EUROPE WITHOUT RUSSIAN GAS

PLATTS - 23 Feb 2023 - On March 8 last year -- two weeks after Moscow launched its invasion of Ukraine -- the European Commission outlined plans to significantly reduce the EU's dependence on Russian gas.

As part of its REPowerEU strategy, the EC said it would aim to cut imports of Russian gas by two thirds by the end of 2022 from 155 Bcm the previous year.

Before the invasion, the idea that Europe could live without Russian gas seemed almost impossible, but attitudes were quick to change.

"By the end of this year, we can replace 100 Bcm of gas imports from Russia -- that is two thirds of what we import from them," EC Executive Vice-President Frans Timmermans said March 8.

"This will end our over-dependency and give us much-needed room for maneuver. It is hard -- but it is possible," Timmermans said.

What happened next seemed to resemble a political thriller novel more than real life.

First Moscow changed gas payment terms and cut off a number of EU countries for their refusal to comply, followed by Gazprom ultimately blaming a small oil leak in a gas turbine for ending gas supplies to Germany via Nord Stream.

Then in late September, both strings of Nord Stream were hit by a suspected sabotage attack -- the cause of which is still under investigation -- rendering the system unusable.

Gas diversification

What was initially an EU initiative to cut Russian imports ended up being as much down to Moscow's supply curtailments as it was Europe's own efforts to diversify away from Russia.

But the result, in the end, was that Europe did cut its dependence on Russian gas, although not quite to the extent that Timmermans had hoped.

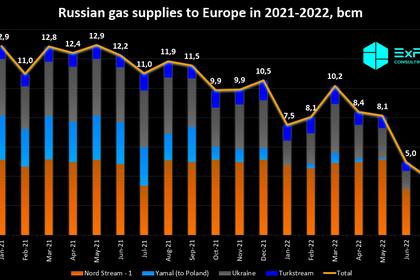

According to S&P Global Commodity Insights data, Russian pipeline volumes to Europe came in at just under 62 Bcm last year, a 78 Bcm decline year on year.

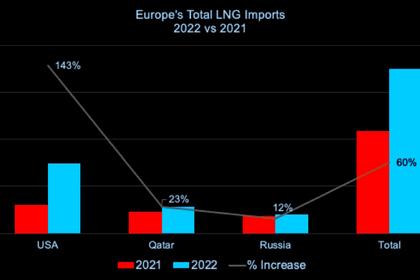

At the same time, Russian LNG imports into the EU rose by around a third to 14.1 million mt (19 Bcm), but it was LNG from other sources -- the US in particular -- that helped fill some of the gap left by lost Russian gas.

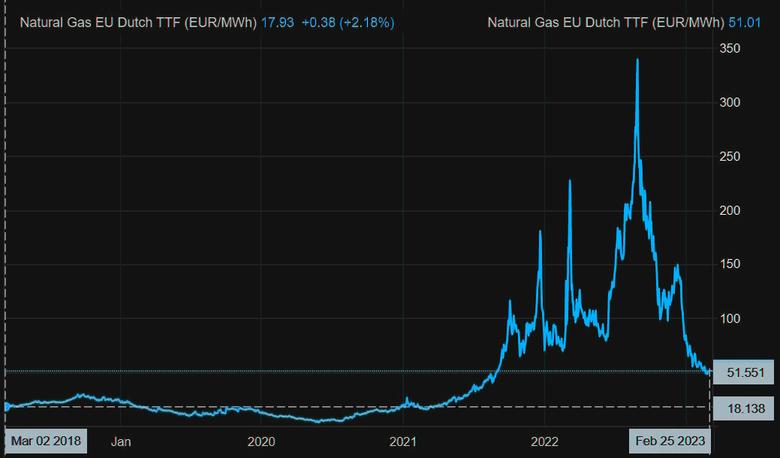

What also helped were significant demand reductions -- largely driven by record high gas prices -- and a huge stock build.

Platts, part of S&P Global Commodity Insights, assessed the benchmark Dutch TTF month-ahead price at an all-time high Eur319.98/MWh ($338/MWh) on Aug. 26, leading to price-related consumption cuts.

Prices have fallen sharply since thanks to a continuation of high LNG imports, robust storage levels and demand curtailments, with Platts assessing the TTF month-ahead price on Feb. 22 at Eur49.63/MWh.

All three factors were in some way the result of action by the EC and national governments, with the EU agreeing mandatory storage targets and voluntary demand cuts, as well as forming pacts with LNG suppliers such as the US.

Jonathan Stern, leading gas analyst from the Oxford Institute for Energy Studies, said there had been a major increase in state intervention last year, which also included the EU's gas market correction mechanism and joint purchasing scheme.

These interventions, Stern said, "have already impacted -- and if prolonged will further reverse -- European gas market liberalization which required 30 years to achieve."

"We already see many governments happy to abandon gas market competition and put greenhouse gas reduction efforts on hold to prioritize government-dictated security of supply measures," Stern told S&P Global Commodity Insights.

Winter test

While Europe was able to make it through the current winter, this was in part thanks to the fact that stocks were rebuilt while Russian gas imports remained robust in the spring and early summer of 2022.

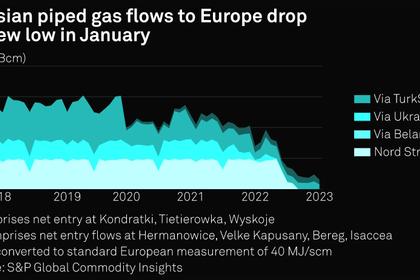

This year will be different, with S&P Global analysts expecting a further loss of 35 Bcm of Russian pipeline supply.

Russian deliveries into Europe are currently limited to flows via Ukraine entering at the Sudzha point on the Russia-Ukraine border and via the European string of the TurkStream pipeline.

"In 2023, Europe will likely, for the first time, need to survive a full calendar year with only minimal volumes of Russian pipeline gas," S&P Global analysts Michael Stoppard and Alun Davies said in a recent report.

"The test will be to restock in the second and third quarters and then potentially to pass a winter with less favorable weather conditions than winter 2022/23," they said.

Then there is the question -- asked regularly by European gas market observers -- about whether Russian gas could ever recover market share in Europe.

"The politically correct answer is that Russian pipeline gas exports to Europe will be phased out by the end of the decade," Stern said.

"But if a number of political conditions are met in relation to some form of settlement in Ukraine, then some partial increase in the current level of flows -- particularly under long-term contracts that are still in force -- may be possible via the existing Ukrainian and TurkStream routes," he said.

But, Stern said, what was clear was that Russian pipeline gas will never return to its previous export level of up to 200 Bcm/year.

"No new long-term contracts will be signed but short-term and spot purchases could be possible within defined limits," he said.

The extent to which Europe would allow larger volumes of Russian gas to return would also depend on the success of political overtures to other pipeline suppliers as well as existing and new LNG suppliers, Stern said.

-----

Earlier: