GLOBAL OIL OF SAUDI ARABIA

As we come to the end of the Africa Climate Summit week in Nairobi, Kenya, a variety of discussions have taken place among various stakeholders and global citizens to explore different methods to reduce greenhouse gas emissions.

These conversations enable the creation of a balance in scales to bring a collective sense and reasoning through ideas towards the betterment of sound global community health.

Moves within the Oil markets have been very critical, starting us off is news from Saudi Arabia concerning major supply cuts henceforth cementing its place as Chair Umpire to Oil Market. In addition to the modest Russian contribution, this is a sign of strength by the OPEC+ Group.

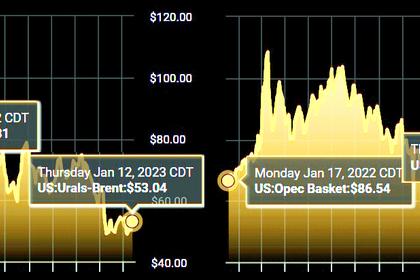

Prices on the global benchmark Brent soared past $90/bbl after the news,Crude WTI substantially north of $80/bbl currently trading at $86.25/bbl on the daily tabs.

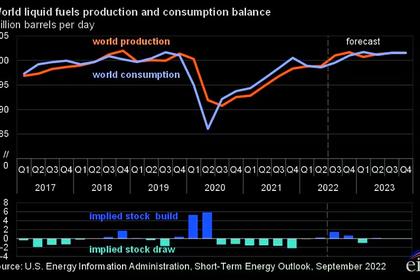

Iranian Crude into the markets during summer created somewhat of a 'cap' on prices for months,however bleeding onto inflation data vis a vis Gas prices,we are in a more bullish situation today.Conclusions drawn from the major play is either this is a response to previously experienced demand weakness that is needed to get ahead of,a substantial tailwind per se,or an assertion of control by the Saudis. The latter holds more weight in my opinion.

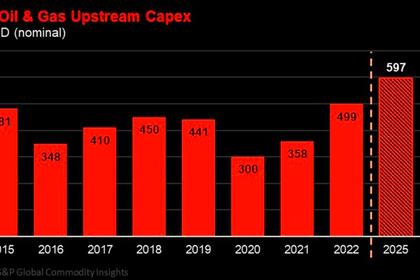

A factor to consider in the following weeks is Shale is also moving higher,there has also been an increase of dividend by major Oil companies but majorly,refinery margins data is the broth in determination of $100/bbl Oil movement. Backwardation reflects physical fundamental in the markets, if we have a macroeconomic shock,that's where we get steep contango.

Response through the big jump indicated was due to the length of the cut(3months) rather than the size of the cut,a much bigger deficit is to be experienced in the months to come. At the same time,Open Interests jumps on $100 calls.

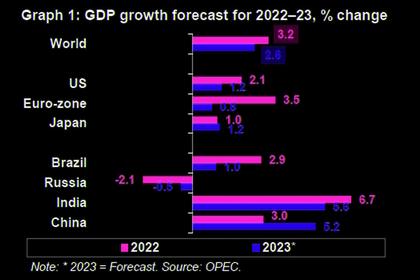

On the China FX Outlook, there has been chatter of more CNH weakness trickling down to the EM Central Banks through easing cycles from increased China macro risks.Previous weeks have been marked by profit booking swings however the weakness is still a big bias within the Yuan see-saw.

Asia is pushing back against the Dollar Strength, Yen is one to look at keenly,as strengthening can be done since China has the tools in place.Japan has issued strong warnings on speculatory moves.The thin line of diminishing returns of individual trades and volatility of trades being experienced puts both within a tug of war.Every cloud has a silver lining,just a matter of time.

On the European front,

The ECB expectation of a rate hike next week is one to draw attention to.Steepness of rates curve in the Euro Area are far away from making money.Correlation between the FTSE250 & Rates data should be a compass,expectations of a good buying opportunity is the diamond in the rough as it is a laggard with respect to its equity peers.

On the US front,

Investment Grade Bond sales are keeping the markets busy.FED has offloaded $1T Bonds.

US CPI Print is in next week therefore majority are getting deals done when markets are quiet.

A rise in US yield is spurred by strong economic data.

Let us row our boats gently down the stream.

Nice month ahead & many blessings,

Andy Warr,

TophatFinanceGroup.

-----

Earlier: