GLOBAL OIL DEMAND 2025: +1.8 MBD

OPEC - 17 January 2024 - OPEC OIL MARKET REPORT

Oil Market Highlights

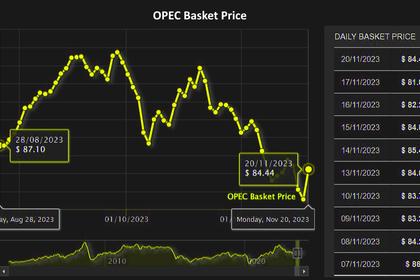

Crude Oil Price Movements

The OPEC Reference Basket (ORB) value fell by $5.92, or 7.0%, m-o-m in December, to average $79/b. The ICE Brent front-month contract dropped by $4.71, or 5.7%, m-o-m, to $77.32/b, and the NYMEX WTI frontmonth contract fell by $5.26, or 6.8%, to average $72.12/b. The DME Oman front-month contract dropped by $6.23, or 7.5%, m-o-m, to settle at $76.83/b. The front-month ICE Brent/NYMEX WTI spread widened again in December by 55¢ to average $5.20/b. The market structure continued to weaken in all markets as hedge funds and other money managers remained bearish, substantially reducing their long positions, which contributed to volatility in prices.

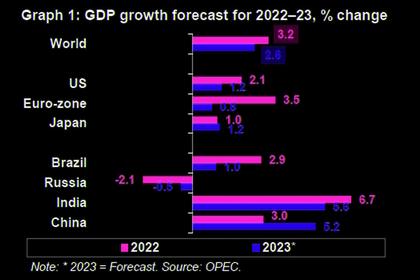

World Economy

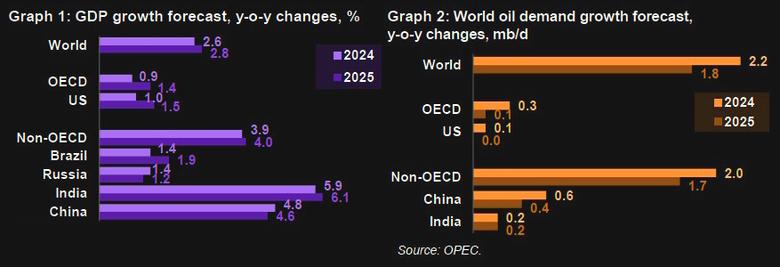

Global economic growth forecast for 2024 remains at a healthy 2.6%, unchanged from the previous month’s assessment. The economic growth in 2025 is expected to pick up slightly reaching 2.8%. This positive trajectory is in line with the expectation that general inflation will continue to diminish throughout 2024 and into 2025, particularly in major economies. A shift towards increasingly accommodative monetary policies is anticipated for 2H24 and throughout 2025, with key policy rates expected to peak in 1H24. US economic growth forecast for 2024 remains unchanged at 1%, followed by 1.5% for 2025. Economic growth forecast in the Eurozone remains at 0.5% for 2024, before rising to 1.2% in 2025. Japan’s economic growth forecast for 2024 remains at 0.9%, while growth in 2025 is forecast to pick up slightly to 1%. China’s economic growth forecast for 2024 remains at 4.8%, with economic growth forecast for 2025 at 4.6%. India’s economic growth forecast remains at 5.9% for 2024, expanding further to 6.1% in 2025. Brazil’s economic growth forecast for 2024 is revised up to 1.4% and then rises to 1.9% in 2025. Russia’s economic growth forecast in 2024 is revised up to 1.4% and is expected to grow by 1.2% in 2025.

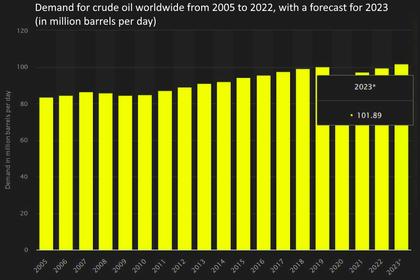

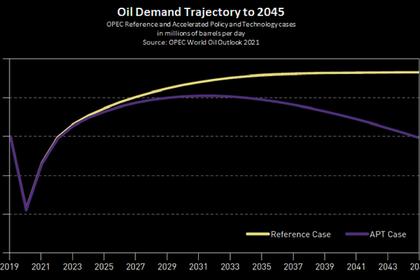

World Oil Demand

The global oil demand growth forecast for 2024 remains unchanged at 2.2 mb/d, with the OECD growing by around 0.3 mb/d and the non-OECD by about 2.0 mb/d. The global oil demand growth in 2025 is expected to see a robust growth of 1.8 mb/d, y-o-y. The OECD is expected to grow by 0.1 mb/d, y-o-y, while demand in the non-OECD is forecast to increase by 1.7 mb/d.

World Oil Supply

The non-OPEC liquids production in 2024 is expected to grow by 1.3 mb/d, slightly revised down from the previous month’s assessment. The main drivers for liquids supply growth in 2024 are expected to be the US, Canada, Guyana, Brazil, Norway and Kazakhstan. The non-OPEC liquids supply growth in 2025 is expected to stand at 1.3 mb/d, mainly driven by the US, Brazil, Canada, Norway, Kazakhstan and Guyana.

OPEC natural gas liquids (NGLs) and non-conventional liquids are forecast to grow by around 64 tb/d to average 5.5 mb/d, followed by growth of 110 tb/d in 2025 to average 5.6 mb/d. OPEC-12 crude oil production in December 2023 increased by 73 tb/d, m-o-m, to average 26.70 mb/d, according to available secondary sources.

Product Markets and Refining Operations

In December 2023, refinery margins declined in the Atlantic Basin, weighed down by higher refinery product output levels and rising product availability, in line with seasonal trends. Despite some support observed over the year-end holidays, the gasoline in the US Gulf Coast (USGC) and Rotterdam was relatively weak, and the positive performance in naphtha and high sulphur fuel oil proved insufficient to avert heavy supply-side pressures associated with jet/kerosene and gasoil. In Singapore, margins rose driven by robust naphtha performance and additional support across the entire barrel. Global refinery intake extended its recovery momentum from the previous month, registering a rise of 1.5 mb/d m-o-m in December, and averaged 82.3 mb/d compared to 80.8 mb/d in the previous month. In the coming months, refinery intakes are expected to remain steady.

Tanker Market

Dirty spot freight rates experienced a seasonal dip in December, despite increased uncertainties along key routes which were seen adding upward pressure on rates. For the year, spot freight rates in 2023 declined from the elevated levels seen in 2022. Very large crude carriers (VLCCs) rates were less directly impacted by trade dislocations seen in 2022 and thus experienced a less pronounced decline, falling 7% on the Middle East-to-East route in 2023. Suezmax averaged 17% lower on the USGC-to-Europe route. Aframax saw the largest decline, giving up about one-third of the previous year’s gains. Rates on the Intra-Med route fell by about 32% in 2023, after more than doubling in 2022. Clean tanker spot freight rates experienced similar volatility, with rates on the Middle East-to-East route declining 30% in 2023, following an increase of 123% in the previous year. The increased tanker demand and longer distances travelled were insufficient to fully outweigh the market’s adjusting to trade dislocations seen in 2022.

Crude and Refined Products Trade

Preliminary data for the final month of the year points to 2023 being a robust year for crude and product trade flows. US crude imports in 2023 averaged 6.5 mb/d, the highest since 2019, while US crude exports averaged just under 4.1 mb/d, a new record high. China’s crude and petroleum product imports are likely to have set new record highs in 2023. China’s crude imports averaged 11.3 mb/d in 2023, surpassing the previous record of 10.9 mb/d in 2020. China’s product imports are on track to average above 2 mb/d once final December data is available, compared to the previous record of 1.5 mb/d set in 2022. India’s crude imports are also likely to see a record high in 2023, averaging close to 4.7 mb/d compared to the previous record of 4.6 mb/d in 2022.

India’s product imports are on course to achieve a record level above 1.1 mb/d I 2023, compared to a previous high of just under 1.06 mb/d set in 2022. Product exports from India are broadly in line with the previous year, averaging around 1.3 mb/d. In contrast, Japan had a more muted performance in 2023, compared to more robust flows in recent years. Preliminary estimates for OECD Europe crude imports point to flows in 2023, remaining largely in line with the previous year’s levels.

Commercial Stock Movements

Preliminary data for November 2023 shows total OECD commercial oil stocks down by 7.3 mb, m-o-m. At 2,819 mb, they were 122 mb below the 2015–2019 average. Within the components, crude stocks rose by 17.5 mb, m-o-m, while products stocks fell by 10.2 mb, m-o-m. OECD commercial crude stocks stood at 1,354 mb in November, 97 mb lower than the 2015–2019 average. Total product stocks stood at 1,466 mb, which was 25 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks rose by 0.1 days, m-o-m, in November, standing at 61.5 days. This was 0.7 days less than the 2015–2019 average.

Balance of Supply and Demand

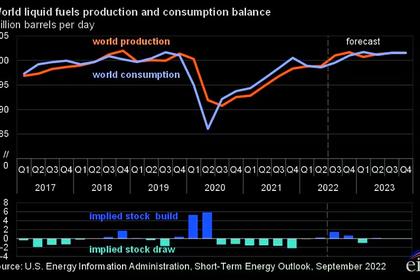

Demand for OPEC crude in 2024 stands at 28.5 mb/d, which is 0.8 mb/d higher than the estimated level in 2023. Based on the initial world oil demand and non-OPEC supply forecast for 2025, demand for OPEC crude is expected to reach 29.0 mb/d, 0.5 mb/d higher than the forecasted 2024 level.

-----

Earlier: