GLOBAL OIL GAS LIMITS $11 TLN

BLOOMBERG - A group of institutional investors who together oversee $11 trillion in assets is placing new limits on the fossil-fuel spending it will tolerate.

The Net-Zero Asset Owner Alliance, whose signatories include Allianz SE and and the California Public Employees’ Retirement System, is advising members to halt direct funding of any new investments in fields, pipelines or power plants that are fueled by oil or gas, according to a report on Wednesday. NZAOA also said oil and gas companies must set science-based targets to include so-called Scope 3 emissions, follow science-based pathways and stop lobbying against action on climate.

The stricter guidelines come as the outlook darkens for limiting global temperature increases to around 1.5C, with a lack of financing for greener projects a key hurdle. The latest report by the United Nations’ Intergovernmental Panel on Climate Change warned that the world needs to cut greenhouse gas emissions so that they’re 60% below 2019 levels by 2035.

That’s putting pressure on banks and investors to tighten the screws on fossil finance and steer more capital toward low-carbon projects. That includes targeting markets that often fall under the radar. Earlier this year, NZAOA said members should ensure their climate reporting includes assets that aren’t publicly traded.

The latest report from the IPCC was “abundantly clear,” Christiana Figueres, a strategic adviser to the alliance and former executive secretary of the UN Framework Convention on Climate Change, said in a statement. “There is simply no space for any investment in new oil and gas fields or infrastructure.”

The steps NZAOA is taking represent “important new standards for investors to align with this transition,” she said.

But Figueres also said the alliance should have set explicit expectations to immediately prevent investments in new fields and infrastructure.

French nonprofit Reclaim Finance, which said NZAOA had watered down an earlier version of its report, said “the final version fails to directly acknowledge that there is no room in feasible 1.5C scenarios for investments in new oil and gas projects.”

Patrick Peura, ESG engagement manager at Allianz Investment Management and co-lead of NZAOA’s engagement unit, said there have been “many iterations” of the report, but nowhere “was watering down in the process. Every single member is making their own approach to how they address the transition in their portfolios of companies.”

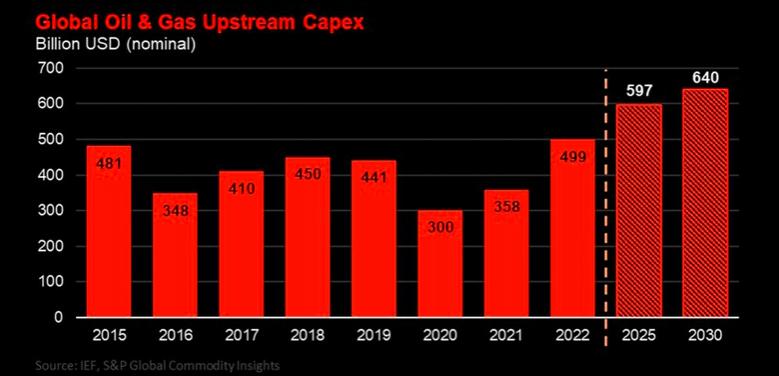

In its report, NZAOA said members that continue investing in oil and gas will probably be saddled with stranded assets. “Business-as-usual” investments are incompatible with targeting 1.5C, the alliance said. And if there are projects, they must include emission abatement measures “in line with a 1.5 degree pathyway,” Peura said.

Governments too should stop issuing licenses for new projects, require climate reporting that covers all emissions — including Scope 3 — and closely monitor “lower performing operators” who acquire assets, the report said.

But such initiatives have faced pushback, especially after Russia’s war on Ukraine sent energy prices spiraling and made investments in fossil fuels more lucrative in the short term. However, the alliance said the long-term management of assets on behalf of clients demands action on climate.

“As part of our fiduciary obligation to these stakeholders, we seek to safeguard these assets and achieve the best investment returns possible,” the report said.

Members of the NZAOA, which was convened by the United Nations, have agreed to transition their investment portfolios to net-zero greenhouse gas emissions by 2050, which is aligned with the goal of limiting global warming to 1.5C. The group also sets intermediate targets.

-----

Earlier: