GLOBAL OIL DEMAND WILL UP BY 2.3 MBD

OPEC - 14 March 2023 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

Crude Oil Price Movements

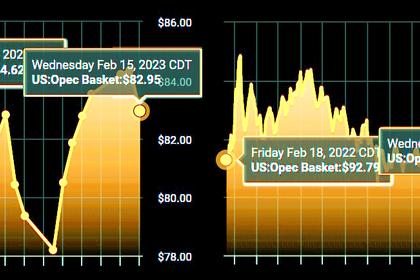

The OPEC Reference Basket (ORB) value rose by 26¢, or 0.3%, m-o-m in February to average $81.88/b. The ICE Brent front-month contract declined by 37¢, or 0.4%, m-o-m to $83.54/b and the NYMEX WTI front-month contract fell by $1.30, or 1.7%, m-o-m to average $76.86/b. In contrast, the DME Oman front-month contract increased by $1.08, or 1.3%, m-o-m reaching $81.97/b. The front-month ICE Brent/NYMEX WTI spread widened again in February by 93¢ m-o-m to average $6.68/b. The market structure of ICE Brent and DME Oman strengthened in February and the first-to-third month spread moved into wider backwardation.

However, the NYMEX WTI price structure remained in contango. Hedge funds and other money managers raised ICE Brent bullish positions m-o-m in February but cut WTI-related futures and options net-long positions in the first three weeks of the month.

World Economy

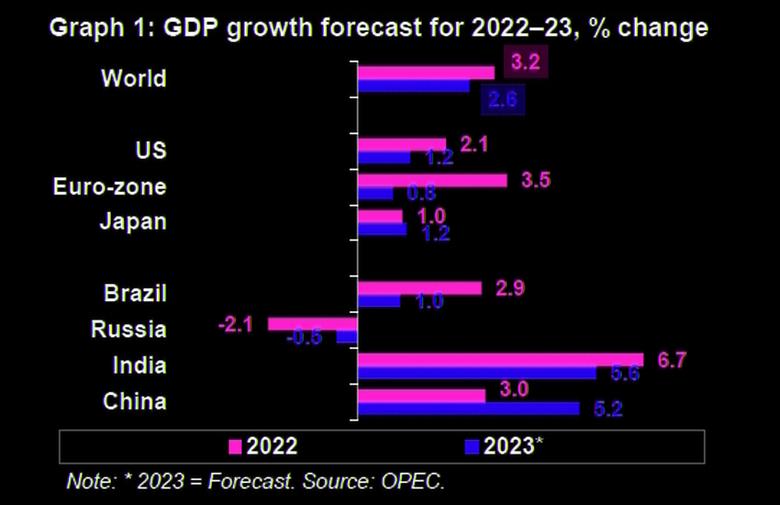

The world economic growth forecast for 2022 is revised up slightly to 3.2%, given the better-than-anticipated economic performance in 2H22 in various key economies. The 2023 global economic growth forecast remains unchanged at 2.6%. For the US, the economic growth forecast is unchanged, standing at 2.1% for 2022 and 1.2% for 2023. Similarly, the Euro-zone’s economic growth forecast remains at 3.5% for 2022 and 0.8% for 2023. Japan’s economic growth forecast for 2022 is revised down to 1%, following the release of the government’s estimate, while the growth forecast for 2023 remains at 1.2% for 2023. China’s economic growth forecast remains at 3% for 2022 and 5.2% for 2023. India’s 2022 economic growth estimate is revised down slightly to 6.7%, considering official 2022 data, while the forecast for 2023 remains at 5.6%. Brazil’s economic growth is adjusted based on the officially reported growth level of 2.9% for 2022 and remains at 1% for 2023.

Russia’s statistical office reported a contraction of 2.1% in 2022. This is expected to be followed by a smaller contraction of 0.5% in 2023. Although growth momentum is expected to carry over into 2023, the global economy will continue navigating through challenges amid high global inflation, likelihood of further rate hikes particularly in the Euro-zone and the US, high debt levels in many regions, and geopolitical uncertainties.

World Oil Demand

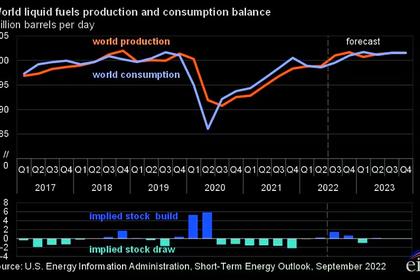

World oil demand growth in 2022 remains at 2.5 mb/d, broadly unchanged from last month’s assessment. Oil demand for OECD Americas and OECD Europe is adjusted lower, reflecting weaker-than-expected demand, but oil demand in Asia Pacific and non-OECD countries is revised higher, reflecting better-than-expected improvements in these regions. For 2023, the world oil demand growth forecast remains unchanged at 2.3 mb/d, with the OECD Americas and OECD Europe revised slightly lower, while China is revised higher, with jet/kerosene and gasoline leading demand growth. OECD demand is expected to grow by 0.2 mb/d, while non-OECD is forecast to grow by 2.1 mb/d.

World Oil Supply

Non-OPEC liquids supply is estimated to have grown by 1.9 mb/d in 2022, broadly unchanged from the previous assessment. Minor downward revisions to OECD Europe and OECD Americas were largely offset by upward revisions to liquids production in the non-OECD. The main drivers of liquids supply growth for 2022 are seen to be the US, Russia, Canada, Guyana, China and Brazil, while the largest declines are expected from Norway and Thailand. For 2023, non-OPEC liquids production growth remains unchanged from last month and is forecast to grow by 1.4 mb/d. The main drivers of liquids supply growth are expected to be the US, Brazil, Norway, Canada, Kazakhstan and Guyana, while the decline is expected primarily in Russia.

Nevertheless, large uncertainties remain over the impact of ongoing geopolitical developments, as well as the output potential for US shale in 2023. OPEC NGLs and non-conventional liquids are forecast to grow by 0.1 mb/d in 2022 to average 5.39 mb/d and by 50 tb/d to average 5.44 mb/d in 2023. OPEC-13 crude oil production in February increased by 117 tb/d m-o-m to average 28.92 mb/d, according to available secondary sources.

Product Markets and Refining Operations

Refinery margins in February underwent a counter seasonal downturn to show solid losses in all main trading hubs despite rising global offline capacities as maintenance work intensified. Most of the weakness stemmed from the middle section of the barrel, as a result of increased arrivals of middle distillates in Europe, mainly from the East. The high product availability in Europe, amid weaker US product exports and strong refinery product output levels in Asia, led to stock builds and caused jet fuel and gasoil margins to experience massive losses across all regions. Global refinery processing rates continued to decline in February, losing nearly 646 tb/d, according to preliminary estimates.

Tanker Market

Dirty freight rates improved in February, with m-o-m gains in VLCCs and Suezmaxes outpacing declines in Aframaxes. VLCCs picked up from a relatively lower base, as renewed demand for long-haul vessels strengthened rates. Rates on the Middle East-to-East route rose 22% m-o-m. Gains in Suezmax spot freight rates earned back some of the previous month’s losses with rates on the US Gulf Coast-to-Europe route up 18% compared with the previous month. By contrast, Aframax rates fell from high levels. Spot freight rates on the intra-Med route declined 18% m-o-m. Clean rates edged up, as West of Suez rose 14% and East of Suez rates slipped 4%. Rates in the Atlantic basin claimed back some of the previous month’s losses.

Crude and Refined Products Trade

Preliminary data shows US crude exports set a record high of 4.3 mb/d in February. US crude imports declined from a three-year high the month before to an average 6.4 mb/d in February. Preliminary aggregate customs data showed China’s crude imports declined in January and February 2023 from the high levels seen in the previous three months to an average 10.4 mb/d. China’s product exports were lower in the first two months of the year, averaging 1.6 mb/d, falling from an almost three-year high the month before, with losses seen across all major products. India’s crude imports rose 2% in January to average 4.7 mb/d, as refiners returned from maintenance and boosted inflows of discounted Russian grades. India’s product exports erased much of the gains seen the month before, averaging 1.1 mb/d, with declines across the barrel. Japan’s crude imports fell from a four-month high in January to an average 2.7 mb/d. Japan’s product imports, including LPG, were little changed in January after reaching an 11-month high the month before, and product exports recovered further. Preliminary estimates for February show OECD Europe bringing in alternate crudes from a variety of regions, with Russian imports limited to Turkey and southern Druzhba flows.

Commercial Stock Movements

Preliminary January 2023 data sees total OECD commercial oil stocks up by 34.9 mb m-o-m. At 2,802 mb, they were 147 mb higher than the same time one year ago, but 75 mb lower than the latest five-year average and 124 mb below the 2015–2019 average. Within the components, crude and product stocks rose m-o-m by 10.5 mb and 24.5 mb, respectively. At 1,372 mb, OECD crude stocks were 120 mb higher than the same time a year ago, but 4 mb lower than the latest five-year average and 59 mb lower than the 2015–2019 average. OECD product stocks stood at 1,430 mb, representing a surplus of 26 mb from the same time a year ago, but they were 71 mb lower than the latest five-year average and 65 mb below the 2015–2019 average.

In terms of days of forward cover, OECD commercial stocks rose m-o-m by 0.8 days in January 2023 to stand at 60.8 days. This is 2.9 days above the January 2022 level, but 3.1 days less than the latest five-year average and 1.2 days lower than the 2015–2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2022 is revised down by 0.2 mb/d from last month’s assessment to stand at 28.4 mb/d. This is around 0.5 mb/d higher than in 2021. Demand for OPEC crude in 2023 is revised down by 0.2 mb/d from the previous assessment to stand at 29.3 mb/d. This is around 0.8 mb/d higher than in 2022.

-----

Earlier: