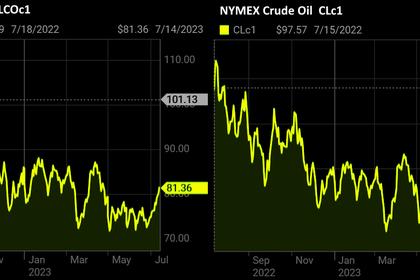

OIL PRICE: BRENT ABOVE $85, WTI NEAR $82

REUTERS - Aug 3, 2023 - Oil prices rose for a second day on Friday, set for their sixth week of gains, after Saudi Arabia and Russia, the world's second and third-largest crude producers, pledged to cut output through next month.

Brent crude futures for October rose 10 cents, or 0.1%, to $85.24 a barrel by 0330 GMT, while U.S. West Texas Intermediate crude for September rose 17 cents, or 0.2%, to $81.72.

Both benchmarks were on track for a sixth week of gains,their longest streak of weekly gains this year. Brent has risen 15.4% and WTI 18.2% during the last six weeks.

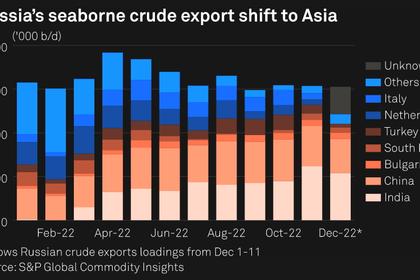

Saudi Arabia extended a voluntary oil production cut of 1 million barrels per day (bpd) till end-September. Russia will also slash its oil exports by 300,000 bpd in September, its Deputy Prime Minister Alexander Novak has said.

The Joint Ministerial Monitoring Committee of OPEC+ is unlikely to tweak overall oil output policy at the meeting on Friday, sources have said. But the cuts by Saudi Arabia and comments by Russia ahead of a crucial OPEC+ meeting have raised supply concerns, supporting prices.

White House national security spokesman John Kirby said the United States will continue to work with producers and consumers to ensure the energy market promotes growth. The U.S. is the world's biggest oil producer and consumer.

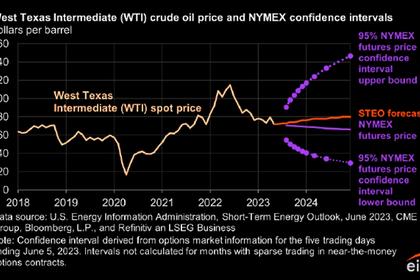

However, the latest batch of U.S. data showing tight labor markets and a slowing service sector has triggered some worries that an economic slowdown would curb demand for oil and pressure prices lower, even with the supply cuts.

"A strong dollar has weighed on crude prices and everyone wants to know if a hot labor market will force the Fed to tighten policy even further," said Edward Moya, an analyst at OANDA.

Additionally, the downturn in euro zone business activity worsened more than initially thought in July and the Bank of England raised its interest rate to a 15-year peak on Thursday. Higher borrowing costs for businesses and consumers could slow economic growth and reduce oil demand.

However, an improved demand outlook and a tight supply could continue to buoy the oil markets, said Tina Teng, an analyst at CMC markets.

"The upcoming US non-farm payroll (data) will be in focus, and steer market sentiment tonight," Teng said.

-----

Earlier: