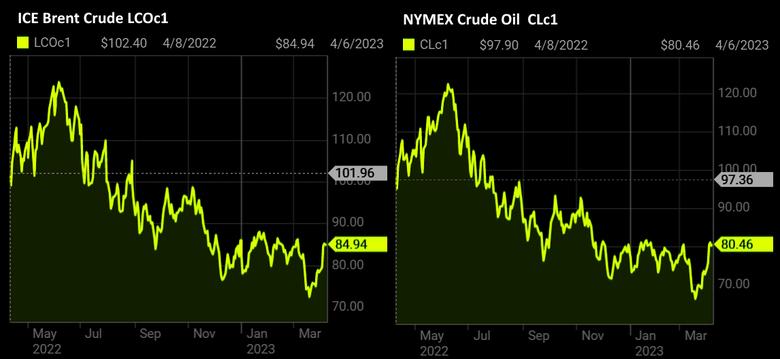

OIL PRICE: BRENT NEAR $85, WTI ABOVE $80

REUTERS - April 6 - Oil prices were little changed on Thursday but posted a third weekly gain as markets weighed further production cuts targeted by OPEC+ and falling U.S. oil inventories against fears about the global economic outlook.

Brent crude settled up 13 cents, or 0.2%, at $85.12 a barrel. West Texas Intermediate U.S. crude closed 9 cents, or 0.1%, higher at $80.70. There will be no trading on the Good Friday holiday.

Both benchmarks jumped more than 6% this week after OPEC+, the Organization of the Petroleum Exporting Countries (OPEC) and allies including Russia, surprised the market on Sunday with a pledge of production cuts.

Hedge funds have bought crude all week, moving from the sidelines back into "risk on" mode, said Dennis Kissler, senior vice president of trading at BOK Financial.

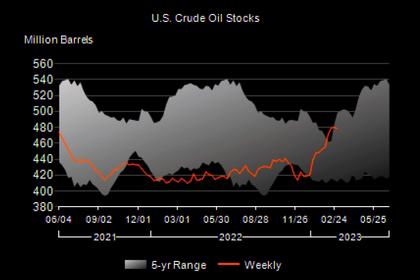

Prices drew support from a steeper-than-expected drop and a second consecutive weekly drawdown in U.S. crude inventories last week. Gasoline and distillate inventories also declined, hinting at rising demand.

U.S. energy firms this week also cut the number of oil rigs for a second week in a row. The rig count, an early indicator of future output, dropped two to 590 this week, Baker Hughes data showed.

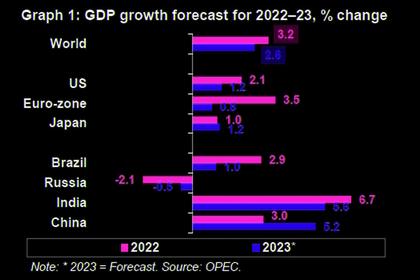

Limiting gains, however, U.S. labor market data pointed to slowing economic growth, and there was also slower-than-expected growth in the U.S. services sector.

"Demand destruction as function of the threat of recession is greater than the cut by OPEC+," said Robert Yawger, said director of energy futures at Mizuho Securities.

Buyers of put options that hedge downside risk were more active than buyers of call options, which bets on rising prices, implying traders were worried prices could fall, Yawger added.

"The oil market's bullish momentum may have paused, but upside potential remains given the tightening supply backdrop," said Stephen Brennock of oil broker PVM.

-----

Earlier: