RUSSIAN OIL FOR INDIA WILL UP

PLATTS - 06 Feb 2023 - India's appetite for Russian crude is expected to rise even further in 2023, extending the stellar growth seen last year, but decisions on purchasing will continue to be taken by refiners independently based purely on commercial considerations, the head of the Federation of Indian Petroleum Industry told S&P Global Commodity Insights.

Speaking exclusively on the sidelines of the India Energy Week, FIPI's Director General Gurmeet Singh reiterated the recent statement made by the country's external affairs minister S. Jaishankar, who said Indian refiners buy crude depending on the best option available, with zero interference from the government in the process.

India's oil imports from Russia are likely to continue to rise this year mainly because of the steeply discounted prices it is selling at, he said, and assuming there are "no further stringent actions by the Western countries targeting Russian oil."

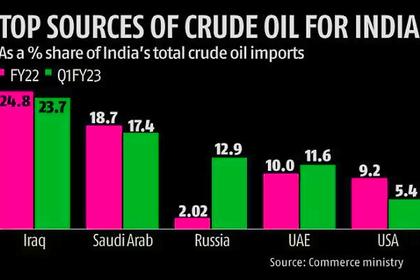

Prior to the Russia-Ukraine conflict, more than 60% of the Indian crude basket was made up of Middle Eastern crudes, while the remainder was made up of North American crudes at around 14%, West African crudes at 12%, Latin American crudes at 5%, and Russian grades accounting for only about 2%, Singh said.

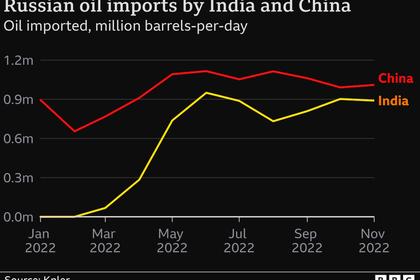

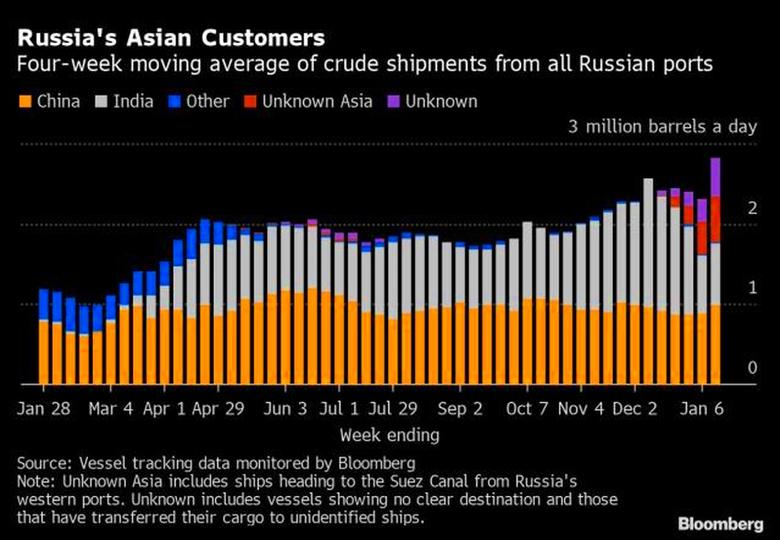

"India's imports of Russian oil have seen a significant increase in the last few months. Russia remained the top oil supplier to India in December followed by Iraq and Saudi Arabia, possibly the result of deepening discounts due to additional sanctions from the G-7 and European Union, including a $60/b price cap," he added.

Platts assess Urals CIF Rotterdam at $45.31/b on Feb. 3, a more than $35/b discount to benchmark Dated Brent at $80.62/b.

Russian flows erode OPEC's share

Singh said India ended the year 2022 with Russian crude making up 15% of total purchases and dragging down OPEC's share to the lowest in more than a decade.

OPEC saw its share of India's crude imports shrinking to 64.5% in 2022, from a peak of 87% in 2008. Still, Iraq and Saudi Arabia remained India's top two suppliers last year, Singh said.

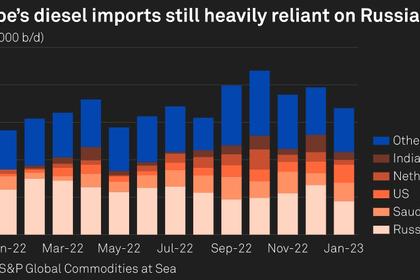

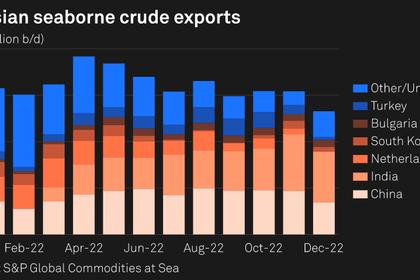

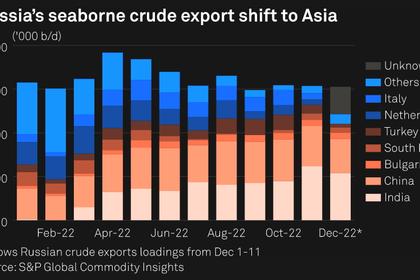

S&P Global also expects the flow of Russian crude to remain healthy in coming months. According to data from S&P Global Commodities at Sea, Russian seaborne crude exports surged to eight-month highs in January, with exports to China and India hitting record highs of 1.12 million b/d and 1.3 million b/d, respectively.

"Higher intake of Russian oil reduced India's appetite for African grades, whose share in 2022 imports declined to a 17-year low while that of Latin America plunged to the lowest in 15 years," he added.

According to OPEC's January 2023 report, India's total oil demand is expected to reach 5.41 million b/d in 2023, up from 5.16 million b/d in 2022, mainly driven by the economy continuing on a recovery path, supported by pent-up demand for services and higher industrial output, Singh said.

"The demand for petroleum products in India is supported by the healthy economic growth and easing of trade-related bottlenecks supporting both mobility and industrial sector activity," Singh said.

According to S&P Global, India's oil demand is expected to grow 290,000 b/d in 2023, with demand growth expected to ease to 190,000 b/d in 2024.

Refining growth not over yet

Singh added that India has plans to grow its current refining capacity of 248.9 million mt/year (nearly 5 million b/d) to 450-500 million mt/year in the next 10 years to meet rising domestic fuel demand, as well as cater to the export market. "The capacity addition will be for both brownfield and greenfield refineries."

He added that while oil and gas would continue to play a significant role in India's energy mix, the share of new and alternative energy sources, such as renewables, would continue to rise.

In May 2022, the government of India approved changes in its biofuel policy bringing forward the target for 20% ethanol blending with petroleum to 2025-26 from an earlier target of 2030. The government also plans to set up 5,000 compressed biogas plants by 2023, Singh said.

"The Indian oil and gas industry will also remain engaged to move towards increased volumes and technology for non–fossil fuels, such as hydrogen and biofuels," Singh added.

He added that energy transition would reduce demand for oil products but increase opportunities to capture the growing demand for petrochemicals.

Therefore, India's refining sector would need to adopt a dual approach of diversifying into petrochemicals and alternative fuels, as well as improve efficiency of its oil business amid stricter emission norms, to meet the challenges of the changing energy landscape.

"The demand for petrochemical feedstocks will continue to grow. Hence, the forward-looking refiners are already looking for opportunities to adjust or modify their production modes to capture growing demand for petrochemicals by, for example, increasing their output of naphtha, propylene and reformate, the building blocks of other petrochemicals," Singh added.

-----

Earlier: