GLOBAL RENEWABLES NEED INVESTMENT $150 TLN

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

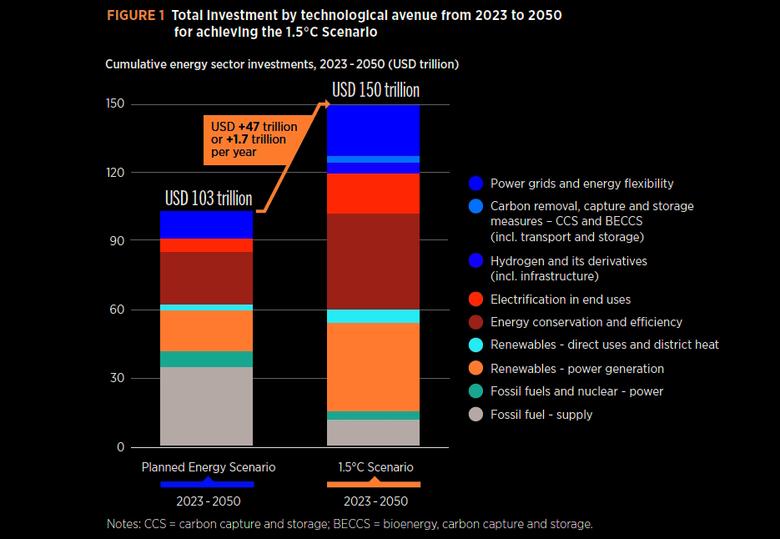

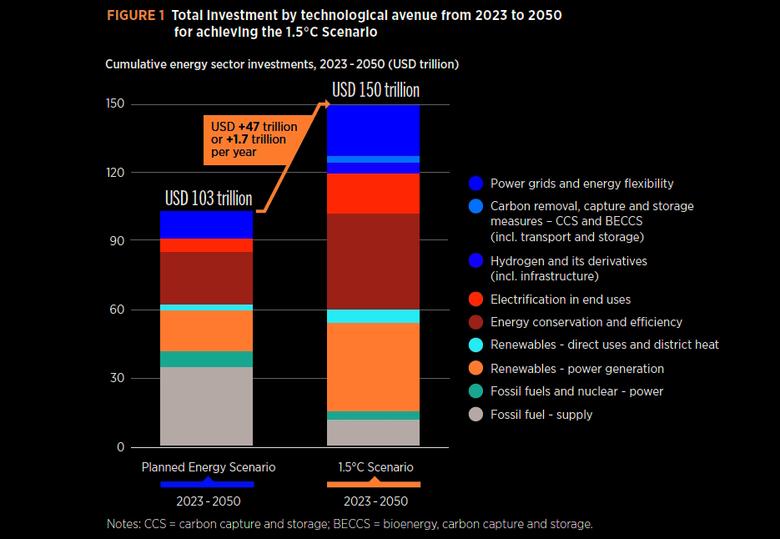

GLOBAL RENEWABLES NEED INVESTMENT $150 TLN

IRENA - 28 March 2023 - WORLD ENERGY TRANSITIONS OUTLOOK 2023

KEY MESSAGES

The energy transition is off-track. The aftermath of the COVID-19 pandemic and the ripple effects of the Ukraine crisis have further compounded the challenges facing the transition. The stakes could not be higher - every fraction of a degree in global temperature change can trigger significant and far-reaching consequences on natural systems, human societies and economies. Achieving the necessary coursecorrection in the energy transition will require bold, transformative measures that reflect the urgency of the present situation.

Current pledges and plans fall well short of IRENA’s 1.5°C pathway and will result in an emissions gap of 16 gigatonnes (Gt) in 2050. Nationally Determined Contributions (NDCs), long-term low greenhouse gas emission development strategies (LT-LEDs) and net-zero targets, if fully implemented, could reduce carbon dioxide (CO2) emissions by 6% by 2030 and 56% by 2050, compared to 2022 levels. However, most climate pledges are yet to be translated into detailed national strategies and plans, implemented through policies and regulations, or supported with sufficient funding. According to IRENA's Planned Energy Scenario, the emissions gap is projected to reach 35 Gt by 2050, underscoring the urgent need for comprehensive action to accelerate the transition.

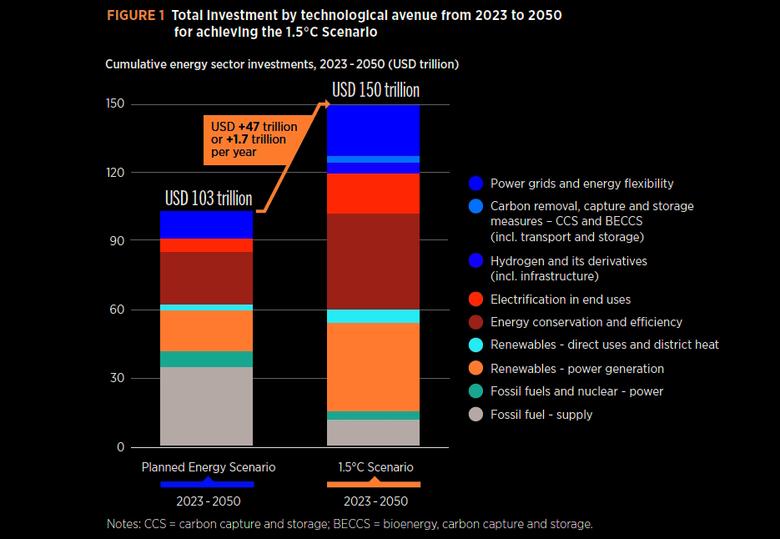

Although global investment across all energy transition technologies reached a record high of USD 1.3 trillion in 2022, annual investment must more than quadruple to remain on the 1.5°C pathway. A cumulative USD 150 trillion is required to realise the 1.5°C target by 2050, averaging over USD 5 trillion in annual terms. Compared with the Planned Energy Scenario - under which a cumulative investment of USD 103 trillion is required - an additional USD 47 trillion in cumulative investment is required by 2050 to remain on the 1.5°C pathway. Around USD 1 trillion of annual investments in fossil fuel based technologies currently envisaged in the Planned Energy Scenario must therefore be redirected towards energy transition technologies and infrastructure.

Cumulative investments between now and 2030 need to total USD 44 trillion, with energy transition technologies representing 80% of the investment, or USD 35 trillion. Total cumulative energy sector investments in the Planned Energy Scenario until 2030 are USD 29 trillion. An additional cumulative investment of USD 15 trillion - or an annual average investment of USD 1.9 billion - would be needed in the 1.5°C Scenario until 2030. Furthermore, a change in the volume and type of investments is required under the 1.5°C Scenario to prioritise the energy transition and set the stage for a dramatic decrease in the fossil fuel share by 2050

Full PDF version

-----

Earlier:

2023, March, 24, 07:35:00

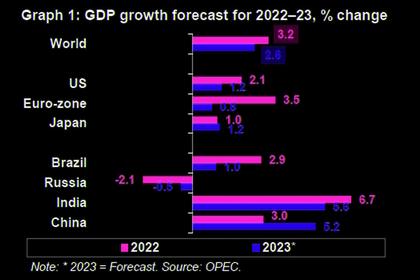

GLOBAL OIL DEMAND WILL UP BY 2.3 MBD

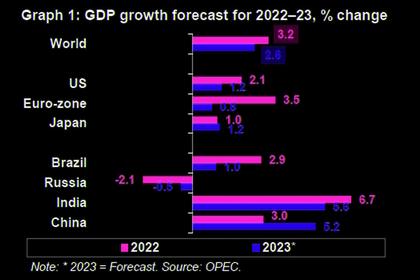

For 2023, the world oil demand growth forecast remains unchanged at 2.3 mb/d, with the OECD Americas and OECD Europe revised slightly lower, while China is revised higher, with jet/kerosene and gasoline leading demand growth.

2023, March, 24, 07:25:00

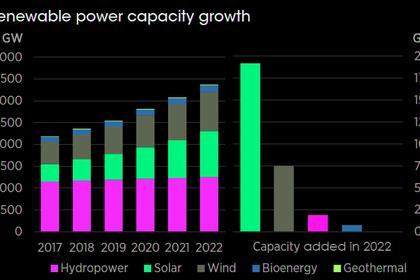

GLOBAL RENEWABLES CAPACITY UP

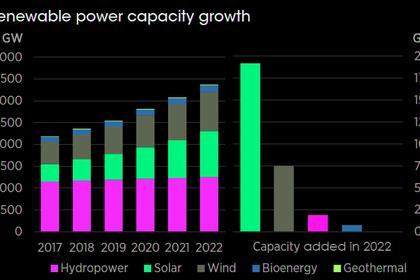

Renewable generation capacity increased by 295 GW (+9.6%) in 2022. Solar energy continued to lead capacity expansion, with a massive increase of 192 GW (+22%), followed by wind energy with 75 GW (+9%). Renewable hydropower capacity increased by 21 GW (+2%) and bioenergy by 8 GW (+5%). Geothermal energy increased by a very modest 181 MW.

2023, March, 15, 06:55:00

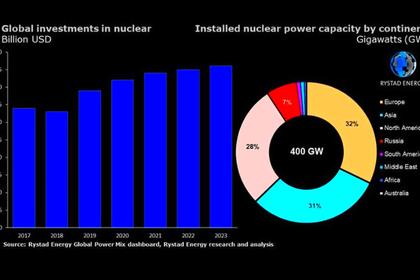

GLOBAL RUSSIAN NUCLEAR POWER

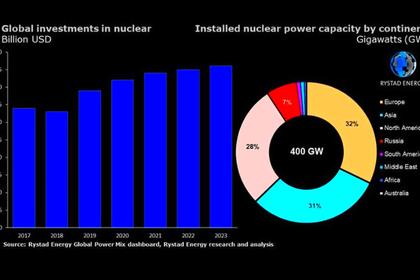

Since the invasion of Ukraine in February 2022, some European countries have started to step away from Russia’s nuclear energy superstore.

2023, February, 15, 13:50:00

GLOBAL OIL GAS CHANGES

We can replace all crude oil with cellulosic biomass (corn stover, forest debris, etc.) liquid drop-in hydrocarbons if the conversion process uses massive external sources of heat and hydrogen.

2023, February, 15, 13:45:00

GLOBAL NUCLEAR POWER RISE

Many countries including China and India have developed aggressive nuclear development plans, as have Poland, the Czech Republic, the UK, the Netherlands, and even Ukraine to a lesser extent.

2023, February, 10, 12:25:00

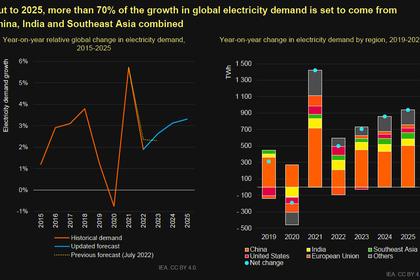

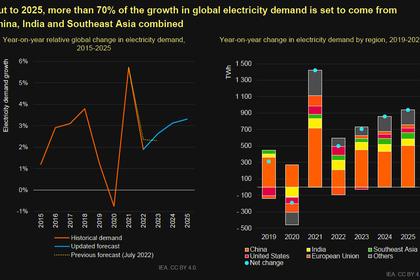

GLOBAL ELECTRICITY DEMAND UP

World electricity demand remained resilient in 2022 amid the global energy crisis triggered by Russia’s invasion of Ukraine. Demand rose by almost 2% compared with the 2.4% average growth rate seen over the period 2015-2019.

2023, January, 30, 11:30:00

GLOBAL ENERGY TRANSITION FOR PEOPLE

As the world seeks to address climate and biodiversity challenges and move to clean energy solutions for example, these will deliver impacts within the workplace.

All Publications »

Tags:

RENEWABLE,

INVESTMENT,

CLIMATE,

ENERGY,

ENERGY TRANSITION