2023-11-23 06:30:00

VENEZUELA'S DEBT OVERVIEW

By Morgan Stanley, Oct 30, 2023 - Venezuela Debt: A Refresher

The debt:

- High external debt:Venezuela’s external debt stands at around US$167 billion, around 175-225% of GDP.

- External bonds 54% of total:External bonds make up US$59 billion in principal and around US$90 billion once arrears are added.

- All in default:All bonds are currently in default and assigned zero weights in the main EM bond index.

- Index re-weighting the key near-term event:However, the index may re-weight the bonds as liquidity picks up, leading to around US$1.5 billion of market value in potential buying.

Bond-Level Considerations

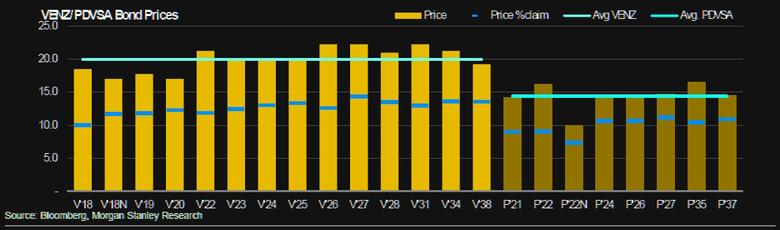

- Seven key bond drivers:At a bond level, we see seven key drivers when it comes to differentiating between bonds –whether it’s VENZ/PDVSA, the size of the claim, potential statute of limitation issue, CAC strength, collateral, real money holdings and the potential size in the index.

- Assessing total claims is the most important one:We suggest that a starting point for valuations is looking at bond prices versus claims, given the significant arrears that leave individual bonds with claims between 132-184. After that further adjustments can be made depending on individual bond features.

- Upside remains in the near term: This means that even with conservative near-term price/claims levels of 15 and 13 for VENZ and PDVSA, respectively, bond prices may reach 24 and 18.5 on average for VENZ and PDVSA.

- Bond preferences:Near term, we favour PDVSA over VENZ given the current price difference, with PDVSA 12.75% 22, VENZ 2022 and VENZ 2026 preferred bonds.

Debt Outstanding

We estimate Venezuela’s external debt stands at around US$167 billion. The majority is from the sovereign at US$107 billion, with PDVSA adding US$59 billion and ELECAR another US$1 billion. 21% is arrears due to missed interest payments.

- Difficult to collect data leading to clear uncertainty as to final amounts: With no real data published since 2019, or earlier, it’s hard to establish exact claims. The numbers here use our own calculations for bonds and a mix of old data and local consultants for the rest. In an eventual restructuring, there is likely to be a lot of time dedicated to determining the admissibility of claims and reconciling them.

- External bonds make up US$90 billion, or 54% of the total:The external bonds are from Venezuela sovereign (VENZ), Petroleosde Venezuela (PDVSA) and Electricidadde Caracas (ELECAR). US$59 billion is the principal outstanding with another US$31 billion in arrears given most bonds have been in default since 2017.

- Other sovereign debt:Bilateral debt is largely due to Russia while multilateral debt is with IDB and CAF. The debt to China is very hard to track due to multiple renegotiations and also still some ongoing repayments via oil sales. Finally, the arbitration claims via ICSID are made up of US$14.5 billion that have already seen rulings and another US$16.6 billion in pending cases (hard to assess final number).

- PDVSA debt:Outside of the bonds, PDVSA has a mix of debt via loans, promissory notes, supplier debt and others.

- No real domestic debt:While domestic debt tends to be less important in sovereign restructurings, although not always, in this case it will not be important given that it has nearly been entirely inflated away at this point.

- We also ignore private sector FX claims:There is likely around US$6.5 billion in debt from private sector FX claims from arrears in the Cadivi/Concoexmechanisms, yet we doubt they will be included in an eventual debt restructuring.

- Debt/GDP likely around 175-225% of GDP:GDP is also unknown but generally seen to be around US$75-95 billion in 2023, leaving debt/GDP at 175-225% of GDP.

Bond Overview| Summary

There is US$58 billion in outstanding external bonds across VENZ/PDVSA, with another US$31 billion in past due interest to leave the total claim at US$89 billion. We see seven key differentiating aspects between the bonds.

- US$31 billion in VENZ bonds, US$27 billion in PDVSA, all in default: We show 23 bonds in most tables. This excludes VENZ 2036 which was issued domestically yet never sold abroad so unlikely to enter any restructuring. For ease, we combine the two separate issuances (and ISINs) of VENZ 13.625% 2018. We also do not focus on the single issue from ELECAR. All bonds are in default, with all seeing the last coupon made in 2017 apart from PDVSA 2020 that defaulted in 2019.

- The rest of the presentation goes into more detail on multiple matters yet in the end we think markets will use seven different aspects to differentiate across the bonds, with the following page detailing how it impacts each bond.

- VENZ/PDVSA: Very important:Unsurprisingly this will be a key differentiator. An eventual restructuring process is likely to be very different for the two entities, with VENZ looking like a more ordinary sovereign debt restructuring while PDVSA likely has to go through an insolvency procedure and reorganisationto settle all claims. While this doesn’t prevent recovery rates eventually being similar, the process will likely be very different.

- The total claim: Very important: The bonds have very different coupons and claims thus accrue at very different rates. A restructuring can choose to ignore this but we think it will matter, especially given the size.

- Statute of limitation/maturity: Moderately important: The actual prescription period is not 100% clear, yet for now the assumption should be that it has been handled by legal representatives of both sides.

- CAC strength:Moderately important:They differ materially across bonds and will drive pricing in the near term yet in the end we think it’s unlikely to lead to materially different recovery values.

- Collateral:Very important:As the only one, PDVSA 2020 is collateralisedby 50.1% of Citgo Holdings.

- Real money holdings as % outstanding: Moderately important: Since this can give an idea of where demand will be higher for certain bonds in the near term, it can matter for differentiating between bonds.

- Potential share in the index:Important near term:In particular, we think it’s important to track the bonds that potentially would not qualify for index inclusion, even as all the other bonds are re-weighted.

-----

Earlier:

2023, November, 17, 06:55:00

INDIA'S OIL DIVERSIFICATION

Oil ministry officials said India diversified its sources to import crude from as many as 39 nations and hoped the return of OPEC member Venezuela would add to the country's list of steady suppliers.

2023, November, 3, 06:45:00

INDIA NEED VENEZUELA'S OIL

India, the world's third biggest oil importer and consumer, ships over 80% of its oil needs from overseas and wants to cut its crude import bill.

2023, November, 3, 06:40:00

VENEZUELA: LIFTING SANCTIONS

However, there are growing signs of a thaw in relations between the Biden administration and Caracas, with the sides holding talks to explore temporarily lifting sanctions to encourage Venezuela to hold competitive presidential elections next year.