GLOBAL CLIMATE WANT MONEY

By TONY PARADISO Principal, E3

ENERGYCENTRAL - Jul 10, 2023 - The bill to stop global warming is rising faster than the temperature. I’ve done a number of posts and videos on the topic. The last estimate was $131 trillion. That was back in September 2022.

Unfortunately, every time a new estimate is published, it’s significantly higher than the previous one.

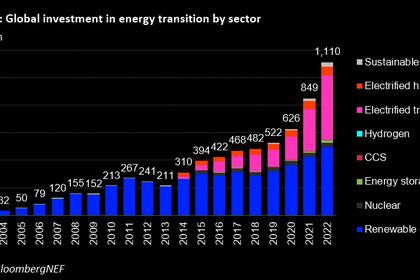

The latest from a recently release BloombergNEF report: a whopping $196 trillion to achieve zero carbon emission by 2050.

BNEF estimates that the global annual green investments would need to almost triple to $6.9 trillion by 2030 to have any hope of getting to net zero by 2050.

And the BNEF estimate is on the low side compared to McKinsey’s projection of $275 trillion. That equates to an annual spend level of $9.2 trillion between 2021 and 2050.

To put the numbers into context, $196 trillion is about 9 times the GDP of the United States – still the largest global economy. On a global level a $9.6 trillion annual spend would equal about 10% of worldwide GDP which currently sits in the range of $100 trillion.

Massive numbers. But according to Insurance giant Swiss Re, the required investment levels pale in comparison to the cost of doing nothing. The company estimates that global warming could reduce global GDP by $23 trillion annually.

You’d think that possibility alone would cause nations to rachet things up. Think again. That isn’t how the human race works. Collectively, we’re not particularly good at instituting preventive policies. We seem to prefer more of a crisis management strategy.

So let me save some time: there is no chance of hitting net-zero by 2050. Investments aren’t going to triple. And the world isn’t going to allocate 10% of its overall economic output to fighting climate change.

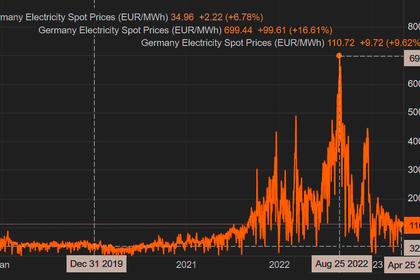

We’d be lucky if investment levels doubled over the next decade. This is why I continue to say we need a more focused and prioritized strategy. And that strategy needs to incorporate realistic investment levels.

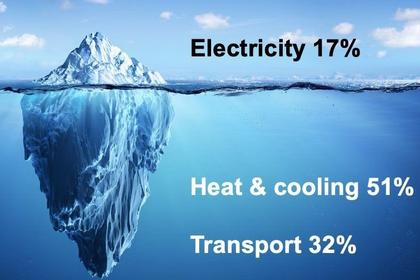

If you look at where BNEF is projecting the bulk of the investment it’s in EVs and low-carbon power. Only relatively small amounts are allocated toward grid upgrades, hydrogen, and carbon capture and storage. This is almost the exact opposite of what our strategy should be.

2050 may be impossible, but the goal should be net-zero ASAP. To accomplish that, funds need to be redirected to hydrogen - which may be better suited to our long-term clean power goals, and to grid modernization.

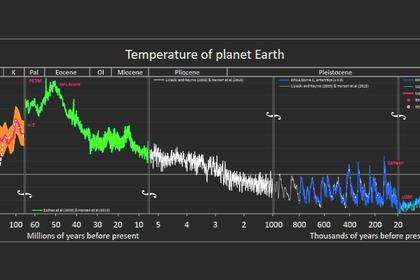

Finally, let’s collectively admit we aren’t going to stop emitting carbon fast enough. That makes carbon capture and storage the best strategy to pursue. If we can figure out how to economically remove carbon from the atmosphere, we buy the necessary time to reduce emissions and ensure we can manage carbon levels forever.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: