GLOBAL ENERGY CHALLENGES

By RON MILLER Principal, Reliant Energy Solutions LLC

ENERGYCENTRAL - Jun 1, 2023 - The three issues impacting the future of energy discussed in this article are: 1) grid reliability with increasing electrification, 2) future electricity price increases, and 3) the clean energy mineral mismatch.

Grid reliability could deteriorate:

As the energy transition/energy addition continues, many changes are occurring that will impact the performance of grid reliability. Our modern digital society is wedded to energy for everything we do, and reliable and moderately-priced energy has become a necessity for the developed world, much like a cellular telephone is for communication.

We depend upon the electrical grid for everything including cooking, heating, air conditioning, charging our vehicles, internet, et al, therefore, stability and reliability are key consumer concerns going forward.

One grid-loading example in the transition is the electrification of current natural gas heating and cooking for residential, commercial and industrial customers, which will increase winter peaks on the grid, a grid that is currently having increasingly more difficulty remaining reliable.

Another example of future grid-loading is the use of battery electric vehicles (BEVs). To replace the U.S. demand of oil per day for gasoline and distillate demand, the grid would need an incremental 2.8 million gigawatt-hours (GWh) of electricity for future BEVs, or a 72% increase in generation, and the attendant transmission/distribution/sub-station lines required to serve the increased consumer demand. Key future concerns are:

- How will the increased electricity demand be met specifically in areas where the grid is not economically or physically able to be expanded?

- How will transmission lines be permitted and built amidst an attitude of “Not In My Backyard” (NIMBY)?

The concern is the grid’s ability to handle increased demand, and the stress this load places on the grid’s efficient and effective operation.

States that have been moving toward increased renewable energy in their mix such as California, Texas, and New York are the top three states in the most power outages over the past 20 years, and the highest outage incidence above the national average. In 2022, California accounted for 24% of all U.S. power outages, while Texas accounted for 14%.

With more electrification loading the grid, along with higher renewable energy penetration, the grid may see more outages and reliability issues.

As we add more intermittent solar and variable wind into the energy generation mix, consumers’ perspective is that their grid will react to these energy generation mix changes while performing with the same level of reliability and availability of electricity as before. Any negative change to this grid status quo, could be met by significant consumer concern/pushback on a new grid that does not offer the same “basic service” of electricity on demand at any hour of the day.

Solutions include:

- adding energy storage facilities to insure an energy supply/demand balance and grid reliability, adding incremental cost to consumer energy bills,

- incenting consumers to change their energy demand habits with Time Of Use electricity pricing to shape energy demand more in line with the grid reliability at each hour of the day/night, and

- building more reliable backup generation, with more transmission/distribution infrastructure.

Electricity pricing could accelerate above consumers’ ability to pay:

A corollary issue to grid reliability is the increasing cost of electricity for the residential, commercial, and industrial sectors. For industry to locate in the U.S. or anywhere else, the cost of power, regulatory environment, and the labor pool are all key considerations for investment. Energy availability and reasonable pricing are key determinants of economic growth and employment.

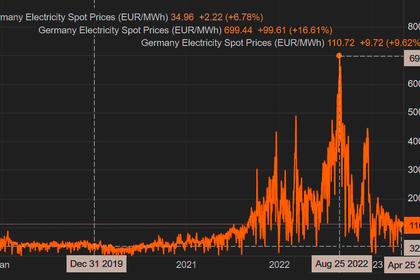

Case in point is Germany over the last 15 years where the annual rate of electricity inflation is over 3.41%, with an increase in electricity prices of over 65% during that period.

Due to the impact of the Ukraine invasion, coupled with the sole-sourcing of natural gas supply from Russia, Germany has seen an acceleration of energy costs to such high levels that it has precipitated the start of its de-industrialization. The recent action by BASF to lay off thousands of workers and the closure of segments of its flagship facility, in Ludwigshafen, Germany is a prime harbinger of the future.

Closer to home, the California residential retail electricity rate has inflated at a 3.31% annual rate that is 6.54 times more than the rest of U.S. during the 2011-2019 time frame. In 2022, the California residential retail rate of 23 cents/kWh reflected an 11% annual inflation from 2020-2022. How long will consumers of all market segments accept this run-up in prices, and the ability to maintain their homes and businesses?

As more renewables come onto the grid with capacity factors in the 20-30% range, additional transmission lines will be needed to connect the remotely-located solar and wind farms to the grid. Due to the intermittency of solar energy production and the variability of wind energy production, the grid will need reliable backup energy generation and/or energy storage technologies. Both of these stop-gap solutions require more capital expenditures for renewables, driving the cost of energy higher, even though the renewable energy farm energy production cost is relatively-low.

The concern is that the grid provide reliable electricity that does not inflate in price above the consumer’s ability to pay. Since we use energy for everything we do in this digital age, it is a necessity that a modern society cannot and will not accept a dramatic change in either energy availability, price, or reliability.

Solutions include:

- lowering the cost of nuclear as the sole baseload, zero emissions source of electricity now available,

- breakthroughs in energy storage costs that allow more renewables to enter the grid without a large price hike, and

- finding the optimal mix of renewables and fossil fuel generation that lowers emissions while keeping the grid reliable and dampening consumer electricity cost hikes.

Clean energy minerals challenge/mismatch:

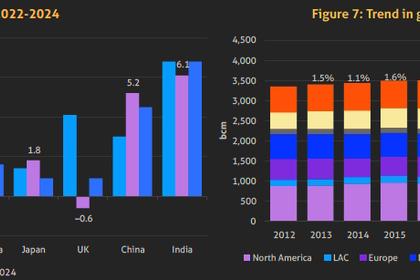

The minerals for the clean energy transition, along with rare earths, will be needed in huge multiples (6x+) to the current production, which begs the obvious questions of:

- where will minerals be mined and processed,

- what is the cost of mineral delivery, and

- which countries on the globe will control future mineral supply?

BEVs require over 200 kilograms (kg) of minerals, while the current internal combustion engine vehicle requires 35 kg, or a multiplier of minerals needed for the energy transition of ~6 times. For a specific example of this mineral multiplier, it takes ~0.5 million pounds raw materials mined and processed to make a battery for just one BEV.

The first concern is the large concentration of mineral production and mineral processing in a very few number of countries, giving them potential future monopolistic powers over both mineral supply and price. Some examples include:

- China with 79% of the Li-ion manufacturing capacity in world,

- China’s lithium production of over 10 times that of the U.S.,

- China’s control of a majority of the elements needed to manufacture batteries, and

- the DRC’s control of 70% of world cobalt reserves.

Production of clean energy minerals is more geographically concentrated than that of the current oil & natural gas industry.

The second concern is the record and mining practices of several mining countries that do not always follow mining environmental laws and practices commonly found in the U.S. and the EU. How much future mining environmental damage in developing countries can be tolerated to move the energy transition forward?

The third concern is the future price volatility of clean energy minerals when demand grows by over 6x, while some countries have more monopolistic powers over price. The problem with high concentration of possible mineral sources leads to a key sole-sourcing liability for the clean energy industry. Over the recent years, we have seen clean energy mineral price volatility in the 25-130% range, and the transition is just beginning with a large share of the key minerals needed for 2050 yet to be mined, processed, and sold into the market.

In 2021, global lithium prices increased by 496.7%, magnesium by 207.6%, and cobalt by 115.2%, tin by 93.6%, and molybdenum by 90.4%. And we are just at the start of the global energy transition/addition.

Combining all the above concerns is whether clean energy minerals will be used as a future geo-political weapon much like OPEC with oil in 1970’s.

Solutions include:

- finding alternative minerals that are in larger and more diversified global supply areas,

- encouraging mining in new areas of the globe that provide more mineral supply competition, and

- balancing clean energy with hydrocarbons to find the correct mix of emissions, price, supply reliability, and a competitive global market.

Summary:

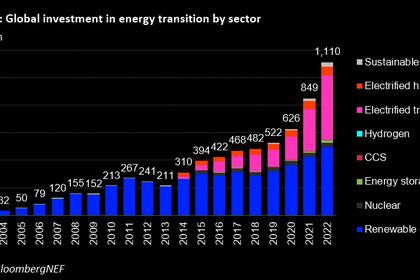

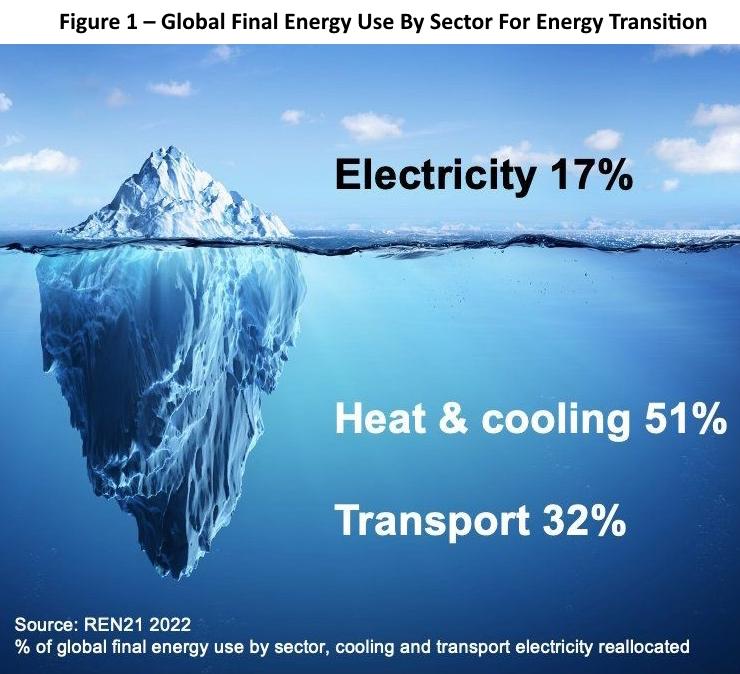

The future energy transition/addition will require many changes and challenges as shown in Figure 1. This figure depicts electricity’s 17% as the tip of the energy demand iceberg in decarbonizing our civilization, while graphically demonstrating the huge challenge of the underlying heating, cooling, and transportation carbon.

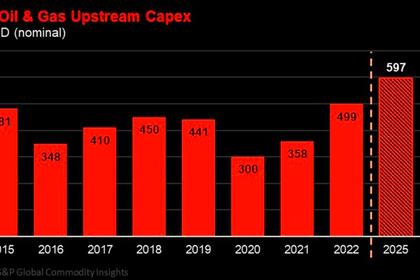

To further illustrate the immense challenge ahead is Figure 2 which graphically demonstrates the share of renewables (not counting hydro) that will be needed to satisfy the energy production/demand currently from coal, natural gas, and oil.

As we analyze the energy transition/addition, there are some key questions that we as both consumers and stewards of our planet should be asking:

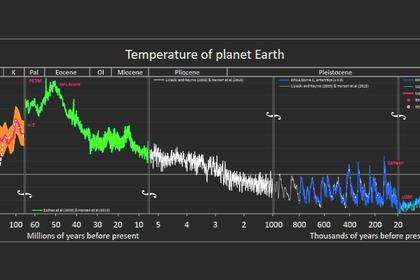

- Will future generations see hugely-noticeable temperature/climate changes with dramatically-higher projected climate catastrophic events?

- Will we be able to say in the future that we evaluated all of the options, and feel confident we “bet on the right horse" in 2023?

- Will we be able to afford the projected/recommended energy changes, and what impact will that increased cost have on our expenditures for education, security, health, taxes, and cost of living?

- Will the future electric grid be as reliable as we have become accustomed to enjoying over the last 50 years?

- Will we enjoy reasonably-priced energy on 24/7 demand, or will we have to dramatically change our life style?

- Will the new world of mineral dependency be an easier trade off than the current use of fossil fuels with regards to price, supply reliability, emissions, environmental quality, and geo-political pressure?

In summary, the future energy transition may change from a global dependency on major oil/gas suppliers, to a global dependency on clean energy minerals, i.e. we may move from a hydrocarbon-dependent society to a mineral-dependent society.

-----

This thought leadership article was originally shared with Energy Central's Generation Professionals Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Generation Professionals Community today and learn from others who work in the industry.

-----

Earlier: