A LOOK AT RECOVERY ESTIMATES FOR VENEZUELA

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

A LOOK AT RECOVERY ESTIMATES FOR VENEZUELA

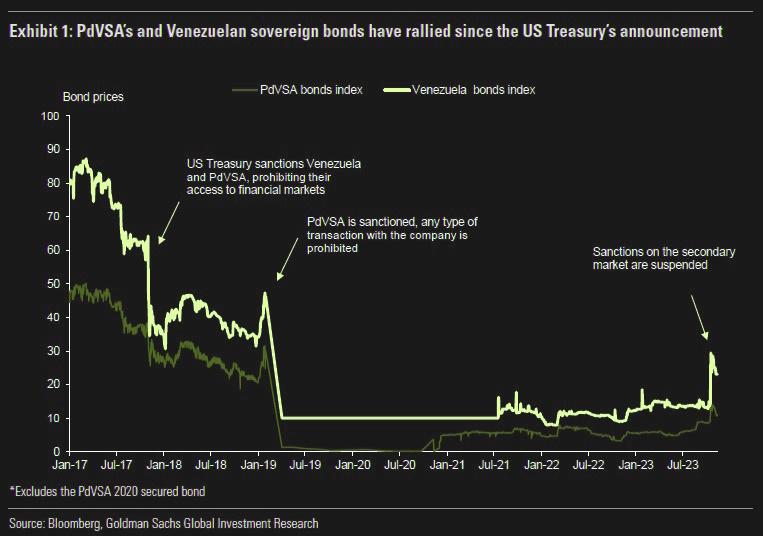

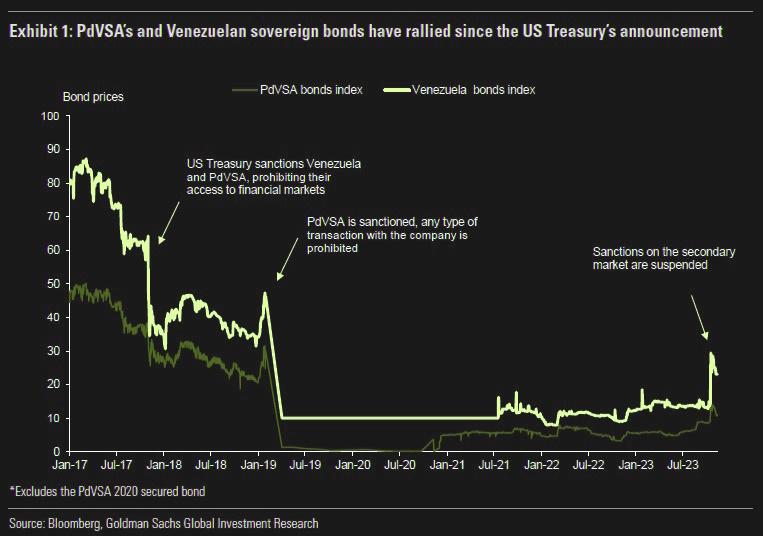

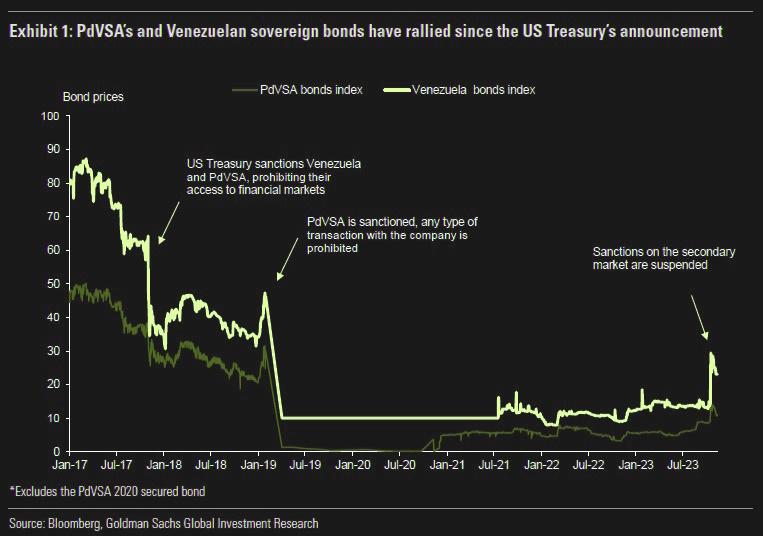

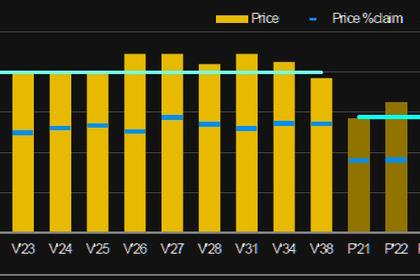

GOLDMAN SACHS - 29 November 2023 - On October 18, the US Treasury suspended certain sanctions measures on Venezuela’s oil and gas sector operations. This effectively removed the ban on secondary trading of certain Venezuela bonds and pre-2017 bonds issued by PdVSA. If the suspension of sanctions turns out to be permanent, this could be an opportunity for Venezuela to restructure its debt. In this piece, we look into Venezuela’s fundamentals to assess the type of possible restructuring outcomes under different scenarios.

To assess the restructuring outcome of a country’s defaulted USD bonds, one needs to take into account its current and future fundamentals. In the case of Venezuela, these have changed substantially over the past 10 years: oil production has fallen by ~70%, and GDP per capita by ~80%. This suggests that any recovery value estimates of Venezuela’s debt would have changed significantly since the initial default in 2017, and future recovery estimates will be highly dependent on the trajectory of Venezuela’s oil production and, by extension, economic recovery.

In addition to the uncertainty around Venezuela’s economic outlook, the overall level of debt outstanding remains unclear given limited data availability. From the bonds and multilateral debt outstanding, we can infer that Venezuela and its government-related entities have ~$99bn outstanding (including accrued interest). In terms of bilateral debt, suppliers, ongoing litigation and ‘debt for oil’ contracts, various sources suggest that the debt outstanding could amount to an additional ~$48bn, although this may be as high as ~$78bn. This would place the total external debt of Venezuela and its government-related entities (primarily PdVSA) in the range of ~$148bn-$177bn.

To assess the potential restructuring outcome based on the available data we use a cash flow analysis and our own top-down recovery value model. Using these frameworks, our cash flow analysis points to a recovery estimate of ~19-25 cents, assuming a 15% exit yield. Our top-down NPV haircut model, which does not include an exit yield assumption, puts the recovery rates at the lower end of that range, at ~13-20 cents on the USD (depending on the level of debt), but with more upside if oil production recovers.

Full PDF version

-----

Earlier:

2023, November, 23, 06:30:00

VENEZUELA'S DEBT OVERVIEW

We estimate Venezuela’s external debt stands at around US$167 billion. The majority is from the sovereign at US$107 billion, with PDVSA adding US$59 billion and ELECAR another US$1 billion. 21% is arrears due to missed interest payments.

2023, November, 3, 06:45:00

INDIA NEED VENEZUELA'S OIL

India, the world's third biggest oil importer and consumer, ships over 80% of its oil needs from overseas and wants to cut its crude import bill.

2023, November, 3, 06:40:00

VENEZUELA: LIFTING SANCTIONS

However, there are growing signs of a thaw in relations between the Biden administration and Caracas, with the sides holding talks to explore temporarily lifting sanctions to encourage Venezuela to hold competitive presidential elections next year.

2023, October, 20, 06:45:00

СОТРУДНИЧЕСТВО РОССИИ, ВЕНЕСУЭЛЫ

Стороны ведут совместную работу по стабилизации мирового рынка энергоносителей, в том числе в формате ОПЕК+ и Форума стран – экспортёров газа.

All Publications »

Tags:

VENEZUELA,

SANCTIONS,

VENEZUELA SANCTIONS,

OIL,

GAS