RUSSIA'S SLOW LNG

ENERGY FLUX - Dec 20, 2023 - Russia has delivered the first drop of liquefied natural gas (LNG) from its heavily sanctioned flagship project, Arctic LNG-2. Moscow will hail the achievement as a victory over Western boycotts and proof that its domestic LNG industry is in rude health. In reality, however, the plant is likely to operate at severely reduced capacity and might never achieve its full potential – undermining the Kremlin’s aspirations to become a major player in the global LNG market.

On 2 November, the United States expanded sanctions against Arctic LNG 2 (ALNG2), Novatek’s flagship LNG project on Russia’s frigid Gydan Peninsula. The move represents an escalation in the West’s strategy targeting Russia’s fossil fuel industry that has long focused on minimising export revenues while maintaining liquidity in global energy markets.

The newest round of sanctions seeks to toxify the $22 billion-plus project, which was designed with three liquefaction trains and a nameplate capacity of 19.8 million tons per year (mtpa). The idea is to deter European and Asian companies from purchasing gas liquefied at ALNG2 with the threat of being locked out of the US-dominated financial system from 31 January 2024 – and kill Russia’s hopes of capturing 20% of global LNG market share.

The sanctions also aim to put a definitive end to logistical support for ALNG2 from Western firms, which have been slowly curtailing their exposure to Russian oil and gas projects following the European Union’s April 2022 fifth package of restrictive measures.

However, it is likely that Novatek will be able to produce and liquefy Arctic gas without Western support. The energy giant expects the first train of ALNG2 to be fully up and running by the end of the year using technology acquired from its Western partners, which found ways to keep supplying the project long after the fifth package came into effect, as revealed in an investigation by Data Desk published in Le Monde and the FT.

Whether the second and third trains will come online as scheduled and at what capacity is more uncertain. But Novatek has overcome some of the sanctions hurdles and is redesigning the configuration of ALNG2 around technology and expertise available from domestic and nontraditional firms, such as those in China.

Russian reshoring

Novatek has made surprising progress replacing fleeing Western engineering firms and expertise. The most significant achievement has been the fabrication of cryogenic heat exchangers – the heart of the liquefaction system – in Russia.

Germany’s Linde agreed to supply coil-wound heat exchangers (CWHEs) to ALNG2 as part of its joint venture with Russian steelmaker Severstal, but withdrew from that partnership last year. However, before doing so it built capacity to produce CWHEs locally in Saint Petersburg.

Novatek integrated know-how gleaned from Linde-Severstal into the Arctic Cascade liquefaction technology that was trialled at Train 4 of the Yamal LNG project, its other flagship project in the region.

While Arctic Cascade did not perform at the same efficiency as technology manufactured by Western partners, it did provide a valuable testbed for incorporating Russian-made liquefaction tech into future projects – such as ALNG2. Arctic Cascade now bears a striking resemblance to Linde’s Mixed Fluid Cascade (MFC) process, according to market sources.

Novatek and partners NIPIGAS, Nova Energies, Green Energy Solutions also gained valuable experience installing the first gravity base structure (GBS-1) for ALNG2 without Western support. Each GBS would host one 6.6 mtpa liquefaction train. GBS-1 was fabricated at a specialist construction yard in Belokamenka near Murmansk and towed to site this summer. GBS-2 is nearing completion, while GBS-3 is in the concrete pouring phase, it is understood.

Technical hurdles

Not all technical challenges have been resolved. Baker Hughes delivered four LM9000 gas turbines before the first round of sanctions came into effect, from a total order of 21 units (seven per train). This leaves Novatek in a quandary. With only four units, Train 1 is missing three.

One option is to run Train 1 at 50% capacity only. This is the most likely option, at least to begin with. But the gas turbines both drive the refrigeration process and generate electricity for the plant. To remedy this, Novatek is looking at installing electric turbines from Chinese mobile power plants based on Ukrainian Soviet design. These have not yet been installed, raising the prospect of significant delays in ramping up output.

Progress on GBS-2 and 3 will depend on how well the Chinese technology performs on GBS-1. However, using electric rather than gas turbines implies loss of exhaust steam, a valuable source of process heat, which will need to be replaced by a furnace. This will itself consume gas, resulting in reduced LNG output.

Also, electric turbines do not benefit from gains in efficiency when operating in Arctic temperatures. The efficiency boost afforded by running gas turbines in sub-zero conditions helped Novatek achieve above-nameplate production at Yamal LNG. Losing this imposes higher financial and energy costs upon ALNG2, which might impact the competitiveness of the plant’s LNG exports in global markets.

Tightening web of sanctions

Still, ALNG2 is proceeding against the odds and the first export cargo is expected imminently. The newest round of sanctions recognises this reality and has shifted focus away from blocking the project completely to reducing its profitability and reach.

While producing LNG is one thing, getting the super-chilled fuel to market comes with its own set of obstacles, especially when considering that ALNG2’s remote location in icy waters demands a specialty fleet of icebreaking LNG tankers.

The critical path is no longer whether or how quickly Novatek can bring online the remaining two trains. The real bite of the latest sanctions package is to create logistical challenges for transporting cargoes to demand centres in Europe and Asia along the treacherous Northern Sea Route (NSR).

Breaking the ice

Novatek's replacement of Western technology and expertise is impressive, but these efforts will mean nothing if the gas giant can’t get its fuel to global markets along the NSR. Transporting LNG in the Arctic Ocean is a huge undertaking that requires highly specialised carriers to cut through the thick, seasonal ice.

Novatek has experience with this endeavour at Yamal LNG, which has a dedicated fleet of fifteen 172,600 cubic metre carriers with icebreaking capabilities, called Arc7s. But the company will need many more vessels to service ALNG2.

The Russian independent has spent years configuring a cost-efficient supply route involving a complex web of Russian and Western logistics providers, shipbuilders, and financiers in anticipation of reaching nameplate capacity for its megaproject by the end of the decade. Year-round sailings on the NSR are slated to begin early next year.

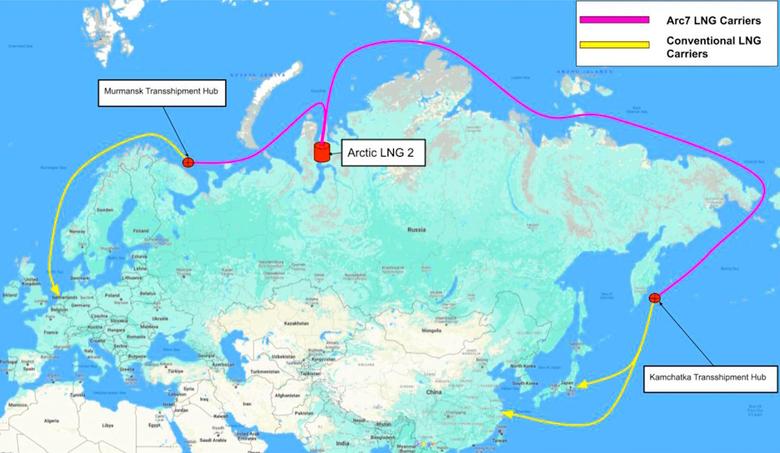

After liquefaction at the ALNG2 site, LNG will be loaded onto an Arc7 and shipped to a transshipment facility at either end of the NSR. It will then be transferred via a floating storage unit (FSU) to a conventional carrier that delivers it to its final destination.

Debilitated fleet

These transshipment hubs, which were designed to service ALNG2, give Novatek flexibility to take advantage of spot pricing with storage closer to markets. They also enable the Arc7 fleet to shuttle cargoes out of the Arctic without needing to make deliveries to distant markets, in warmer waters where their ice-breaking capability turns from asset to liability; Arc7s are slower and less fuel efficient than regular cryogenic LNG carriers.

But Western sanctions have stymied these hubs by targeting Arctic Transshipment LLC, the operator of the transshipment facilities at Murmansk (in northwest Russian) and Kamchatka (in Russia’s far east). They are also undermining the rollout of the Arc7 fleet. With all three trains operating, ALNG2 will need a dedicated fleet of 21 ice-class vessels to transport the 19.8 mtpa of nameplate capacity: 15 built by Russia’s Sovcomflot and the remaining six by South Korean and Chinese yards.

Sovcomflot had originally teamed up with South Korea’s Samsung Heavy Industries for vessel design and hull construction of the first five Arc7 vessels, or ‘Batch 1’ of three. The carriers began their lives in South Korea before being towed to Russia’s Zvezda shipyard for final assembly and sea trials. Currently, Batch 1 carriers are not yet operational.

Batch 2 and 3 may never materialise. Samsung is likely pulling out of its partnership with Sovcomflot to avoid violating Western sanctions. Similarly, the French manufacturer GTT, which provided its proprietary Mark III containment technology to Sovcomflot, ended its activities in Russia in January 2023. And the South Korean shipyard designated to build the additional six Arc7 vessels cancelled orders because Sovcomflot could not fulfil payments under EU sanctions.

Logistical nightmare

That leaves ALNG2 without an Arc7 fleet capable of lifting ALNG2’s maximum output of 19.8 mtpa. Novatek’s ability to access growth markets in Asia and Europe has been “dramatically compromised,” according to Mehdy Touil, an LNG industry expert who was consulted for this research.

That is of course if ALNG2 can reach maximum output. For now, Russia has enough Arc7 vessels from the Yamal LNG project to service the first train that will likely start working at half capacity. But it will not be able to support Trains 2 and 3 when they come online, even if they too operate at reduced capacity.

The designation of the transshipment hubs by the US Office of Foreign Assets Control (OFAC) makes physical and monetary transactions there infeasible for conventional charterers with US exposure. But most of the global LNG carriers reportedly have no affiliation with US companies or registries, so it is unclear how effective these targeted sanctions will be.

That leaves the question of which countries will purchase spot market gas from ALNG2 in the midst of tightening sanctions and frayed logistics.

How the new sanctions will play out is yet to be seen with ALNG2’s equity partners, each of which has equity lifting rights for volumes proportional to their investment in the project. France’s TotalEnergies, which has a 10% stake but ceased booking proved reserves from ALNG2 last year, is still assessing the impact of the newest sanctions.

Japan Arctic LNG, a consortium of Mitsui and JOGMEC, also has a 10% stake in the project and is eligible for 2 mtpa of LNG. Japan has said it will work with G7 countries to balance alliance cohesion with its energy security, for which Tokyo heavily depends on Russia for imported LNG.

That leaves Chinese state oil giants CNPC and CNOOC, each with 10% equity volumes. Separately, Novatek has signed LNG sales and purchase agreement (SPA) deals with Chinese independents Zhejiang Energy, ENN and Shenergy for a combined 4.6 mtpa of LNG over the next 11 to 15 years. Novatek has also reportedly signed SPAs with Vitol and Repsol for 1 mtpa apiece, and with trader Gunvor for 0.5 mtpa.

Incentivising circumvention

Just as Novatek managed to replace Western liquefaction technology, so too it could try to work around shipping and logistical headaches. And like liquefaction, China could step in to help complete a fleet of Arc7 vessels capable of getting Russian LNG to market. Chinese shipyards are fully capable of building Arc7 vessels and have bid on projects in the past, albeit unsuccessfully.

But China too may want to steer clear of supplying vessels to Russia, leaving Sovcomflot no other choice but to domesticize all facets of its shipbuilding. For example, to compensate for GTT’s departure, Technip and Novatek started a technical school in Russia to teach young Russian welders how to make containment systems for Arc7 vessels.

It is also unclear which countries will dare to use the FSUs at the Kamchatka and Murmansk transshipment hubs. Will ALNG2 Arc7s need to deliver cargoes all the way to Chinese ports? That would certainly exacerbate logistical costs and challenges.

It could be the case that, just like with sanctioned Russian oil cargoes, traders could obfuscate the provenance of ALNG2 gas at sea via ship-to-ship transfers from existing Arc7s to the many carriers untouched by the US financial ecosystem.

Novatek could also skirt this ecosystem by selling ALNG2 cargoes to Chinese offtakers using the Renminbi. According to Craig Kennedy (no relation), an energy expert and author of Navigating Russia, the Chinese currency has had considerable success in settling oil transactions between the two countries.

Where’s the demand?

It is unclear whether Europe will receive even limited volumes of gas from ALNG2. Sanctions ought to render the project untouchable, although some experts believe otherwise. In any case, many EU countries already source and re-export lots of Russian gas from Yamal LNG, and European gas demand is at best stagnant.

Then there is Japan, which will take a small portion of ALNG2 volumes. But demand growth ultimately depends on China’s appetite for risk and Russian LNG. It has been well documented that China doesn’t really want or need more Russian gas, even when offered at steep discounts. And the country is undergoing deep structural changes that mute its reliance on spot LNG.

Beijing’s energy security strategy has been to diversify gas imports via pipeline from its Central Asian neighbours, and ink a flurry of new long-term contracts with LNG superpowers Qatar and the US. Still, China may prefer Russia’s LNG over its pipeline gas because it can take advantage of spot prices

when these are lower than oil indexed contracts, and can ramp up volumes in times of higher demand.

ALNG2 may never cobble together enough appetite for its 19.8 mtpa nameplate capacity, either through existing SPAs or spot demand. And it might never acquire the needed transport tonnage to bring that capacity to market.

For the foreseeable future, Novatek may opt instead to prioritise cash flow from Yamal LNG and make a statement by bringing ALNG2’s Train 1 into service, albeit at reduced capacity. That would keep Russia’s LNG kingpin in business while it figures out how to deliver Trains 2 and 3 – if indeed that is even possible.

Seb Kennedy and Zach Simon | Energy Flux | 20 December 2023

-----

Earlier: