QATARI LNG FOR CHINA

REUTERS - Feb 13, 2023 - China National Petroleum Corp (CNPC) is close to finalising a deal to buy liquefied natural gas (LNG) from QatarEnergy over nearly 30 years from the Middle Eastern exporter's massive North Field expansion project, three people with knowledge of the matter said.

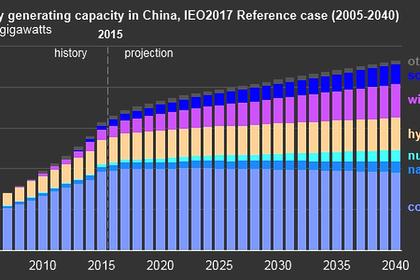

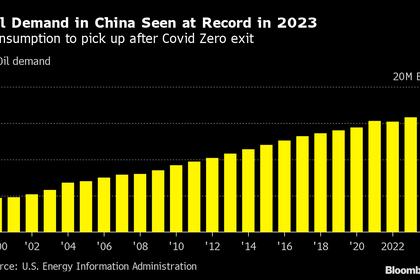

If sealed, this would be the second such deal between major LNG exporter Qatar and the world's no.2 LNG buyer, as Beijing looks to beef up gas supply and diversify its sources in a drive to replace coal and cut carbon emissions.

CNPC's talks follow a deal announced last November by China's Sinopec, in which QatarEnergy agreed to supply 4 million tonnes of LNG annually for 27 years, the longest duration LNG supply contract ever signed by Qatar.

"CNPC has agreed on the major terms with Qatar in a deal that will be very similar to Sinopec's," said a Beijing-based state-oil official who declined to be named as he is not authorised to speak to the media.

CNPC declined to comment. QatarEnergy did not respond to a request for comment.

"This is a good move for CNPC, securing additional long term supply from a reliable and well positioned partner. This will further insulate from market volatility, diversify supply while optimising between the state owned units," said Toby Copson, global head of trading at Trident LNG.

Sinopec said in November the gas purchase agreement was part of an "integrated partnership", which indicated the Chinese firm could be considering acquiring a stake in Qatar's North Field expansion export facility.

The two companies have yet to announce any stake investment.

As Beijing's ties with the United States and Australia, Qatar's two biggest LNG export rivals, are strained, Chinese national energy firms increasingly see Qatar as a safer target for resource investment.

Sinopec and CNPC would not opt for such long-duration supply contracts unless they were also hoping to acquire small stakes in the North Field expansion export facility, a second Beijing-based state gas official said.

QatarEnergy has maintained a 75% stake overall in the North Field expansion, that will cost at least $30 billion, and could give up to a 5% stake to some buyers, QatarEnergy Chief Executive Officer Saad al-Kaabi has said.

Kaabi has said the state energy company is negotiating supply deals with many potential buyers and they would be announced when agreements are reached.

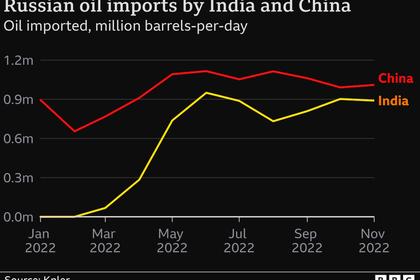

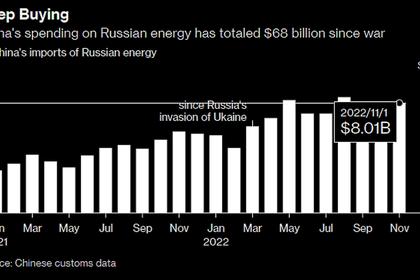

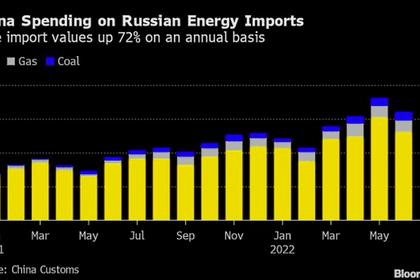

State-controlled CNPC, China's top gas importer, last year also stepped up gas imports from Russia, by pipeline and tanker, snapping up supply that was no longer going to Europe due to sanctions amid Moscow's war on Ukraine.

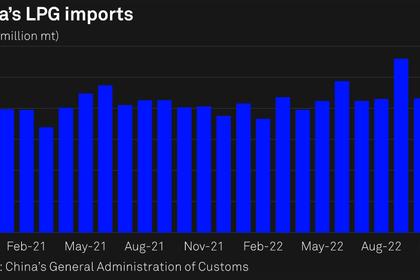

Chinese customs data showed the country's imports of Qatari LNG surged 75% last year from 2021 to 15.7 million tonnes, making up a quarter of the nation's total imports, while China's total LNG imports shrank nearly 20%.

In contrast, imports from Australia and the United States dropped 30% and 77% respectively from 2021, to 21.9 million tonnes and 2.09 million tonnes.

QatarEnergy last year signed five deals with international majors for the North Field project, a two-phase expansion plan that will boost Qatar's liquefaction capacity to 126 million tonnes per year by 2027 from 77 million tonnes.

Each of the five majors -- TotalEnergies , ExxonMobil, ConocoPhillips , ENI and Shell -- signed a joint-venture agreement with QatarEnergy that includes an equity investment in liquefaction export facilities.

-----

Earlier: