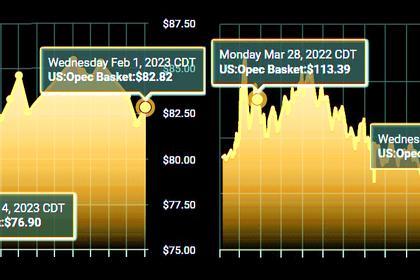

OIL PRICE: BRENT NEAR $80, WTI ABOVE $73

REUTERS - Feb 6, 2023 - Oil prices inched up on Monday after falling 8% last week to more than three-week lows as concerns that slower growth in major economies may limit fuel consumption outweighed signs of a demand recovery in China, the world's top oil importer.

Brent crude futures rose 32 cents, or 0.4%, to $80.26 a barrel at 0700 GMT, while U.S. West Texas Intermediate (WTI) crude futures climbed 22 cents, or 0.3% higher, to $73.61.

Last Friday, WTI and Brent slid 3% after strong U.S. jobs data raised concerns that the Federal Reserve would keep raising interest rates, which in turn boosted the dollar. The stronger greenback typically reduces demand for dollar-denominated oil from buyers paying with other currencies.

While recession fears dominated the market last week, on Sunday International Energy Agency (IEA) Executive Director Fatih Birol highlighted that China's recovery remains a key driver for oil prices.

The IEA expects half of global oil demand growth this year will come from China, where Birol said jet fuel demand was surging.

He said depending on how strong that recovery is, the Organization of Petroleum Exporting Countries (OPEC) and allies, together called OPEC+, may have to reassess their decision to cut output by 2 million barrels per day through 2023.

"If demand goes up very strongly, if the Chinese economy rebounds, then there will be a need, in my view, for the OPEC+ countries to look at their (output) policies," Birol told Reuters on the sidelines of a conference in India.

Higher interest rates, however, are keeping a lid on further price gains, as they are likely to curtail economic growth and increases in fuel demand, say analysts.

"We are not seeing any big evidence of a China domestic demand rebound yet, though mobility numbers are encouraging. Hence, concerns about central banks' rate hike cycles and higher for longer interest rates remains the key drag on oil prices after falling more than 7% last week," said Suvro Sakar, lead energy analyst at DBS Bank.

"It's not immediately intuitive that good jobs data would cause a crash in oil prices, but such are the vagaries of the market currently."

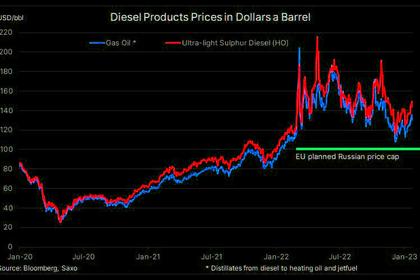

Price caps on Russian products also took effect on Sunday, with the Group of Seven (G7), the European Union and Australia agreeing on caps of $100 per barrel on diesel and other products that trade at a premium to crude, and $45 per barrel for products that trade at a discount, such as fuel oil.

"For the moment, the market expects non-EU countries will increase imports of refined Russian crude, thus creating little disruption to overall supplies," ANZ analysts said in a client note.

"Nevertheless, OPEC's continued constraint on supply should keep the market tight," they said.

Saudi Arabia's energy minister also warned over the weekend that sanctions and underinvestment in the energy sector could result in a shortage of energy supplies.

-----

Earlier: