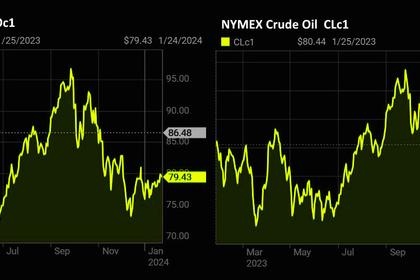

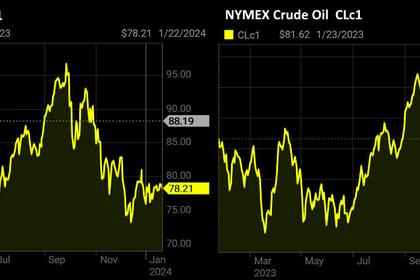

OIL PRICE: BRENT NEAR $84, WTI ABOVE $78

REUTERS - Jan 29, 2024 - Oil prices climbed on Monday after a drone attack on U.S. forces in Jordan added to worries over supply disruption in the Middle East as Houthi rebels stepped up their attacks on vessels in the Red Sea, hitting a Trafigura-operated fuel tanker.

Risks of a widening conflict comes as Russian refined product exports are set to fall, with several refineries under repair following drone attacks.

Brent crude futures rose 29 cents, or 0.4%, to $83.84 a barrel by 0230 GMT after hitting a session-high of $84.80. U.S. West Texas Intermediate crude gained 34 cents, or 0.4%, to $78.35 a barrel after reaching an intraday high of $79.29 earlier in the session.

The attack on U.S. troops in a drone strike in Jordan raised concerns of a wider conflict in the oil-rich Middle East.

"We believe the death of three U.S. service members today in Jordan marks a critical inflection point in the ongoing conflict in the Middle East and raises a specter of a more substantial U.S. involvement in the war," RBC Capital analyst Helima Croft said in a note, adding that a more direct confrontation with Iran raises the specter of regional energy supply disruptions.

Commodities trader Trafigura said on Saturday it was assessing the security risks of further Red Sea voyages after firefighters put out a blaze on a tanker attacked by Yemen's Houthi group a day earlier.

"Disruptions to supply have been limited, but that changed on Friday after an oil tanker operating on behalf of Trafigura was hit by a missile off the coast of Yemen," ANZ analysts said in a note.

"With oil tankers linked to the U.S. and UK now under threat of attack, the market is likely to reprice the risk of disruptions."

Both contracts rose for a second week in a row and settled at their highest in nearly two months on Friday, supported by Middle East and Russian supply concerns while positive U.S. economic growth and signs of Chinese stimulus boosted demand expectations.

"The air of complacency lingering around the oil market has evaporated," IG markets analyst Tony Sycamore said.

"Dips in WTI are likely to find buyers back towards the 200-day moving average at $77.60, before a stronger layer of support at $75.00 from buyers looking for a push into the low $80's."

Russia will likely cut exports of naphtha, a petrochemical feedstock, by some 127,500 - 136,000 barrels per day, or around a third of its total exports, after fires disrupted operations at refineries on the Baltic and Black Seas, according to traders and LSEG ship-tracking data.

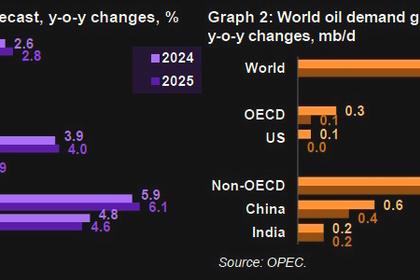

On Feb. 1, leading ministers from the Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, known as OPEC+, will meet online.

However, OPEC+ will likely decide its oil production levels for April and beyond in the coming weeks, OPEC+ sources said, as the meeting would take place too early for decisions to be made on further output policy.

-----

Earlier: