U.S. URANIUM IMPORTS DOWN

U.S. EIA - June 13, 2023 - Uranium Marketing Annual Report

Uranium purchases and prices

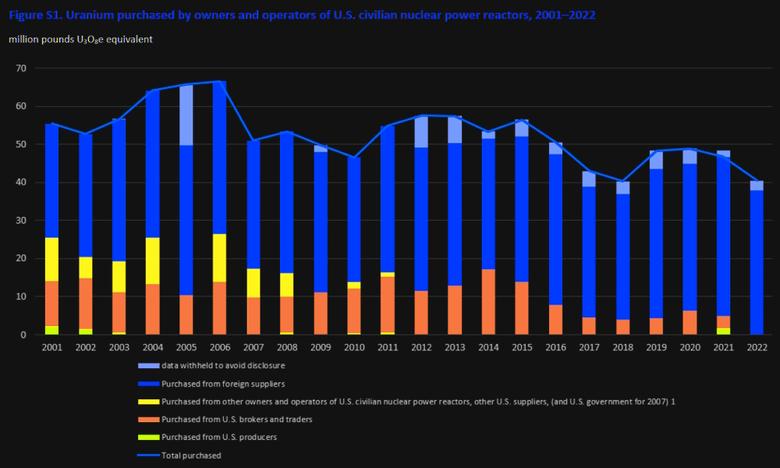

Owners and operators of U.S. civilian nuclear power reactors (civilian owner/operators, or COOs) purchased a total of 40.5 million pounds U3O8e (equivalent) of deliveries from U.S. suppliers and foreign suppliers during 2022, at a weighted-average price of $39.08 per pound U3O8e. The 2022 total of 40.5 million pounds U3O8e was 13% lower than the 2021 total of 46.7 million pounds U3O8e. The 2022 weighted-average price of $39.08 per pound U3O8e was 15% higher than the 2021 weighted-average price of $33.91 per pound U3O8e (Table 1) and the highest price since 2016.

The largest sources of uranium delivered in 2022 was of foreign-origin with Canada the top source at 27% of total deliveries, followed closely by Kazakhstan with 25% of total deliveries. Uzbekistan-origin material accounted for 11% of total deliveries and Australia was fourth at 9% of total deliveries. United States material accounted for 5% of total deliveries in 2022 (Table 3).

COOs purchased three material types of uranium for 2022 deliveries from 31 sellers (Table 4, Table 24). During 2022, 15% of the uranium delivered was purchased under spot contracts at a weighted-average price of $40.70 per pound. The remaining 85% was purchased under long-term contracts at a weighted-average price of $38.81 per pound (Table 7). Spot contracts are contracts with a one-time uranium delivery (usually) for the entire contract, and the delivery typically occurs within one year of contract execution (signed date). Long-term contracts are contracts with one or more uranium deliveries to occur at least a year following the contract execution (signed date) and as such may reflect some agreements of short and medium terms as well as longer term.

New and future uranium contracts

In 2022, COOs signed 27 new purchase contracts with deliveries in 2022 of 4.6 million pounds U3O8e at a weighted-average price of $41.87 per pound (Table 8).

COOs report minimum and maximum quantities of future deliveries under contract to allow for the option of either decreasing or increasing quantities. At the end of 2022, the maximum uranium deliveries for 2023 through 2032 under existing purchase contracts for COOs totaled 223 million pounds U3O8e (Table 10). Also at the end of 2022, unfilled uranium market requirements for 2023 through 2032 totaled 179 million pounds U3O8e (Table 11). These contracted deliveries and unfilled market requirements combined represent the maximum anticipated market requirements of 402 million pounds U3O8e over the next 10 years for COOs.

Uranium feed, enrichment services, uranium loaded

In 2022, COOs delivered 35 million pounds U3O8e of natural uranium feed to U.S. and foreign enrichers. U.S. enrichment suppliers received 41% of the feed, and the remaining 59% was delivered to foreign enrichment suppliers (Table 13). Fourteen million separative work units (SWU)2 were purchased under enrichment services contracts from nine sellers in 2022 (Table 16, Table 25). The average price paid by the COOs for the 14 million SWU was $101.03 per SWU in 2022, a slight uptick from the $99.54 per SWU paid in 2021. In 2022, the U.S.-origin SWU share was 27%, and the foreign-origin SWU accounted for the remaining 73%. Foreign-origin SWU included 24% from Russia, 12% from Germany, 11% from the United Kingdom, and 9% from the Netherlands (Table 16).

Uranium in fuel assemblies loaded into U.S. civilian nuclear power reactors during 2022 contained 44.4 million pounds U3O8e, the same volume loaded in 2021. During 2022, 3% of the uranium loaded was U.S.-origin uranium and 97% was foreign-origin uranium (Table 18).

Uranium foreign purchases/sales and inventories

U.S. suppliers (brokers, converters, enrichers, fabricators, producers, and traders) and COOs purchase uranium each year from foreign suppliers. Together, foreign purchases totaled 32.1 million pounds U3O8e in 2022, and the weighted-average price was $40.31 per pound U3O8e (Table 19). U.S. suppliers and COOs also sold uranium to foreign suppliers. Together, foreign sales totaled 2.5 million pounds U3O8e in 2022, and the weighted-average price was $54.65 per pound U3O8e (Table 21).

Year-end commercial uranium inventories represent ownership of uranium in different stages of the nuclear fuel cycle (in-process for conversion, enrichment, or fabrication) at domestic or foreign nuclear fuel facilities. Total U.S. commercial inventories (including inventories owned by COOs, U.S. brokers, converters, enrichers, fabricators, producers, and traders) were 140 million pounds U3O8e at the end of 2022, down 1% from 141.7 million pounds at the end of 2021. Commercial uranium inventories owned at the end of 2022 by COOs totaled 103.8 million pounds U3O8e, a 4% decrease in inventories from the year-end 2021 level. Uranium inventories owned by U.S. suppliers (converters, enrichers, fabricators, producers, brokers and traders) totaled 36.2 million pounds U3O8e at the end of 2022, up 9% from 2021 year-end levels (Table 22).

-----

Earlier: