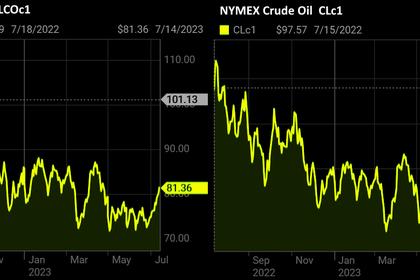

OIL PRICE: BRENT ABOVE $80, WTI NEAR $76

REUTERS - July 21, 2023 - Brent oil prices rose in Asian trading on Friday, as markets assessed the prospect of economic stimulus in China after weak economic data, falling inventories in the U.S. and supply cuts from key producers.

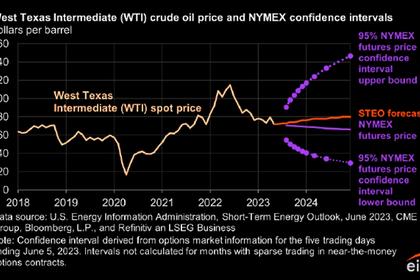

Brent futures rose 63 cents to $80.27 a barrel by 0425 GMT, while U.S. West Texas Intermediate (WTI) crude climbed 62 cents to $76.27 a barrel. Prices closed marginally higher on Thursday.

Brent was on track to close up 0.5% for the week, while WTI was set to tick up 1.1%, which would represent a fourth consecutive week of gains for both benchmarks.

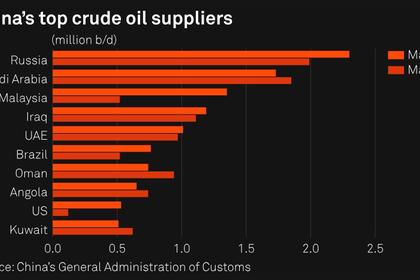

China's weak economic figures had kept a lid on prices through the week. The world's second biggest oil consumer this week posted disappointing growth in second-quarter gross domestic product, increasing the likelihood of the economy's missing the government's 5% annual growth target.

However, sentiment across commodity markets has picked up on hopes the central government would roll out more stimulus measures to support the economy.

On Wednesday, Beijing announced that it will formulate plans to stabilise growth in 10 sectors, as well as to increase support for private firms.

Supporting prices, recent data, including lower-than-expected inflation and moderating job growth, have convinced many investors and analysts the Federal Reserve's expected July rate hike will be the last of its current tightening cycle.

Supply fundamentals have also provided support to market sentiment.

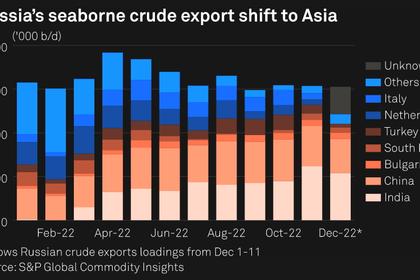

"Evidence of supply cuts from Saudi Arabia and Russia have been the trigger for the rebound in prices this month," analysts from ANZ Bank said in a client note.

In early July, Riyadh said it would extend a voluntary output cut of 1 million bpd into August, while Moscow said it would cut exports by 500,000 bpd in August.

"That tightness in supply is already showing up in inventories," ANZ noted.

U.S. crude inventories (USOILC=ECI) fell last week, supported by a jump in crude exports as well as higher refinery utilization, the Energy Information Administration (EIA) said on Wednesday.

-----

Earlier: