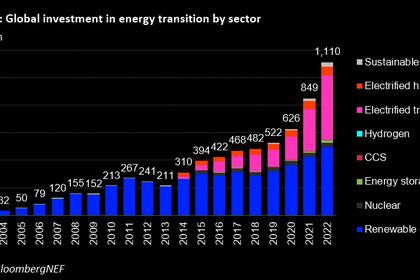

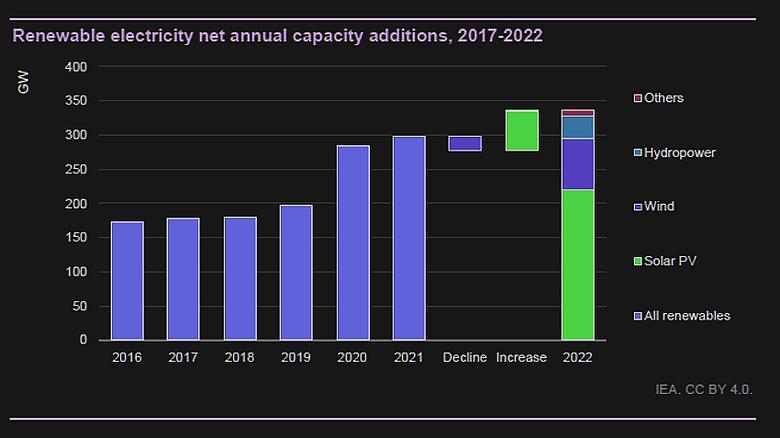

GLOBAL RENEWABLES UP BY 107 GW

IEA - 01 June 2023 -

Led by solar PV, renewable power growth is surging –

driven by the global energy crisis and policy momentum

Global renewable capacity additions are set to soar by 107 gigawatts (GW),

the largest absolute increase ever, to more than 440 GW in 2023. This is

equivalent of more than the entire installed power capacity of Germany and Spain

combined. This unprecedented growth is being driven by expanding policy

support, growing energy security concerns and improving competitiveness against

fossil fuel alternatives. These factors are outweighing rising interest rates, higher

investment costs and persistent supply chain challenges.

Solar PV capacity, including both large utility-scale and small distributed

systems, accounts for two-thirds of this year’s projected increase in global

renewable capacity. In response to higher electricity prices caused by the global

energy crisis, policy makers in many countries, particularly in Europe, have

actively sought alternatives to imported fossil fuels that can improve energy

security. This shifting focus created a favourable environment for solar PV,

especially for residential and commercial systems that can be rapidly installed to

meet growing demand for renewable energy. These smaller distributed PV

applications are on track to account for half of this year’s overall deployment of

solar PV – larger than the total deployment of onshore wind over the same period.

Following two consecutive years of decline, onshore wind capacity

additions are on course to rebound by 70% in 2023 to 107 GW, an all-time

record amount. This is mainly due to the commissioning of delayed projects in

China following last year’s Covid-19 restrictions. Faster expansion is also

expected in Europe and the United States as a result of supply chain challenges

pushing project commissioning from 2022 into 2023. On the other hand, offshore

wind growth is not expected to match the record expansion it achieved two years

ago due to the low volume of projects under construction outside of China.

Solar PV additions will continue to increase in 2024 while challenges remain

for wind expansion. Declining module prices, greater uptake of distributed solar

PV systems and a policy push for large-scale deployment are driving higher

annual solar additions in all major markets – including China, the European Union,

the United States and India. In contrast, without rapid policy implementation,

global onshore wind additions in 2024 are expected to fall by around 5% from

2023 levels. While China’s wind energy additions will continue to increase in 2024,

they are set to be more than offset by undersubscription of auctions and pending

permitting delays in Europe. The situation in Europe is expected to improve once

new legislation is implemented. Overall, cumulative world renewable capacity is

forecast to reach over 4 500 GW at the end of 2024, equal to the total power

capacity of China and the United States combined.

Global renewable capacity additions could reach 550 GW in 2024 in our

accelerated case, almost 20% higher than in the main forecast. This is mainly

due to a more rapid deployment of residential and commercial PV installations,

assuming a faster implementation of recent policies and incentives. The upside

for utility- scale onshore wind and solar PV projects mostly depends on the pace

of permitting, construction and timely grid connection of projects under

development.

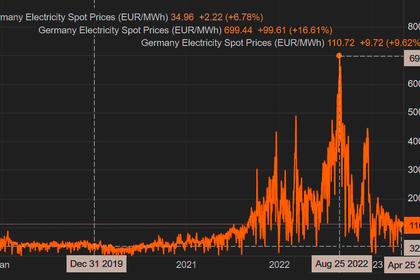

Renewables are at the forefront of Europe’s response to

the energy crisis

The crisis triggered by Russia’s invasion of Ukraine has accelerated

renewable energy deployment in the European Union, driving the bloc to

urgently reduce its dependence on Russian natural gas imports. Policy actions in

many European countries has led us to revise our forecast for renewable capacity

additions in the EU in 2023 and 2024 upwards by 40% compared with before the

war. Rapid growth in distributed solar PV is the main reason for the more positive

outlook, accounting for almost three-quarters of the EU forecast revisions. This is

driven by high electricity prices that make solar PV more financially attractive and

by increasing policy support in key EU markets, especially in Germany, Italy and

the Netherlands.

European countries introduced more policy and regulatory changes to ease

permitting in the last 18 months than over the entire previous decade. While

permitting has become a key policy focus in Europe to accelerate the deployment

of large-scale wind and solar PV and early benefits are starting to be visible, the

proposed policy changes are expected to have limited impact on the deployment

of renewables in 2023 and 2024 compared with other drivers, such as installations

of small-scale residential and commercial solar PV.

EU electricity consumers are set to save an estimated EUR 100 billion during

the 2021-2023 period thanks to newly installed solar PV and wind capacity.

Accelerating renewable energy deployment in Europe since 2021 has mitigated

the economic impact of the energy crisis. Low-cost wind and solar PV are on

course to displace an estimated 230 terawatt-hours (TWh) of expensive fossil fuel

generation over the 2021-2023 period, helping to reduce wholesale electricity

prices in all European markets. Without these capacity additions, the average

wholesale price of electricity in the EU in 2022 would have been 8% higher, hurting

consumers, businesses and government budgets.

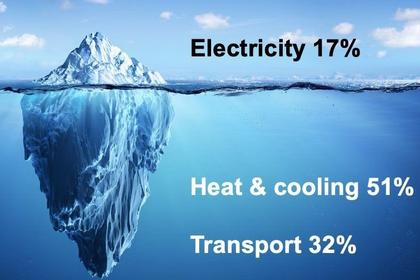

Renewables could help Europe displace more natural gas for heating

buildings next winter. Last year was the second warmest winter on record in

Europe, which helped the EU use less gas for heating buildings. Projected growth

of renewable energy such as clean electricity, bioenergy boilers, heat pumps,

and solar thermal and geothermal technologies could displace almost 8 bcm of

EU buildings-related gas consumption annually in 2023 and more than 17 bcm

in 2024. This would represent a significant contribution to cover increasing gas

demand, should harsher winters and hotter summers occur over the course of

2023-2024.

China is poised

to outpace the rest of the world in

renewable capacity installations in 2023 and 2024

China’s contribution to global renewable capacity additions is expected to

increase in 2023 and 2024, consolidating its position as the undisputed

leader in global deployment. In 2022, China accounted for almost half of all new

renewable power capacity worldwide. By 2024, the country’s share is set to have

expanded to a record 55% of global annual renewable capacity deployment. By

2024, China will deliver almost 70% of all new offshore wind projects globally, as

well as over 60% of onshore wind and 50% of solar PV projects.

In the United States, capacity additions will rebound this year after a difficult

2022. The US markets for wind and solar PV contracted last year due to restrictive

trade measures and supply chain constraints, but annual additions for both

technologies are set to increase by around 40% in 2023, with solar PV setting a

new record. The current forecast is underpinned by existing tax incentives, while

the Inflation Reduction Act will show its full effect after 2024, providing

unprecedented certainty for renewable energy projects until 2032.

India’s renewable capacity additions are expected to increase again in 2023

and 2024, owing to faster onshore wind, hydropower and distributed solar

PV deployment. However, utility-scale solar PV projects, India’s largest

renewable electricity growth segment, are expected to slow briefly this year due

to supply chain challenges, lower auction volumes and trade policies. While largescale

PV manufacturing is emerging in India, import tariffs are causing short-term

demand and supply mismatches.

Competitiveness of wind and solar PV has improved, but

policies need to adapt to changing market conditions

Electricity generation costs from new onshore wind and solar PV plants are

projected to decline by 2024 but will likely remain 10-15% above their pre-

Covid levels in most markets outside China. Regardless, solar PV and onshore

wind remain the lowest cost options for new electricity generation in most

countries. Future power contracts for the end of 2023 and into 2024 in the

European Union, the United States, Japan, Australia and India indicate wholesale

power prices two to three times above 2020 averages. Today, wind and solar PV

plants can provide electricity at prices 30-50% lower than those of future power

contracts in most key markets, increasing renewables’ attractiveness for investors.

Policy uncertainties and volatile prices left one-sixth of renewable energy

auction volumes unallocated in 2022. Competitive renewable energy auctions

resulted in the awarding of a record-breaking 100 GW of capacity. However, 20

GW remained unallocated, the highest ever level with Europe accounting for twothirds

of it. Government auction designs need to take into account recent inflation,

interest rate rises and turbulence in commodity prices – and to envisage dynamic

indexation methods to attract investments.

Market-driven procurement is expected to contribute to approximately onefifth

of solar PV and wind capacity expansion in 2023 and 2024, driven by

corporate power purchase agreements. The United States leads expansion in

corporate power purchasing agreements, followed by Brazil, Australia, Spain and

Sweden. These agreements are motivated by the economic attractiveness of

renewables, by the opportunity to hedge against rising and volatile power prices,

and by sustainability goals.

The financial health of renewable energy value chains is critical for the

industry’s sustainable growth. Despite challenges from volatile commodity

prices, higher interest rates, supply chain constraints and trade measures, the

renewable energy industry has shown financial resilience overall. However, there

is significant variation across sectors and countries. The solar PV manufacturing

sector has a positive outlook with increasing capacity additions, but potential

supply gluts and declining prices may reduce company profit margins. Western

wind manufacturers face challenges from high commodity prices, as well as

permitting and auction designs that do not reflect changing financing

environments. While the energy crisis has also hurt the profitability of some

specific electricity utilities, these companies overall are maintaining their role as

large investors in renewables.

Global manufacturing capacity of solar PV is projected to reach nearly 1 000

GW in 2024, sufficient to meet annual demand in the IEA’s Net Zero

Emissions by 2050 Scenario. In contrast, wind equipment manufacturing is

expanding more slowly and may struggle to keep up with demand growth through

2030. While China will continue to dominate global manufacturing capacity for

solar PV, announcements of solar PV manufacturing projects in the United States

and India have doubled since December, indicating that supply chains are

diversifying in the medium term.

The rapid expansion of wind and solar PV needs to be accompanied by

policies and market rules supporting grid infrastructure and flexibility

investments. An increasing amount of electricity generation from wind and solar

PV is being curtailed in many markets, particularly where grid infrastructure and

system planning lag behind deployment of these variable renewables. However,

curtailed generation remains relatively low, ranging from 1.5% to 4% in most large

renewable energy markets. Multiple countries in Europe – including Spain,

Germany and Ireland – will see their annual share of wind and solar PV reach over

40% by 2024, which will require effective grid management to hold back rising

curtailment rates.

Biofuels have supported energy security during the

recent crisis but are facing challenges of their own

Biofuels avoided the consumption of 2 million barrels of oil equivalent per

day (mboe/d) in 2022, equivalent to 4% of global transport sector oil demand.

Argentina, India and Indonesia all accelerated biofuel use in 2022. However, while

biofuels offered energy security benefits, their prices climbed more quickly than

those of gasoline and diesel in many countries. To mitigate increases in transport

fuel costs, Brazil, Sweden and Finland delayed planned increases to biofuel

blending obligations in 2022.

Biofuel prices are set to decline in 2023 and 2024 while remaining well above

pre-Ukraine war levels. Biofuel prices have declined in all major markets from

their peaks in 2022. In the first four months of 2023, ethanol prices declined

7%-16% from their 2022 average and biodiesel prices dropped 15%-28% across

different markets. While below 2022 peaks, prices for major biofuel feedstocks

such as corn, sugar and vegetable oils are expected to remain above pre-war

price levels, keeping biofuel prices at historically high levels through 2024.

Biofuel demand is to expand by 11% by 2024, supported by existing policies

targeting energy security objectives. Only Indonesia and Brazil are

accelerating deployment by 2024. In advanced economies, new policies are not

likely to influence production until after 2024 as high prices, feedstock concerns

and technical constraints limit additional growth potential.

-----

Earlier: