CHINA CLEAN ENERGY INVESTMENT $72.3 BLN

REUTERS - June 21 - China unveiled on Wednesday a 520 billion yuan ($72.3 billion) package of tax breaks over four years for electric vehicles (EVs) and other green cars, its biggest yet for the industry as it seeks to boost slower auto sales growth.

Weakening sales growth in the world's biggest auto market has raised concern over China's economic growth and while financial support was widely expected after an earlier government pledge to promote the industry, shares in major automakers jumped after the details were released.

"The extension by another four years beat market expectations," said Cui Dongshu, secretary general of the China Passenger Car Association.

New energy vehicles (NEVs) purchased in 2024 and 2025 will be exempted from purchase tax amounting to as much as 30,000 yuan ($4,170) per vehicle. The exemption will be halved and capped at 15,000 yuan for purchases made in 2026 and 2027, the Ministry of Finance said in a statement.

China had also previously offered a subsidy for EV purchases for more than a decade but the programme ended last year.

Chinese auto shares rallied after the announcement, with EV makers NIO also surged 3.5%.

The new package extends the current NEV purchase tax exemption which expires at the end of 2023. NEVs include all-battery EVs, plug-in petrol-electric hybrids and hydrogen fuel-cell vehicles.

Cumulative NEV tax breaks, which were first introduced in 2014 and extended three times as recently as in 2022, exceeded 200 billion yuan as of last year, Vice Minister of Finance Xu Hongcai said at a press conference.

Xu said this year's exemption would top 115 billion yuan, indicating the new package of 520 billion yuan would be the biggest ever amount of tax breaks for the industry.

The tax incentives put NEVs on the front burner of a broad-based push to rekindle growth in the world's second-largest economy.

The government heavily promoted NEVs in recent years through incentives that supported the rise of local players such as Li Auto, NIO and BYD.

BYD, backed by Warren Buffett's investment company Berkshire Hathaway , now outsells Volkswagen branded cars in China and became the country's biggest auto maker by sales this year.

Analysts said the cap on the purchase tax exemption would help drive growth of cheaper models that are mainly produced by domestic firms rather than premium vehicles from foreign makers.

NEV sales suffered a hit earlier this year after the government ended the EV purchase subsidy programme, but bounced back after automakers including Tesla cut prices to defend market share and after the previous extension of the purchase tax exemption.

"This will aid China's EV growth," said Susan Zou, vice president at researcher Rystad Energy, anticipating EVs sales would grow 30% in 2024, accelerating from 15% estimated this year.

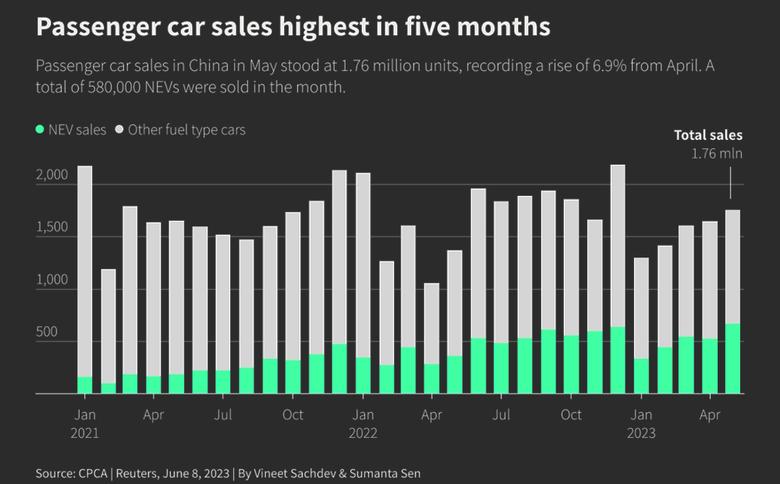

NEV sales rose 10.5% in May from a month earlier, showed data from the China Passenger Car Association. They jumped 60.9% from a year earlier when COVID-19 curbs still roiled auto production and sales.

Many local governments also announced fresh stimulus measures, expanding various incentives that they began rolling out this year to prop up sales.

The local government in Zhengzhou, capital of central Henan province, said on Wednesday it was handing out car purchase coupons totalling 50 million yuan between June and August, allocating 60% of the amount to NEV purchases.

($1 = 7.1936 Chinese yuan renminbi)

-----

Earlier: