INDIA NEED ELECTRIFYING

By MOHANAKRISHNAN P Chief Growth Officer, 82Volt Technologies

ENERGYCENTRAL - Sep 11, 2023 - As of 2023, India stands as the world's third-largest automobile market in terms of sales. Notably, in 2022, India ascended to the fourth position globally in terms of the valuation of its automotive industry. As of April 2022, the Indian automotive sector boasts a substantial worth, exceeding US$100 billion, contributing significantly to the nation's economic landscape. It accounts for 8% of India's total exports and contributes 7.1% to the country's Gross Domestic Product (GDP).

While the electric vehicle (EV) segment has held a relatively modest share in the broader automobile narrative, there is an encouraging upswing in EV adoption. The horizon for EVs in India appears promising, with increasing interest and growth prospects on the horizon.

Present status of the electric vehicle industry in India and the growth trends

Transportation in India contributes 14% of CO2 emissions (ICCT 2022), with 90% of energy used by road transport (Hagemann et al., 2020) and 50% of oil demand (IEA 2021). Amidst economic growth, addressing energy use and decarbonization is vital.

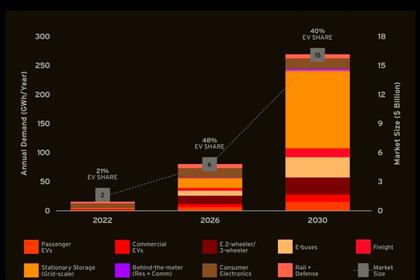

India's EV industry is promising, with 1.2 million EV units sold and forecasts of $200 billion investments by 2030. The government's ambitious goals envision EV sales penetration targets of 30% for private cars, 70% for commercial vehicles, and 80% for two and three-wheelers by the year 2030.

Government schemes like FAME incentivize EV adoption. Increasing buyer awareness, advancements in battery and charging technologies, automakers participation, and green charging infrastructure are enhancing the appeal of EV.

The Indian EV market is diversifying rapidly and includes E3Ws and E2Ws, which are cost-effective and growing in popularity. Studies suggest that lifetime TCO of E3Ws & E2W are already 20% - 70% cheaper than their ICE equivalents. E4Ws on the rise and expected to rise to 30% of all 4 wheeler sales. E-Buses are being promoted with a $7 billion scheme to deploy a fleet of 10,000 electric buses and charging infrastructure across 169 cities within the next decade. The heavy logistics sector is just starting to tap into the potential of EVs.

Overall, EV industry rapid progress is driven by support, awareness, technology advancements, and infrastructure.

Significance of Government initiatives

The EV ecosystem, encompassing materials, supply chain, and operational infrastructure, policies, and stakeholders possesses distinct characteristics compared to ICE vehicles. The unique characteristics of the EV ecosystem demand robust governmental support for a seamless transition and a distinctive global EV position.

- Rules like Battery Waste Management, Vehicle Scrappage Policy, and schemes like FAME, Production Linked Incentive create a roadmap for both manufacturers and consumers to embrace EVs.

- Incentives, subsidies, tax rebates, road tax exemptions, domestic manufacturing etc help bridge the price gap between EV and ICE vehicles and encourage adoption.

- Public awareness campaigns such as “Shoonya – Zero Pollution Mobility” and “Go Electric" campaigns create awareness about the benefits of EVs, including reduced emissions, lower operating costs, and enhanced energy security.

- Governmental support boosts investor confidence in the EV sector. It signals stability, which is critical for attracting investments in EV manufacturing, technology development, and charging infrastructure.

These efforts align with global sustainability trends, enhancing India's image and opening doors for international collaborations. Overall, government initiatives bridge gaps, reduce costs, create jobs, and shape a greener mobility future.

Startups influencing the evolving dynamics of EV industry in India

Startups and entrepreneurs are playing a transformative role in shaping the electric vehicle (EV) industry in India. The areas they actively contribute to the industry's transformation:

- Subscription-based models such as eMaaS offer flexible access that aligns with changing consumer preferences for sustainability and convenience.

- EV-focused ride-sharing and rental platforms optimize vehicle utilization and provide a taste of EV experience without ownership commitments.

- Innovative charging solutions, including fast-charging stations, peer-to-peer charging networks, battery swapping services enhance accessibility.

- Industry 4.0 / Digital Twins for faster and sustainable EV development, creating virtual replicas that revolutionize automaker operations.

- Design EVs for urban landscapes, addressing charging limitations, traffic congestion, and diverse terrains unique to the Indian market.

- Leveraging AI, data analytics, and IoT to optimize battery performance, predictive maintenance, and user experiences, reducing TCO.

- Advancements in battery management systems and solid-state batteries, and battery waste management contributing to higher energy density and localized manufacturing.

Status of EV Charging Infrastructure in India

The present status of EV charging infrastructure in India reveals a mixture of encouraging advancements and a host of challenges. Approximately 11000 - 11500 operational charging stations in the country. However, the average ratio of 200 EVs for every public charging station is negligible compared to its global counterparts.

By 2030, India is estimated to require nearly one and half million charging stations. The nation's ambition is to establish charging stations every 40 to 60 km along highways. There are several insufficiencies and challenges that persist:

- Charging infrastructure is unevenly spread, leaving gaps in coverage in rural areas. Incentivizing investment coupled with strategic planning can help address this imbalance.

- Public charging stations remain quite limited. Developing well-planned fast-charging corridors on highways is critical to address range anxiety and facilitate long-distance travel.

- Seamless charging experiences require standardized charging protocols and compatibility between chargers and EVs.

- The utilization of charging stations varies, with some overburdened and others underutilized. Data analytics can optimize station placement and usage.

Addressing these challenges requires a strategic approach, collaboration between public and private sectors, and continued investment.

Establishing a robust EV charging is critical for mass adoption of EV

Successful EV adoption relies on robust charging infrastructure and tailored policy frameworks that suit local contexts. "Range anxiety," the fear of inadequate charging options, underscores the need for dependable and extensive charging networks.

While incentives impact adoption, investing in charging infrastructure proves more effective. Charging capacity reduces demand for larger batteries and optimises battery sizes ( thus bringing down the EV cost).

As India prioritizes carbon reduction, a robust EV infrastructure becomes vital. However, charging stations are just one facet of a complex puzzle. Numerous elements must converge to build an effective ecosystem:

- Reliable Infrastructure including Charger Management Software, Payment systems, Discovery applications, and backend support ensure consistent access.

- Business Models such as Charging-as-a-Service, Leasing of chargers by eMobility Service Providers and enterprises help amortize the initial infrastructure cost.

- Artificial Intelligence can optimize charging patterns, manage energy demands, predict demand, and integrate with intelligent grid systems for optimized operations.

- Integrating renewable energy generation, energy storage, and smart grid technologies to create an eco-friendly transportation ecosystem.

Diverse charging solutions cater to different EV types and needs, with models like home and fast-charging stations coexisting. Effective planning should account for parameters to select the right charging approach, ensuring a seamless EV transition.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: