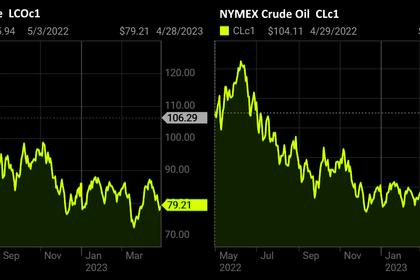

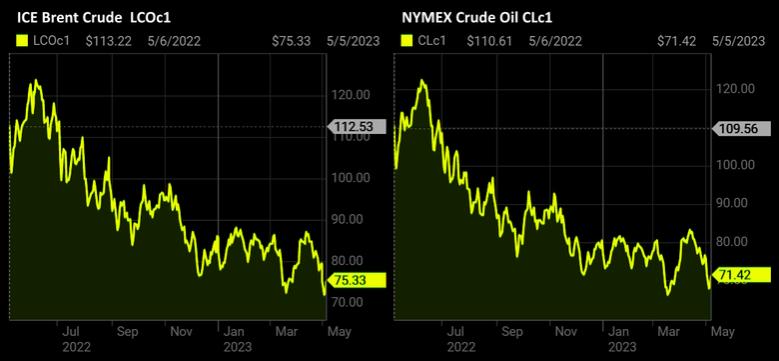

OIL PRICE: BRENT ABOVE $75, WTI ABOVE $71

REUTERS - May 5 - Oil prices jumped on Friday but were set for a third straight week of losses after dramatic drops on fears over the economic impact of interest rate hikes and slowing Chinese demand.

Brent crude rose $2.61, or 3.6%, to $75.11 a barrel by 1336 GMT. U.S. West Texas Intermediate was up $2.70, or 3.9%, at $71.26 after four days of declines that sent the contract to lows last seen in late 2021.

The Brent benchmark was on track to finish the week with a decline of about 5.5%, while WTI was set for a 7% loss, despite heading for their biggest daily percentages rises in a month.

"Rather than underlying fundamentals, the selling frenzy over the past week has been driven by worries about demand linked to recession risks and the strain in the U.S. banking sector," said PVM oil market analyst Stephen Brennock.

"The upshot is that there is a big disconnect between oil balances and oil prices."

Commerzbank analysts also said oil demand concerns were overblown and expect a price correction upward in coming weeks.

Equities, which often move in tandem with oil prices, also edged up.

But worries over U.S. regional banks persisted after PacWest Bancorp (PACW.O) said it planned to explore strategic options.

In China, factory activity contracted unexpectedly in April as orders fell and poor domestic demand dragged on the sprawling manufacturing sector.

However, expectations of potential supply cuts at the next meeting of the OPEC+ producer group in June have provided some price support, said Kelvin Wong, a senior market analyst at OANDA in Singapore.

U.S. data showed employers boosted hiring in April while raising wages for workers, pointing to sustained labour market strength that could see the Federal Reserve keeping interest rates higher for some time.

Investors broadly expect the Fed to pause rate hikes at its June policy meeting.

-----

Earlier: