RUSSIAN OIL PRODUCTS EXPORTS DOWN

PLATTS - 01 Mar 2023 - Russian oil product exports, the target of the West's latest round of efforts to curb Moscow's oil revenues, fell by a fifth on the month in February to the lowest since May 2022 as new buyers in Africa failed to absorb Russian fuels displaced from Europe, according to tanker tracking data.

Russia-origin seaborne oil product exports averaged 2.13 million b/d in February, a 21% slump from recently elevated levels of around 2.7 million b/d in January and 24% below average pre-war levels, according to S&P Global Commodities at Sea data.

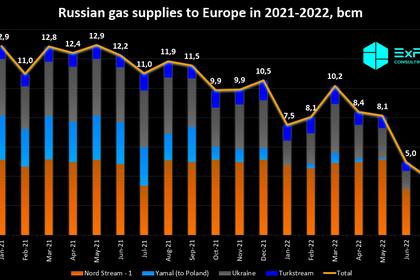

The EU banned imports of Russian oil products from Feb. 5, two months after imposing restrictions on seaborne crude shipments from the country. The move came in lockstep with further US-led "price cap" controls on Western shipping services in a bid to hurt Moscow's ability to fund its war in Ukraine.

The shipping data shows that Europe's imports of Russian fuels slumped sharply in February. So-called "gray" market trade continues, however, albeit at reduced rates, with tankers discharging Russian fuels at common offshore ship-to-ship transfer locations off Greece, Gibraltar, Malta, and Ceuta.

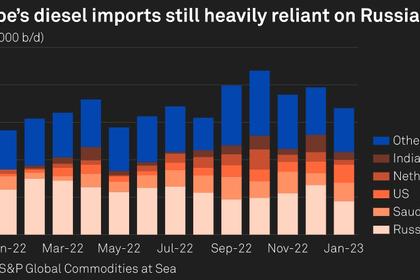

The largest impact has been felt in the diesel and fuel oil markets, Russia's biggest fuel exports and revenue earners. Russian diesel exports slumped by more than 100,000 b/d in February to 830,000 b/d while fuel oil exports slid by some 170,000 b/d on the month to 614,000 b/d, the data shows.

To help plug the gap in Europe, regional refiners and fuel retailers continue to lean on alternative diesel supplies from the Middle East, Turkey and the US, while dipping into stocks in the Amsterdam-Rotterdam-Antwerp refining hub built up ahead of the embargo.

Top new buyers

In terms of destinations, Europe has seen flows of Russian fuel dive from around 1.5 million b/d in December to less than 500,000 b/d in February, the data shows, including volumes destined for unknown buyers from STS transfers in the region.

Over the same period, African buyers in Morocco, Algeria, Nigeria, Senegal, Tunisia, Ghana and Egypt have doubled their Russian fuel imports to around 440,000 b/d, CAS shows.

As a result, Russia's share of European oil product imports -- including STS transfer volumes -- fell to just 7.5% in February, down from pre-war levels of 39%, according to CAS.

Elsewhere, Turkey, the UAE and China consolidated their top-ranking positions as Russia's new biggest fuel buyers, the data shows, with 35% of all Russian oil products now headed to those countries.

Despite the slump in Russian oil product exports in February, the levels seen are largely in line with product exports during mid-2022 before markets began stockpiling discounted Russian fuels ahead of the expected new Western curbs.

"The sharp decline in Russian gasoil headed to Europe has been blunted somewhat by the continued increase in volumes going to Europe from the Middle East and Asia," S&P Global Commodities Insights analyst Tony Starkey said in a Feb. 17 note. "While the Russian drop in the month was expected with the implementation of the new European sanctioning, it has largely resulted in total diesel/gasoil import volumes returning to more normal levels seen before we observed significant inflows over the past several months aimed to bolster European inventories ahead of the anticipated loss of Russian supply."

Crude exports

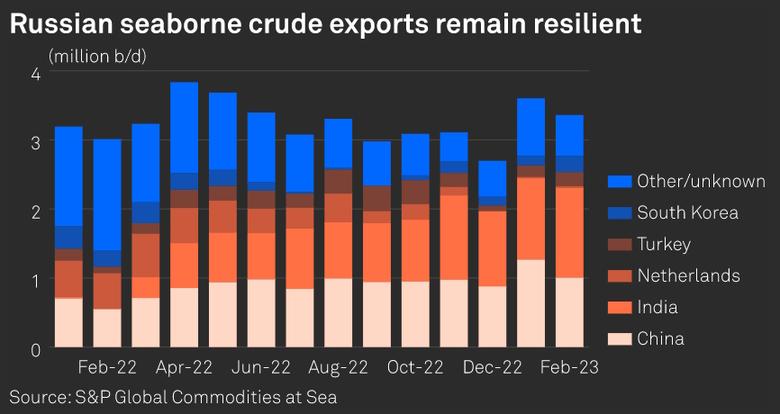

Meanwhile, Russian seaborne crude exports remained resilient in February, dipping back from an eight-month high a month earlier, the data shows, as Moscow redirected record volumes of its crude to India and a growing gray market in offshore transfers obscured other buyers.

Russian-origin crude loadings averaged 3.31 million b/d during February, down 300,000 b/d or 8% from January levels to hover around the highest since August 2022 and still above pre-war levels of 3.1 million b/d.

Despite the G7's $60/b price cap on Russian crude, the value of Russia's key Urals export-grade crude has traded well below $60 since December, easing concerns from traders and shippers that the shipping controls would hamper Russian crude flows.

Next month could see Russia's crude exports slide more sharply, however.

Russia has announced a 500,000 b/d crude output cut for March in retaliation for the EU's ban and G7 price cap on seaborne imports of Russian crude.

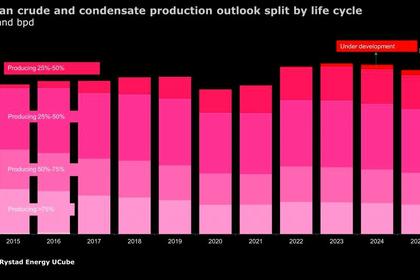

To date, the restrictions had not had a major impact on Russian crude oil production volumes. Russian output fell 10,000 b/d on the month to 9.85 million b/d in January, according to the latest Platts survey by S&P Global Commodity Insights. That compares with 10.11 million b/d in February 2022.

Analysts at S&P Global expect Russian crude and condensate supply will fall by 500,000 b/d between December 2022 and March 2023 due to logistical problems and runs cuts triggered by EU import ban through Feb. 5. Output is then expected to recover by 250,000 b/d by October unless more prohibitive price caps or new Western sanctions are rolled out.

-----

Earlier: