GLOBAL OIL DEMAND WILL UP BY 2.3 MBD ANEW

OPEC - 13 April 2023 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

Crude Oil Price Movements

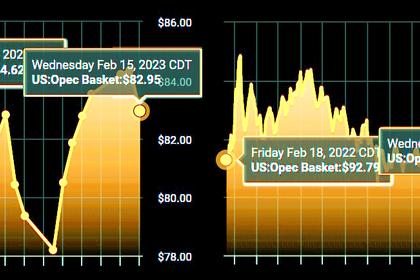

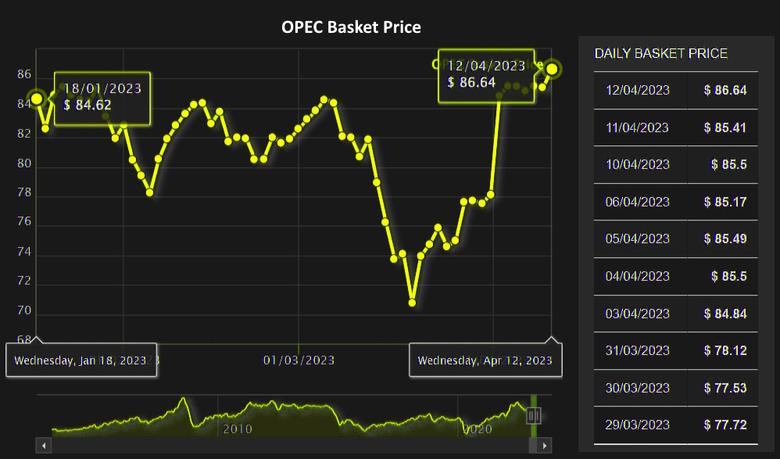

The OPEC Reference Basket (ORB) declined in March by $3.43, or 4.2%, m-o-m to average $78.45/b. The ICE Brent first-month contract fell by $4.33, or 5.2%, m-o-m to $79.21/b, while the NYMEX WTI first-month contract fell by $3.49, or 4.5%, m-o-m to average $73.37/b. The DME Oman first-month contract fell by $3.63, or 4.4%, m-o-m to settle at $78.34/b. The front-month ICE Brent/NYMEX WTI spread narrowed in March by 84¢ m-o-m to average $5.84/b. The futures forward curves of ICE Brent and DME Oman flattened slightly in March, but remained in backwardation. However, the NYMEX WTI price structure remained in contango, although the nearest time spread contracted m-o-m. Hedge funds and other money managers heavily cut bullish positions in ICE Brent and NYMEX WTI last month.

World Economy

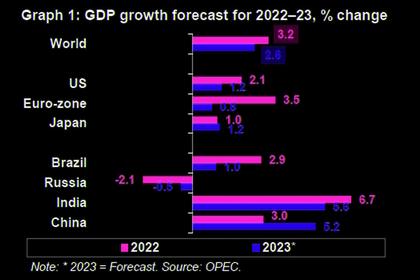

The world economic growth forecast for 2022 is revised up slightly to 3.3%, given better-than-anticipated economic performance in 2H22 in various key economies. The 2023 global economic growth forecast remains unchanged at 2.6%. For the US, the economic growth forecast is unchanged at 2.1% for 2022 and 1.2% for 2023. Similarly, the Euro-zone’s economic growth forecast remains at 3.5% for 2022 and 0.8% for 2023. Japan’s economic growth forecast for 2022 remains at 1%, while growth for 2023 is revised down to 1% from 1.2%. China’s economic growth forecast remains at 3% for 2022 and 5.2% for 2023. India’s 2022 economic growth estimate remains at 6.7%, with the forecast for 2023 at 5.6%. Brazil’s economic growth estimate remains at 2.9% for 2022 and is also unchanged at 1% for 2023. Russia’s contraction estimate is unchanged at 2.1% in 2022 and is expected to be followed by a smaller contraction of 0.5% in 2023, unchanged from last month. Although some growth momentum from 2H22 is expected to carry over into 1H23, the global economy will continue to navigate through challenges including high inflation, higher interest rates particularly in the Euro-zone and the US, and high debt levels in many regions.

World Oil Demand

The world oil demand growth estimate for 2022 remains at 2.5 mb/d, broadly unchanged from last month’s assessment. For 2023, it is also unchanged from the last month’s assessment at 2.3 mb/d. There are minor downward adjustments reflecting the latest developments in the OECD region, primarily in OECD Americas and OECD Europe. However, the stronger-than-expected demand seen in non-OECD in January and February necessitated some upward revisions. Oil demand in the OECD is forecast to increase by 0.1 mb/d in 2023, while the non-OECD is forecast to grow by 2.2 mb/d.

World Oil Supply

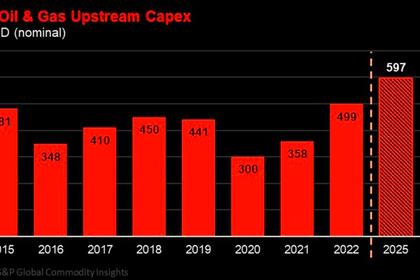

The non-OPEC liquids supply growth estimate for 2022 remains at 1.9 mb/d, broadly unchanged from the previous month’s assessment. The main drivers of liquids supply growth for 2022 were US, Russia, Canada, Guyana, China and Brazil, while the largest declines were from Norway and Thailand. For 2023, non-OPEC liquids supply growth remains broadly unchanged from last month and is forecast to grow by 1.4 mb/d. The main drivers of liquids supply growth are expected to be the US, Brazil, Norway, Canada, Kazakhstan and Guyana, while the decline is expected primarily in Russia. Large uncertainties remain over the impact of the output prospective for US shale in 2023. OPEC NGLs and non-conventional liquids are forecast to grow by 0.1 mb/d in 2022 to average 5.4 mb/d and by 50 tb/d to average 5.4 mb/d in 2023. OPEC-13 crude oil production in March dropped by 86 tb/d m-o-m to average 28.80 mb/d, according to available secondary sources.

Product Markets and Refining Operations

In March, refinery margins regained limited ground, following sharp losses seen the previous month. A contraction in product balances in the Atlantic Basin, due to the onset of heavy refinery maintenance along with product output declines in France due to a nationwide energy workers strike action, led to pressure on product inventories over the month and provided support for product crack spreads. In addition, a decline in feedstock prices further contributed to stronger refinery margins across all main regions. Global refinery processing rates fell further in March, losing nearly 259 tb/d, according to preliminary estimates. In the coming month, refinery intakes are expected to remain under pressure on strong offline capacity, which is projected to peak in the coming month.

Tanker Market

Dirty spot freight rates continued to improve in March, with m-o-m gains across most monitored routes. VLCCs saw the sharpest increase, rising by 45% on the Middle East-to-East route, as renewed buying from China strengthened rates. Suezmax spot freight rates remained at high levels, up 20% m-o-m on the US Gulf-to-Europe route. Aframax rates rebounded from the previous month’s decline, with spot freight rates on the intra-Med route up 23% m-o-m. In the clean tanker market, West of Suez spot freight rates were at 29%, supported by strong performance in the Mediterranean. East of Suez rates fell 10% on average m-o-m, amid a winding down of winter product demand in the Far East.

Crude and Refined Products Trade

Preliminary data shows US crude exports set a fresh record high of 4.8 mb/d in March, while US product exports rebounded to average 6.3 mb/d. China’s crude imports in February partially recovered from the decline at the start of the year to average around 10.7 mb/d. China’s product exports also picked up, averaging a robust 1.7 mb/d. India’s crude imports were at their strongest in over 10 months, averaging just shy of 5.0 mb/d in February. India’s product exports also returned to relatively robust levels, averaging 1.4 mb/d. Japan’s crude imports were broadly unchanged m-o-m at 2.7 mb/d in February. Japan’s product exports, including LPG, hit a five-month high in February. Preliminary estimates for March show crude and refined product imports into OECD Europe declining as a workers’ strike in France disrupted port activities and refinery operations, curtailing trade flows.

Commercial Stock Movements

Preliminary February 2023 data shows total OECD commercial oil stocks increase by 14.1 mb m-o-m. At 2,865 mb, they were 237 mb higher than the same time one year ago and 18 mb higher than the latest five-year average, but 54 mb below the 2015–2019 average. Within components, crude stocks increased m-o-m by 20.9 mb, while product stocks fell by 6.8 mb m-o-m. At 1,434 mb, OECD crude stocks were 172 mb higher than the same time a year ago, and 49 mb higher than the latest five-year average, but 14 mb lower than the 2015–2019 average. OECD product stocks stood at 1,432 mb, representing a surplus of 65 mb from the same time a year ago, though they were 30 mb lower than the latest five-year average and 40 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks rose m-o-m by 1.0 day in February to stand at 62.9 days. This is 4.9 days above the February 2022 level, but 1.8 days less than the latest five-year average and 0.3 days higher than the 2015–2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2022 remained unchanged from last month’s assessment to stand at 28.4 mb/d. This is around 0.5 mb/d higher than in 2021. Demand for OPEC crude in 2023 also remained unchanged from the previous assessment to stand at 29.3 mb/d. This is around 0.8 mb/d higher than in 2022.

-----

Earlier: