OIL ENTROPY

The month has been busy covered with elections from Turkey and Nigeria, the former preceding on the 3rd term and the latter gaining new leadership at the front. An applause for both countries on the exercise of peoples views and rights.

This should be noted as it is a factor in the basis of geopolitics which recquires stability as one of the key ingredients for growth and development cross borders.

Monthly Oil has been choppy to say the least,with the beginning of the SPR Refill that's been way overdue,due to lack of funding appropriation for the procedures involved.

This is slowly turning into a marketplace where entropy reigns supreme.

Sometimes its good to bite what one can chew.

Voluntary production cuts by some members of OPEC is due this coming month.

Russia lifts levy on Oil & Gas firms amid G7 Price cap on CrudeOil.

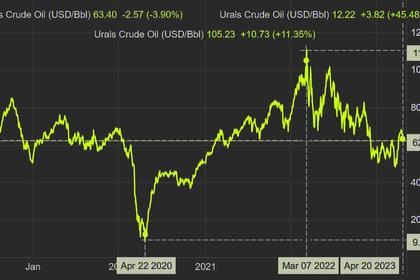

I've attached an Open Interest Chart on both WTI & BRENT.

Oil markets is being driven by macro concerns & China recovery hopes.

Crude WTI trading at $71.30/bbl,

BRENT at $75.49/bbl

Natural Gas at $2.362/mmBtu

In focus is the #ZIRP:

OIL Data suggests,

Hedge funds/CTAs are now massively net short gasoil futures.

In last five years, Managed Money has been net short only three other times:

-Late 2018,

-COVID (3/20),

-Late-2020

Big oil rally followed every case.

Inventory draws is a crucial factor to how this plays out.An absence of this, $CL is fighting an uphill battle with the end of #ZIRP. The paper barrels are getting more expensive to finance and they are liable to keep selling off unless the FED starts cutting.It should be noted that the risk of no cuts this year keeps increasing.

On matters facing the debt ceiling discussions/defaults ; House Republicans reached a tentative deal with the White House on Saturday night to raise the nation’s borrowing limit and avoid a catastrophic default on U.S. sovereign debt.

This has caused jitters amongst many in the markets,hoping to see things calming down once the tide settles in.

As we look into the sensitive Energies complex,an interesting bit that caught my eye was that Solar is set to attract more CAPEX than Oil production for 2023.

On the #FXWatchlist,the EuroTrade specifically #EURUSD has been gaining on the sharp deep pullback as I had stated in the previous post currently trading at 1.07 handle and daily lows at 1.06700.

I'd suggest that you start treading prudently because this is thin ice starting to form.

Highlights of the week and start of the new month is the JOLTS Report & Jobless Claims.

In the words of Mario Draghi during his tenure as ECB President : In a dark room you move with tiny steps.You don't run but you do move.Good luck in finding your way out.

Let's keep moving.

--

Andy Warr,

TophatFinanceGroup .

-----

Earlier: