U.S. GREEN HYDROGEN MARKET DEVELOPMENT

By DIANE CHERRY Principal, Diane Cherry Consulting, LLC

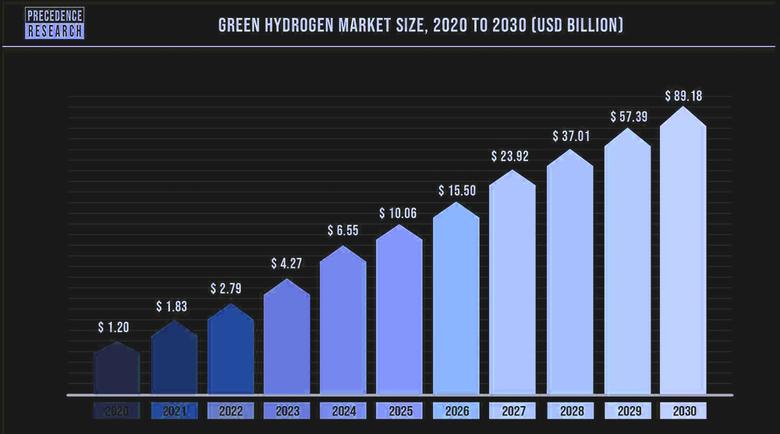

ENERGYCENTRAL - Feb 14, 2023 - Hydrogen could become an important catalyst for decarbonizing the electric grid. Globally, it is primarily used as a feedstock or an intermediate chemical in oil refining processes, ammonia production for fertilizers, and methanol production. Overall, the U.S. hydrogen market is poised for explosive growth over the next few decades, based on these industrial applications and continued development of the hydrogen fuel cell industry. Hydrogen can be produced in many ways, but it is most commonly done with steam methane reforming, coal gasification, and electrolysis. Depending on the carbon emissions released during its production, hydrogen can be considered gray, blue, or green. Green hydrogen is the only color produced in a climate-neutral manner, because it is created by splitting water into hydrogen and oxygen using renewable electricity, with no greenhouse gas emissions.

Current hydrogen production technologies release significant carbon emissions, and up until now, cost has limited expansion to green hydrogen technologies. However, the passage of both the Infrastructure Law and the Inflation Reduction Act (IRA) has completely changed hydrogen economics. This article provides an overview of hydrogen production costs, the impact of recent federal legislation on green hydrogen, and what challenges remain for this emerging technology.

Costs of Green Hydrogen Production

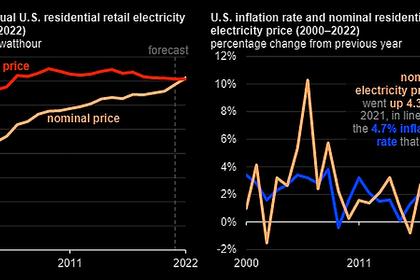

The U.S. has established itself as a green hydrogen leader, and it is predicted to remain a key global player as the global market grows. The U.S. green hydrogen market was valued at $576 million in 2021 and could reach more than $10 billion in the next 10 years, according to consulting firm Grandview Research. Green hydrogen production costs to date have been the largest barrier to additional market growth. For example, hydrogen produced by renewable energy-powered electrolysis is estimated to be 2.5 to 5 times more expensive than hydrogen produced by non-renewable sources. Experts predict that with the help of low renewable electricity prices, supporting carbon reduction mandates and policies, and manufacturing economies of scale, green hydrogen production can reach as low as $1.30/kilogram by 2030, which will help it edge out hydrogen produced by fossil fuels.

The figure below taken from the U.S. Department of Energy (DOE) Hydrogen Strategy shows the different costs of hydrogen production prior to the Infrastructure Law and the IRA, illustrating hydrogen production from fossil fuels as by far the least cost for hydrogen production at full scale.

The Infrastructure Law contains $9.5 billion in funding for hydrogen, including $8 billion for hydrogen hubs. The IRA also contains two provisions that will subsidize clean (blue and green) hydrogen production: a tax credit based on life cycle emissions and a tax credit adder for carbon sequestration, which is required to produce blue hydrogen. The clean hydrogen value chain allows producers to stack tax credits. For example, any project producing zero-emissions power may receive either a 30 percent investment tax credit or a production tax credit worth 1.5 cents/kWh. Combine those subsidies with the $3/kg credit for clean hydrogen, and hydrogen subsidies could stack up around $4.50/kg. The table below lists the hydrogen tax credit and the production tax credit available based on different life cycle emissions.

Source: RFF Report on Clean Hydrogen Production in the Inflation Reduction Act

Investing in Hydrogen Technology and Scaling Up

The emerging green hydrogen economy is similar to any early-stage industry. Investors have focused on companies with strong engineering capabilities for industrial-scale green equipment such as electrolyzer manufacturers. Recent electrolyzer cost decline has contributed to the surge in hydrogen interest. Investment has been made in companies active in hydrogen conversion, storage, and transport technologies. Downstream, investors have been targeting companies for end-use applications, from mobility to stationary fuel cell applications.

The industrial supply chain is now poised for mass production. The electrolyzer industry, for example, has global capacity set to increase more than six-fold, from around 7 gigawatts (GW) annual production capacity in 2022 to around 47 GW by 2025, based on worldwide original equipment manufacturer announcements.

Challenges Remain for Green Hydrogen Projects

The next step to scale up the green hydrogen economy will require putting the equipment to use in large-scale green hydrogen production projects. However, there are three critical challenges which must be overcome for green hydrogen projects to take off, even after the federal legislation and resulting tax credits:

Secured Offtake Agreements: Projects need to have binding offtake commitments as a starting point. Green hydrogen production is 2.5-5 times the cost of hydrogen produced from fossil fuels and will not become cost-competitive until 2030.

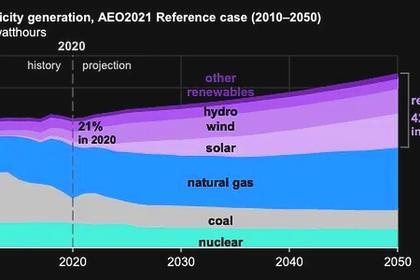

Access to Low-Cost, High-Load Renewables: The cost of renewable electricity is a big factor in the business case for green hydrogen production. Achieving a high load for the electrolyzer is crucial to optimize the utilization of electrolysis plants. This can be done by combining different renewable energy sources with complementary power profiles, as well as energy storage solutions. It is critical to choose strategic project locations with access to low-cost renewables and high load in order to achieve competitive hydrogen production costs.Transportation & Distribution: Pipeline infrastructure for hydrogen is scarce because it cannot be transported in steel pipelines. Storing hydrogen requires high pressure containers, low temperatures, or expensive processing. Its density also means that it requires larger containers than other feedstocks. Connecting supply and demand with transportation access is thus incredibly challenging. Even though a utility scale solar facility could manufacture commercial grade hydrogen, the issue is moving it to where it needs to be used for green hydrogen projects. Most utility scale solar projects are built in rural areas without sufficient infrastructure, so pipelines will have to be constructed to take the hydrogen to where it is needed.

The ten years of tax credits for hydrogen extend to 2032 but it may take longer for the investments to materialize.

-----

This thought leadership article was originally shared with Energy Central's Clean Power Community Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Clean Power Community today and learn from others who work in the industry.

Earlier: