GLOBAL ENERGY CHALLENGES CONTINUING

Global Sales Leader - Energy Portfolio Management, Hitachi Energy

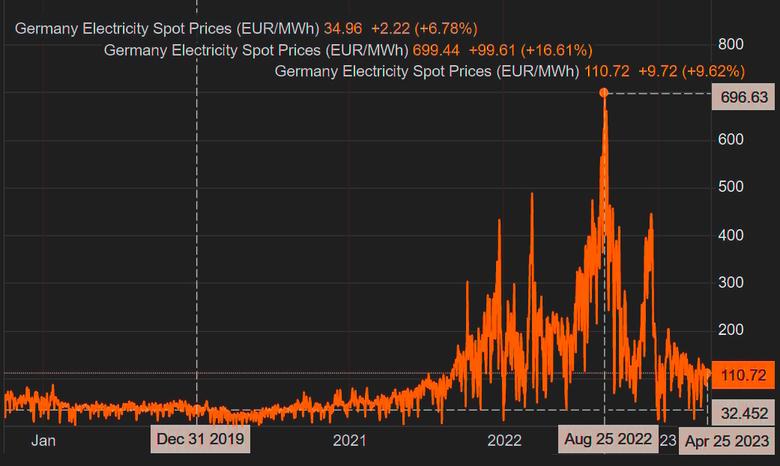

ENERGYCENTRAL - Apr 20, 2023 - Wholesale electricity and natural gas prices have dropped again after a volatile ride the past year. A big sigh of relief – and a thank you to mother nature for a warmer winter. However, as German philosopher Georg Hegel said, “The only thing that we learn from history is that we learn nothing from history.” Remember Enron in 2001, Lehman in 2008, followed by SVB and Credit Suisse in 2023? The value of history is in the countless repeated ways it shows us things can go wrong.

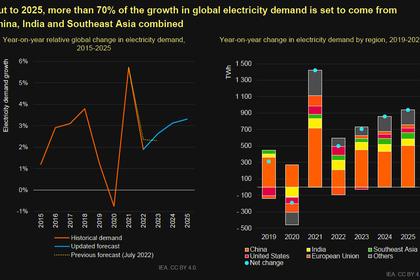

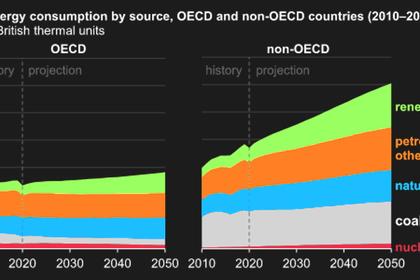

Demand for electricity continues to increase due to decarbonization and electrification. Combine that with changing weather patterns, continued reduction of Russian gas and outages of nuclear stations, and the result may again be tight supply and increased price. You’d think we’d remember the common mistakes – many previously made – and how and why those mistakes were made: The Past Teaches Us About the Present: Better Safe than Sorry in Energy Trading.

The challenges today are not likely to end anytime soon. Market participants must adapt to the uncertainty, tightness of supply and fluctuating prices. Electricity used to be sold on longer term contracts, two or three years ahead, a strategy that mitigated risks when the market was less volatile. In the past year however, the market has been anything but calm and long-term trading hasn’t been a viable option. Wholesale prices have increased steeply, which has caused portfolio value, and subsequently collateral payments and margin calls (the difference between the price at which the deal was made and the current future price of the product) from trading partners consuming capital to likewise increase. The result? A notable impact to cash flows. Market participants are left at risk of being unable to hedge their physical trades. The alternative of not hedging in a rising market means the operations will become unprofitable and potentially fail if prices move in an extreme way. In addition to market risk and cash-flow-at-risk, market participants also deal with credit risk, which occurs when a counterparty is unable to make payments.

A Timely Adoption of Energy Trading Risk Management – ETRM

Now is the time for risk management, what-if scenario analysis and market modeling. Doing so requires an integrated approach, from market intelligence and optimization to market communication and trading. Here’s where an investment in an expanded, integrated Energy Trading Risk Management (ETRM) system earns its justification to support and enable adjusted hedging strategies in today’s new environment.

Often called the system of record, or ‘single source of the truth’, an expanded ETRM (“ETRM+”) enables you to run more complex analyses and visualize outcomes in a more understandable way. It thereby empowers market origination, trading, hedging and risk management to successfully operate in a volatile wholesale market, while at the same time ensuring efficient operations and effective competitive performance.

Optimize through ETRM as International Markets Grow in Importance

As the world commits to decarbonization goals, penetration of intermittent wind and solar power will grow and need to be balanced with solutions like batteries and demand response. It will take deregulation, cross-border trading, and changing market designs to mitigate price volatility, consumer energy prices and how energy markets operate.

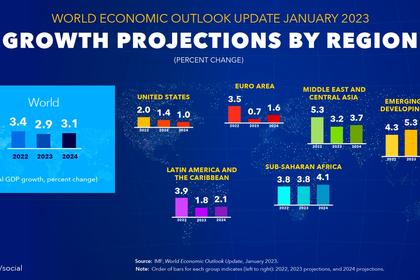

We’re seeing growing momentum across the globe. China prioritized developing the medium and long-term market ahead of the spot market to make a smooth transition from the previous generation quota system and aims to stabilize the market and prices. In 2021, the African Union launched African Single Electricity Market (AfSEM), an initiative to develop a single electricity market. In the USA, FERC 2222 allows Distributed Energy Resources (DERs) to participate in competitive marketplaces. Most recently, the European Commission proposed a reform of the EU electricity market plan for a market design fit for 2050.

Seeking diversification of portfolios and growth opportunities, we have seen various types of market participants entering international markets. For example, European energy companies view North America as a critical market for solar and wind power as well as a source offering procurement for their global renewable portfolios and facilitating management of carbon and renewable compliance obligations. Indeed, the U.S. Inflation Reduction Act (IRA) provides significant, long-term opportunities for renewable energy development and energy storage installations.

Organized, competitive wholesale electricity markets are now prominent in countries and regions around the world, including North America, Ireland, Japan, and Australia. These markets are generally overseen by independent system operators (ISO) or regional transmission organizations (RTO) who facilitate the electric marketplace and provide bulk electric system planning and oversight.

However, operating in these markets have delivered ‘lessons learned.’ Remember the fallout from winter 2020 in Texas? That’s when companies went bankrupt for failing to pay ERCOT-issued settlement invoices.

Tight integration between ETRM and market communication tools enable users to automate and optimize all front and back office workflows for ISO/RTO markets, thereby creating a seamless bid-to-bill platform for straight-through processing. Such expanded ETRM allows users to operate within a single User Interface to determine optimal utilization of all assets, apply ‘what-if’ analysis, stress testing, risk management and hedging, and simplify bid/offer submission through direct ISO/RTO communication. It also manages settlement statements and performs shadow settlement and dispute management.

Mitigate Risk in the REC/GOO Market

The advancement of renewable energy into the energy mix is also leading to increased volumes of Energy Attribute Certificates (EAC), known as Renewable Energy Certificates (REC) in North America, Guarantee of Origin (GOO) in Europe, and International RECs (I-REC) in other geographies. REC/GOOs are tradable and can deliver another income stream for producers while also giving corporate consumers a viable way to reduce their environmental footprint. Demand for them has impacted price development. The increasing volumes of EAC cancellations and customer demands are rapidly outgrowing the current utility of spreadsheet-based systems, reliance on the portal with access to the registry of the certification entity. Managing this Operational Risk will help mitigate the other risks associated with trading EACs, such as REC/GOOs. A built-for-purpose module can help with that.

Those who do not learn from history are doomed to repeat it. Investing in a modern ETRM system will support your new playbook for not just surviving but succeeding in today’s disruptive business world. Enterprises that have adopted an integrated and expanded ETRM solution are already achieving lucrative productivity improvements and gaining new business insights. As a result, they are well positioned for growth in the continued challenging wholesale energy market. They learned it’s better to be safe than sorry.

Earlier: