OPEC+ STABILIZE MARKET

PLATTS - 05 Jul 2023 - Deep OPEC+ production cuts, led by Saudi Arabia, into a skeptical market have yet to lift oil prices, but traders will soon come around, once evidence emerges of tightening fundamentals, the kingdom's energy minister said July 5.

Global oil demand is rising, central bankers are working to tame inflation, and OPEC+ output restraint will turn the tide of "exaggerated negativity" that has flooded the market, Prince Abdulaziz bin Salman told the OPEC International Seminar in Vienna.

"You cannot change a negativity that is emanating from let's say 10 million traders," he told a packed audience of industry officials and market participants, two days after Saudi Arabia announced it would hold its crude output at a two-year low of 9 million b/d through at least August.

But the negativity cannot last, and "I am very optimistic," the prince added. "People should be in their comfort zone that this market will not be left unattended."

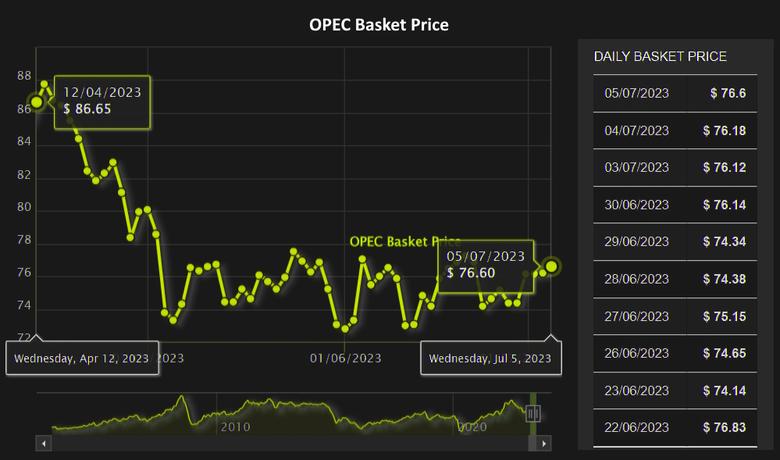

Saudi Arabia on June 4 announced it would be making a unilateral 1 million b/d production cut in July, on top of 3.66 million b/d in collective OPEC+ quota reductions implemented since October. On July 3, the kingdom said it would extend that cut for August, along with a concurrent commitments from Russia to lower its crude exports by 500,000 b/d and Algeria to rein in 20,000 b/d of output.

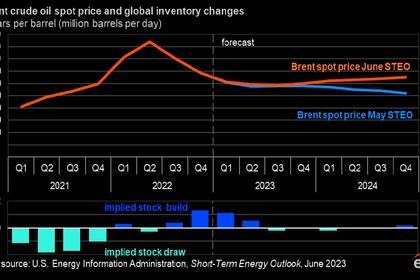

But the gambits have not yielded any price gains.

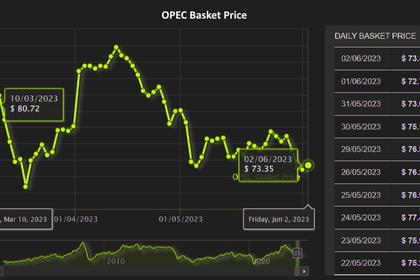

Platts, a part of S&P Global Commodity Insights, assessed the Dated Brent crude spot price at $76/b July 4, still below the $77.31/b reached by the benchmark June 5 after the first Saudi cut announcement.

The market has been weighed down by weak global economic indicators, particularly in the key market of China. Russia's continued high crude exports, as it seeks to maximize its oil revenues in the face of western sanctions over its war in Ukraine, also have cast doubt on its commitment to tightening the market.

OPEC officials, however, said speculators were relying on excessively bearish data and failing to see the wisdom in the group's strategy.

'Whatever necessary'

The organization's analysts see demand for OPEC crude rising to 29.87 million b/d in the third quarter of 2023 and 30.59 million b/d in the fourth quarter, with recovering air travel and industrial activity in China leading the way.

By comparison, OPEC's 13 members pumped 28.07 million b/d in May, which is set to fall significantly in July, with the extra 1 million b/d Saudi cut.

"Tools in our [OPEC+] kit are working," Prince Abdulaziz said. "We will do whatever is necessary."

As for Russian supply, the Saudi minister said Moscow's declaration of its intent to cut 500,000 b/d of its crude exports will be trackable by trade flow monitors, as a "more meaningful" metric to the market than production cuts, which could be obscured by refinery runs or inputs into storage.

UAE energy minister Suhail al-Mazrouei said the voluntary OPEC+ cuts would bear fruit soon and blamed the current market malaise on the disconnect between physical and paper traders.

The UAE committed in April to a voluntary 144,000 b/d cut, but did not announce any additional curbs in conjunction with the Saudi announcements in June and July. In fact, it fought for and won a quota increase that begins in 2024 to reflect its growing crude production capacity.

"The market is dealing with the dynamics between the speculations and what we're trying to do, the gulf between the physical and the paper or the financial side," Mazrouei told reporters on the sidelines of the OPEC seminar. "With the additional cuts that I would like to recognize and thank the other countries that are participating, I'm optimistic that we will see more stability in the market."

-----

Earlier: