GLOBAL CLEAN ENERGY INVESTMENT

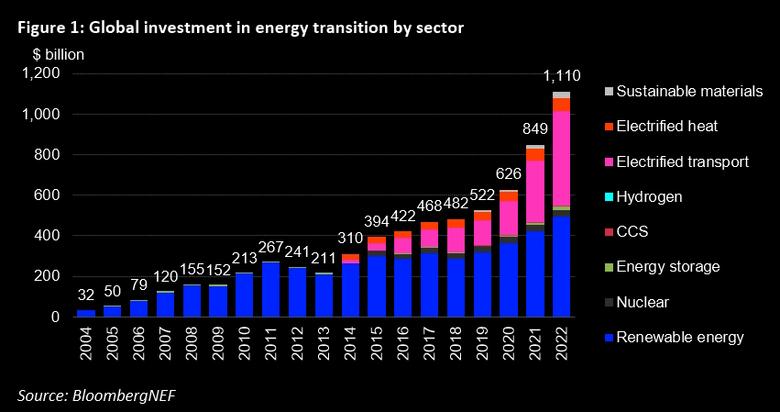

WNN - 26 May 2023 - Nearly two-thirds of the USD2.8 trillion set to be invested globally in energy this year is expected to go to clean technologies including nuclear - but the impressive increase in clean energy investments is concentrated in a handful of countries, according to a newly released report from the International Energy Agency (IEA).

"A new clean energy economy is emerging - and emerging much faster than many realise," IEA Executive Director Fatih Birol said at the launch of the agency's eighth World Energy Investment report.

The last few years have been a period of extreme disruption for the energy sector, with the "powerful alignment" of costs, climate concerns, energy security concerns and industrial strategies contributing to the "growing momentum" behind more sustainable options. Investment in clean energy technologies is now significantly outpacing spending on fossil fuels, with more than USD1.7 trillion of investment this year expected to go to clean technologies including renewables, electric vehicles, nuclear power, grids, storage, low-emissions fuels, efficiency improvements and heat pumps.

"For every dollar invested in fossil fuels, about 1.7 dollars are now going into clean energy. Five years ago, this ratio was one-to-one," Birol said. Led by solar, low-emissions electricity technologies are expected to account for almost 90% of investment in power generation.

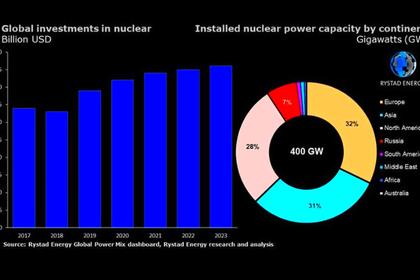

Global investment in nuclear generation is projected by the IEA to be USD63 billion in 2023, USD10 billion up on 2022 figures and continuing a year-on-year increase: "More than a decade after the accident at Fukushima Daiichi, an increasing number of countries are taking a fresh look at how nuclear technologies might provide low-emissions and dispatchable power," the report notes. However, this investment is still less than the USD64 billion investment seen for generation from oil and natural gas.

Dividing lines

Despite upbeat expectations for clean power, the picture for final investment decisions (FIDs) in 2022 was mixed, the report found - and the positive momentum behind clean energy investment is not distributed evenly across countries or sectors. This is something that policy makers will need to address to ensure a broad-based and secure energy transition, the report notes.

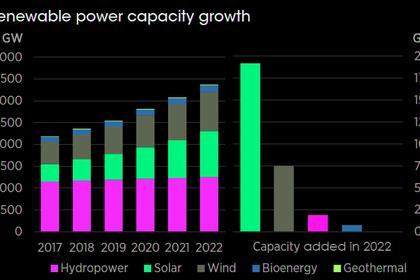

The IEA sees FIDs as an indication of capacity that will come online in the future. FIDs for large hydropower and nuclear power plants decreased significantly to 14 GW and 4 GW respectively (from 20 GW and 6 GW), with China the only region to start the construction of a new nuclear power plant in 2022, the report found.

"After an uptick in 2021, the declining pipeline for these projects is a reason for concern given their potential to support power sector decarbonisation and supply security. However, additional capital is being spent on modernising and extending the lifetimes of existing plants, which is not captured by FIDs; and policy is becoming more supportive to new project approvals in future," the report said.

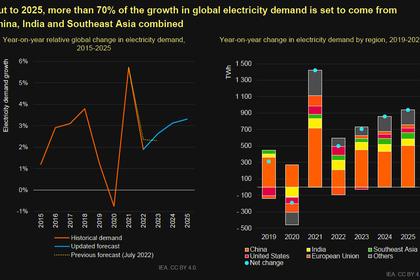

The report found that some 90% of the increase in clean energy investment comes from advanced economies and China. IEA Chief Energy Economist Ian Gould described China as a clean energy powerhouse, leading investment trends in many areas. "Overall we do have quite an imbalanced picture when we look at the geographical spread of that clean energy investment almost all the growth has come from advanced economies and from China and we really need to see that take-off in clean energy investment elsewhere," he said.

Encouraging signs

If clean energy investment - led by electrification - continues to grow at the rate seen since 2021, the report finds that aggregate spending in 2030 on low-emission power, grids and storage, and end-use electrification would exceed the levels required to meet the Announced Pledges Scenario as set out in its World Energy Outlook, in which the net zero emissions pledges announced by governments so far are implemented in time and in full. For some technologies, notably solar, it would match the investment required to get on track for a 1.5°C stabilisation in global average temperatures, by 2050.

However, maintaining those rates of growth will be tough, Gould said, with a "big open question" over accelerating deployment in emerging and developing economies.

"So our overall message: we are in a significantly better place than we were a few years ago … there's still a very long way to go but there are finally some encouraging signs for us all to work with," he said.

-----

Earlier: