EUROPEAN LNG USABILITY

IEEFA - 22 March 2023 - Today, IEEFA launched its European LNG Tracker, the first fully publicly accessible interactive data set to visualise Europe’s rampant LNG buildout.

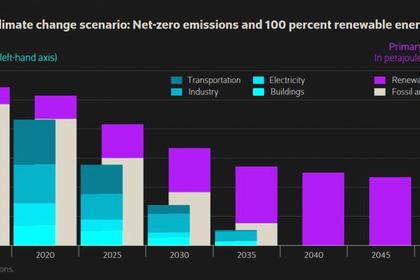

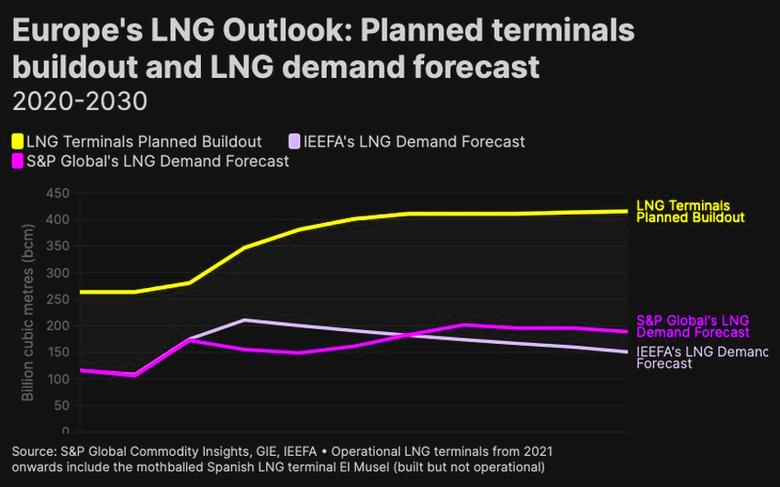

Europe’s appetite for new LNG projects is pushing the continent to boost its import capacity by one-third, but the mismatch between future LNG demand and import facilities might result in 200-250 billion cubic metres (bcm) of unused capacity by 2030. This is equivalent to around half the EU’s total gas demand in 2021, which was 413 bcm.

Europe’s LNG terminal capacity could exceed 400 billion cubic metres in 2030 based on current infrastructure plans. Demand for LNG by 2030 will range between 150 bcm according to IEEFA forecast, and 190 bcm according to S&P Global Commodity Insights forecast.

There is a significant discrepancy between regasification infrastructure being built, and planned and forecasted LNG demand across all countries analysed, with the highest risk of stranded assets forecasted in Spain (50 bcm), Türkiye (44 bcm), United Kingdom (40 bcm) France (14 bcm), Italy (10 bcm), and Germany (9 bcm) in 2030.

Several countries have announced new LNG projects or expansion to existing ones in a bid to cut Russian ties, including Germany (3 onshore and 6 FSRUs), Italy (2 FSRUs), Greece (2 FSRUs), Netherlands (1 FSRU), and France (1 FSRU).

By 2030, IEEFA forecasts a 36% utilisation rate of Europe’s LNG terminals, including those that are currently being planned and being built.

"This is the world’s most expensive and unnecessary insurance policy. Europe must carefully balance its gas and LNG systems, and avoid tipping the scale from reliability to redundancy. Boosting Europe’s LNG infrastructure will not necessarily increase reliability—there’s a tangible risk that assets could become stranded,” says Ana Maria Jaller Makarewicz, author of the analysis and Energy Analyst for IEEFA Europe.

“Over-engineered networks are expensive to build and maintain. Decisions to expand Europe’s LNG infrastructure must be based on future demand needs, and take into account that the EU is planning to reduce gas demand by at least one-third by 2030.”

Europe’s dependency on Russian LNG is deepening

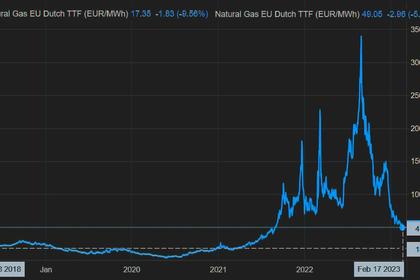

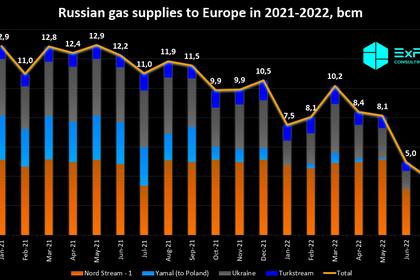

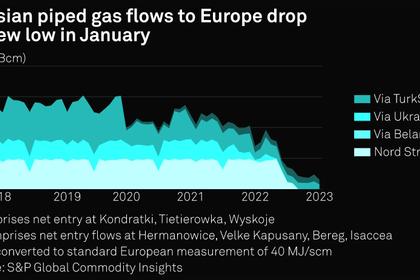

While flows of Russian piped gas significantly decreased in 2022 compared to 2021, LNG imports increased to 20.2 bcm in 2022, up from 18 bcm in 2021. Q3 2022 experienced an increase of 136% in imported LNG from Russia compared to Q3 2021.

The biggest importers of Russian LNG in 2022 were France (7.4 bcm), Spain (5.2 bcm), and Belgium (3.0 bcm). Imports of LNG from Russia increased by 58% in France and Belgium, and 50% in Spain compared to the previous year.

LNG demand is set to decline across Europe

LNG imports into Europe increased by 60% in 2022 compared to 2021, mostly from the top-three exporters: United States (+143%), Qatar (+23%) and Russia (+12%).

In 2022, the largest importers of LNG were France (35.7 bcm), Spain (29.5 bcm), and the United Kingdom (26.5 bcm), followed by the Netherlands (17.1bcm), Türkiye (15.5 bcm), Italy (14.8 bcm), and Belgium (12.9 bcm).

Belgium had the biggest increase of LNG imports in 2022 compared with 2021 (136%), followed by France (96%), Netherlands (94%), Lithuania (88%) and UK (71%).

Demand for LNG is expected to increase in 2023 and then reduce in the following years, mainly due to forecasted gas demand reductions across EU countries.

-----

Earlier: