OPEC+ IS CAREFUL

PLATTS - 05 Feb 2023 - Saudi Arabia is waiting for clearer signs of rising oil demand before committing to hike crude production with its OPEC+ counterparts, its energy minister said, while also warning that current global geopolitics and a lack of industry investment could create supply shortages.

China's reopening and encouraging economic data from some major consuming countries in recent weeks have prompted some oil market forecasters to project firmer demand in the coming months, but Prince Abdulaziz bin Salman told an energy economics conference in Riyadh that he was yet to be convinced.

"With all due respect, forecasters are good forecasters. They do their best but not necessarily what they forecast happens as a reality. So, if people can adapt it to my other mode, which is, ‘I will believe it when I see it, and then take action' -- it's a much more profound, self-assuring, cautious approach," he said late Feb. 4.

He added that the market should trust the OPEC+ alliance's stewardship of the market.

The minister's comments follow the Feb. 1 recommendation by a key OPEC+ advisory committee for the alliance to maintain current output quotas.

OPEC+ is a 23-country bloc of oil producing countries co-chaired by Saudi Arabia and Russia. It agreed in October to slash quotas by 2 million b/d from November until the end of 2023.

The group's cautiousness comes against a backdrop of continued risk of a global recession as well as rising COVID-19 cases in China, which could dampen consumption in the world's largest oil importer.

Analysts with S&P Global Commodity Insights said they expect global oil supply to exceed demand through May, leading to inventory builds that could cap the upside for crude prices, which have retreated in recent days after beginning 2023 with bullish momentum.

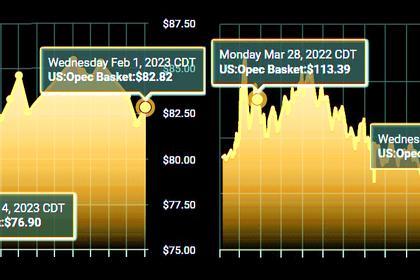

Platts, part of S&P Global, assessed Dated Brent at $80.62/b on Feb. 3, down from the benchmark's eight-week high of $88.21/b on Jan. 23.

"All of these so-called sanctions, embargoes, lack of investments…will all convolute into one thing and one thing only -- lack of energy supplies of all kinds when it is most needed. That is my worry, and that is something I don't want to be responsible for," he said, in response to a question on the impact of western policies on the oil market, including measures targeting Russia and energy transition pressures.

Supply security

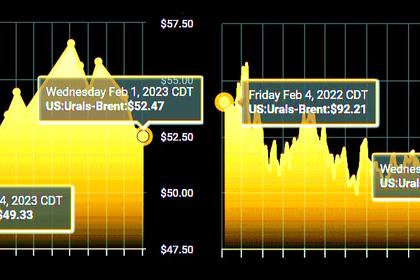

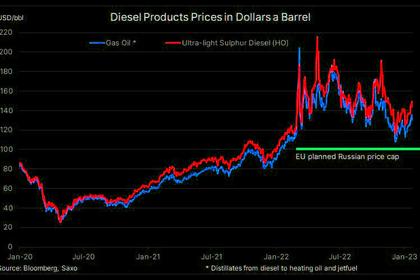

The G7 on Feb. 3 announced its long-awaited price caps on Russian fuel products, which go into effect Feb. 5. The move follows caps enforced in December on the sale of Russian crude. Both actions are meant to limit the revenue Moscow can accrue from energy exports as part of the West's broader multilateral response to Russia's invasion of Ukraine.

The price cap was set at $100/b for the sale of refined products that trade at a premium to crude, particularly diesel. Products that trade at a discount, such as fuel oil and naphtha, are capped at $45/b.

The EU is also banning the import of Russian refined products from Feb. 5, having already imposed a similar prohibition on Russian crude in December.

The combined measures are expected to cause Russia to cut oil production by 500,000 b/d by March, according to S&P Global Commodity Insights, though about 270,000 b/d of that will return by the end of 2023 as the market finds ways to overcome logistical hurdles in trading and shipping Russian barrels.

"Admittedly, losses could be even shallower, given many months for Russia to prepare," S&P Global analyst Paul Sheldon wrote in a Feb. 3 note. "Higher disruptions are also possible if sanctions tighten, including price caps set above market levels. Thereafter, a war escalation could plausibly create political pressure for secondary sanctions, especially if prices soften."

Prince Abdulaziz noted that distortions in some markets can have ripple effects across other commodities. He said his warnings about the impact of the sanctions were not political but rather rooted in the practical impacts on the market, and added that Saudi Arabia was supplying Ukraine with LPG.

"I don't get into this sanctions business. I focus on the reality of the day, with what is happening," he said. "As a responsible citizen of this world, I want to make clear that people understand -- what's going on today, I hope I am terribly wrong, I am not forecasting or projecting, but I hope that it would not lead to shortages of energy supplies -- not oil supplies, not gas supplies, but energy supplies, when it is most needed."

-----

Earlier: