GLOBAL OIL GAS CHANGES

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

GLOBAL OIL GAS CHANGES

By CHARLES FORSBERG Principal Research Scientist, MIT

ENERGYCENTRAL - Feb 6, 2023 - There is a negative-carbon road ahead for the gas and oil industry. Our studies and workshops show we can replace all crude oil with cellulosic biomass (corn stover, forest debris, etc.) liquid drop-in hydrocarbons if the conversion process uses massive external sources of heat and hydrogen. Current biofuels strategies use biomass as (1) a carbon source for the liquid hydrocarbon product, (2) a carbon source to remove the oxygen that is 40% of the biomass as carbon dioxide, (3) a hydrogen source for the liquid hydrocarbon and (4) an energy source to operate the process. As a consequence, no more than a third of oil demand could be met by conventional biofuels strategies. If use massive quantities of external hydrogen and heat, then sufficient cellulosic biomass to replace all crude oil, sequester carbon and enable a more sustainable agriculture—without significant changes in food and fiber prices. Cellulosic biomass becomes primarily a carbon source. We through away the campfire model of biofuels processing.

Heat is provided by nuclear reactors at large-scale bio-refineries (250,000 barrels per day) that will likely be existing oil refineries with changes in the front end. In the near-term, the low-cost low-carbon hydrogen is from natural gas with sequestration of the carbon dioxide byproduct--the low-cost option today. Exxon recently announced a project to produce a billion cubic feet of hydrogen per day with 98% of the carbon sequestered. That carbon footprint is very similar to wind and solar hydrogen that have large amounts of embedded carbon dioxide in them from the manufacturing process. In the longer term, hydrogen from nuclear, wind or solar. Our most recent paper in Hydrocarbon Processing [ Can large integrated refineries replace all crude oil with cellulosic feedstocks for drop-in hydrocarbon biofuels? (hydrocarbonprocessing.com) ] provides the details for such a transition by the oil and gas industry.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

-----

Earlier:

2023, February, 10, 12:25:00

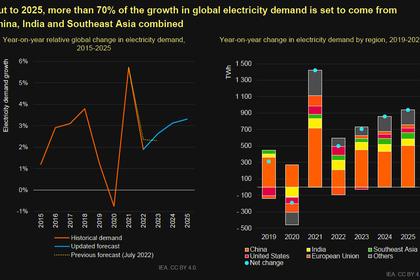

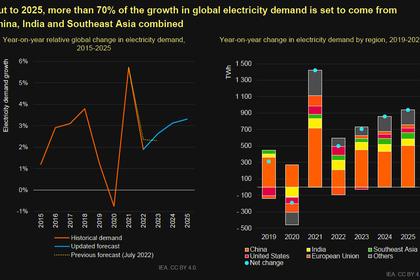

GLOBAL ELECTRICITY DEMAND UP

World electricity demand remained resilient in 2022 amid the global energy crisis triggered by Russia’s invasion of Ukraine. Demand rose by almost 2% compared with the 2.4% average growth rate seen over the period 2015-2019.

2023, January, 30, 11:30:00

GLOBAL ENERGY TRANSITION FOR PEOPLE

As the world seeks to address climate and biodiversity challenges and move to clean energy solutions for example, these will deliver impacts within the workplace.

2023, January, 16, 13:00:00

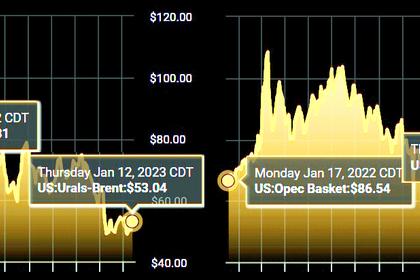

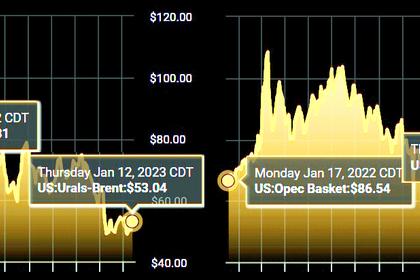

GLOBAL OIL MARKET IS STABLE

The OPEC+ Joint Ministerial Monitoring Committee, on which Mazrouei sits, is co-chaired by Saudi energy minister Prince Abdulaziz bin Salman and Russian Deputy Prime Minister Alexander Novak.

2023, January, 9, 12:20:00

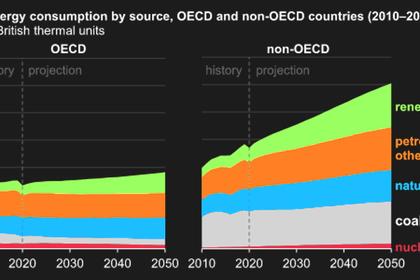

GLOBAL ENERGY TRENDS 2023

Electric utilities are facing a future of increased competition, disruptive technologies, and changing customer demands.

2022, December, 16, 12:40:00

GLOBAL OIL DEMAND UP BY 2.3 MBD

The IEA predicts oil demand will rise by 2.3 million b/d in 2022 and by a further 1.7 million b/d in 2023, noting the contrast between strong gasoil and diesel use, especially in non-OECD economies, and weak petrochemical consumption in Europe and Asia.

2022, November, 21, 10:50:00

GLOBAL ENERGY TRANSITION DOESN'T WORK

Comparing a Solar Variable Renewable Energy Farm to an On-Demand Base Load Coal Fired Power Station is like saying you can use tomato sauce to replace vegetables.

2022, November, 1, 17:10:00

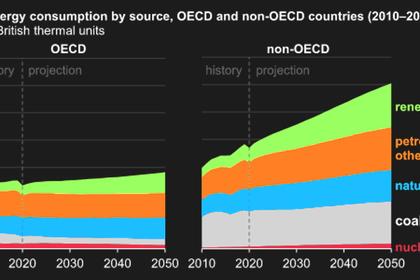

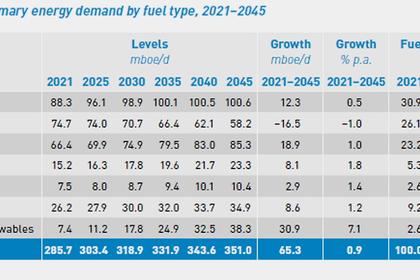

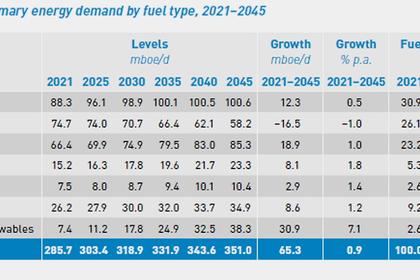

GLOBAL ENERGY DEMAND WILL UP BY 23%

Global primary energy demand is forecast to continue growing in the medium- and long-term, increasing by a significant 23% in the period to 2045. The world needs to annually add on average 2.7 million barrels of oil equivalent a day to 2045.

All Publications »

Tags:

OIL,

GAS,

CLIMATE,

ENERGY TRANSITION,

ENERGY,

RENEWABLE

-----