady source of supply for Europe and will contribute to Europe's energy supply security," Aasland said.

European Commission Director-General for Energy Ditte Juul-Jorgensen commented during a fireside chat with the Atlantic Council Oct. 30 that "the transatlantic cooperation has been absolutely critical for our energy security and for global stability, more generally."

Both shot back at criticism that continued investment in oil and gas would stand in the way of constraining global temperature rise in contravention of the Paris climate agreement and the EU's goal to be climate-neutral by 2050..

Aligning infrastructure

"It's a fairly consistent picture that there will by 2050 be very, very little fossil energy in the system ... but between now and 2050, we're going to continue to need molecules in the system," Juul-Jorgensen asserted. "When we get on the other side of 2050, the question will then be will we be able to remove the carbon from any fossil fuel that is left in the system. I'm not going to speculate on that. What is very clear is we are going to need to import energy over the coming decades."

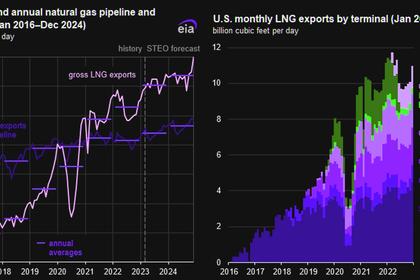

As that relates to the US-EU relationship, US LNG exports have kept the lights on as Europe shifts away from piped gas from Russia.

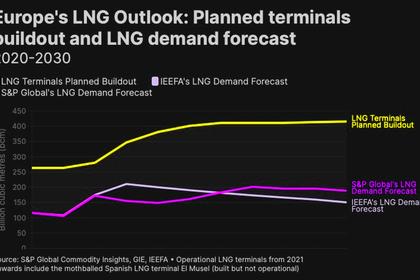

"What we have done on the import side is to make sure that the infrastructure we have is aligned with that new picture," Juul-Jorgensen said. "That means we have invested significantly in LNG import facilities and we have made some limited investments in the infrastructure so that the gas can flow no longer from east to west but ... we can secure energy across the EU."

She added that she hopes to see the US make "needed investments into export capacity" to meet demand needs and ensure a stable global LNG market for the coming decades.

Juul-Jorgensen seemed to downplay concerns that US politics and an aggressive environmental push could jeopardize continued US LNG exports to Europe, especially as it prepares for another "crisis winter."

She pointed to the success of the US-EU Task Force on Energy Security in responding to gas supply challenges with coordination and a common response.

"In our conversations with the Biden administration, we have very good cooperation, very close conversation, and we've seen that our joint engagement has worked well," she said.

Power, capital and competence

Norway's Aasland contended that the oil and gas industry was poised to play a key role in achieving the world's climate ambitions.

With oil and gas companies raking in record profits from the fuel price spikes spurred by geopolitical rifts, Aasland said the sector has a duty to "transfer the income into new technology, taking more risks ... to cut emissions and to bring new solutions to the table." He commended the companies that have taken steps in that direction.

"I have said to the oil and gas industry in Norway a lot of times, every problem in the 50-year history of oil and gas in Norway ... has been solved ... [with] a commercial-driven solution," he said, adding that the industry has the power, capital and competence to not only aid the buildout of renewables but to also "find new decarbonized solutions for how we use oil and gas."

Aasland argued that adequately meeting energy demand and mitigating climate change would ultimately come down to addressing three challenges: energy security, emissions reduction and energy affordability.

Strong energy security must be maintained through investments in greater production capacity; emissions from fossil fuels use must be slashed while more renewable energy is put on the system; and energy prices must be kept affordable to ensure consumer buy-in of the energy transition, he said.

For its part, Aasland said that Norway is boosting oil, gas and offshore wind development on the Norwegian continental shelf.

For instance, the area is home to the world's largest floating offshore wind facility -- Equinor's Hywind Tampern farm, which powers nearby oil and gas platforms, reducing the carbon intensity of production.

Aasland noted that Norway imposes a high tax on carbon emissions from the oil and gas sector, which prompted the industry to look for ways to electrify production and take other steps to cut its carbon footprint.

-----

Earlier: