AFRICA'S ENERGY POSSIBILITIES

By EBOT Elvis Ako Senior IT Specialist | Digital Transformation | oil and Gas operations, Origin 365

ENERGYCENTRAL - Sep 26, 2024 - Energy! Energy!, The driving force of every economy. When evaluating a country's wealth, The exercise usually starts from here. In this article, we take an in-depth analysis of the top African countries with the highest potential for oil and gas drilling, alongside insights into the most promising investment opportunities across the continent. Africa's oil and gas industry holds immense potential, with several countries emerging as key players in both production and future exploration. Over the last decade, traditional giants like Nigeria, Angola, and Algeria have led the continent in output, but new frontiers such as Mozambique, Senegal, Uganda, and Ghana are rapidly gaining attention for their untapped reserves. These countries are attracting significant investment due to discoveries in natural gas and oil fields, favourable regulatory environments, and growing global demand for energy. This article provides an in-depth analysis of the top African countries with the highest potential for oil and gas drilling, alongside insights into the most promising investment opportunities across the continent. Great! Let’s dive deeper into specific countries that present high-potential investment opportunities in the oil and gas sector and provide more details on the factors driving these opportunities

1. Mozambique: High Potential for Gas Investment

Key Drivers:

Rovuma Basin Reserves: Mozambique is home to one of the largest natural gas discoveries in recent years. The Rovuma Basin contains about 180 trillion cubic feet of gas reserves, making it a major player in the global LNG market.

Strategic LNG Projects: Mozambique has attracted significant investment from energy giants such as TotalEnergies, ExxonMobil, and Eni. The Coral South Floating LNG project is already in operation, with others like the Mozambique LNG and Rovuma LNG expected to come online in the near future.

Growing Global LNG Demand: With the energy transition underway, natural gas is seen as a "bridge" fuel, driving demand for Mozambique’s LNG. The country is well-positioned to export to both Europe and Asia, where gas demand is high.

Investment Opportunities:

- Infrastructure development (pipelines, terminals, and ports).

- Midstream LNG projects.

- Services and supply chains for ongoing exploration and production.

2. Senegal: Emerging Oil and Gas Powerhouse

Key Drivers:

Sangomar and Yakaar-Teranga Discoveries: Senegal’s offshore oil and gas fields are some of the largest recent discoveries in West Africa. The Sangomar oil field is expected to start production in 2024, with initial production levels at around 100,000 barrels per day.

Stable Political Climate: Senegal has a relatively stable government and a robust regulatory framework that is welcoming to foreign investment. This is a key differentiator in a region known for political volatility.

Strategic Location: Senegal’s proximity to Europe and its deepwater port infrastructure provides an advantage in terms of export logistics for both oil and gas.

Investment Opportunities:

- Offshore drilling services and equipment.

- Development of export terminals.

- Exploration in deepwater blocks, as well as oil field services and infrastructure.

3. Uganda: Untapped Oil Potential

Key Drivers:

Lake Albert Basin: Uganda’s oil reserves are estimated at 6.5 billion barrels, with around 2.2 billion barrels recoverable. With foreign companies like TotalEnergies and CNOOC taking the lead, Uganda is expected to commence oil production by 2025.

East African Crude Oil Pipeline (EACOP): This 1,443 km pipeline will link Uganda’s oil fields to the port of Tanga in Tanzania, facilitating crude exports. The project, while controversial due to environmental concerns, represents a major infrastructure development that could unlock Uganda’s oil potential.

Supportive Government Policies: Uganda’s government is actively promoting investment in the sector through favourable terms for exploration and production licenses, as well as tax incentives.

Investment Opportunities:

- Exploration of untapped oil blocks in the Lake Albert region.

- Pipeline and infrastructure projects, including the EACOP.

- Refinery projects and petrochemicals.

4. Tanzania: Growing Gas Hub

Key Drivers:

Significant Gas Reserves: Tanzania holds around 57 trillion cubic feet of proven natural gas reserves, much of it offshore. These fields are largely underdeveloped, providing a significant investment opportunity.

LNG Export Plans: The Tanzanian government is keen on developing an LNG export facility, which could transform Tanzania into a major exporter of natural gas. However, delays due to regulatory and land acquisition issues have slowed progress.

Domestic and Regional Gas Demand: Tanzania’s gas reserves could be crucial in meeting regional energy needs, particularly as neighbouring countries industrialize and seek cleaner energy alternatives to coal and oil.

Investment Opportunities:

- LNG plant construction and operational services.

- Onshore and offshore drilling.

- Gas transportation and pipeline infrastructure development.

5. Ghana: Steady Growth and Regulatory Certainty

Key Drivers:

Jubilee and TEN Fields: Ghana’s oil production has grown steadily over the past decade, mainly due to the Jubilee and TEN fields. The country’s output is around 200,000 barrels per day, with additional reserves still being explored.

Gas Potential: Ghana also has substantial natural gas reserves. The Sankofa Gas Project, particularly, is a major contributor to domestic energy generation, reducing reliance on imports and increasing energy security.

Stable Regulatory Environment: Ghana’s government has taken steps to ensure a clear and transparent legal framework, encouraging foreign direct investment. Its relative political stability compared to other West African nations is a significant advantage.

Investment Opportunities:

- Onshore and offshore drilling.

- Oil and gas exploration in untapped fields.

- Expansion of downstream capabilities, including refining and distribution.

6. Egypt: Mediterranean Gas Giant

Key Drivers:

Zohr Gas Field: Egypt’s Mediterranean Zohr gas field is one of the largest ever discovered in the region, with reserves of around 30 trillion cubic feet of gas. This discovery has reinvigorated Egypt’s gas sector and positioned it as a regional energy hub.

Strategic LNG Exports: Egypt is already a well-established LNG exporter. With existing infrastructure and proximity to European and Asian markets, Egypt is becoming a strategic supplier of gas to regions seeking to diversify their energy sources.

Supportive Government Initiatives: The Egyptian government has created incentives for foreign companies to explore and develop the country's vast offshore reserves. The country’s focus on energy security also drives domestic and international demand.

Investment Opportunities:

- Offshore exploration and gas field development.

- LNG export facilities and expansion.

- Petrochemical and refining projects.

7. Namibia: Rising Star in Oil Exploration

Key Drivers:

Recent Discoveries: Namibia’s offshore oil discoveries in the Orange Basin by TotalEnergies and Shell are among the most promising in Africa. These new fields could hold billions of barrels of oil, offering the potential for Namibia to become a key oil producer.

Untapped Offshore Potential: Namibia’s offshore exploration remains underdeveloped, making it a hotspot for future discoveries. The Namibian government is actively promoting exploration activities.

Stable Investment Climate: Namibia has a relatively stable political and economic environment favourable for long-term oil and gas investments.

Investment Opportunities:

- Exploration and development of offshore blocks.

- Oil field services and technology solutions.

- Infrastructure development for oil transport and export.

8. South Sudan: Revitalizing a Challenged Sector

Key Drivers:

Significant Reserves: South Sudan has around 3.5 billion barrels of proven oil reserves. Though production has been hindered by conflict and infrastructure damage, peace efforts could unlock potential for investors.

Partnerships with Sudan: South Sudan’s landlocked position means it relies on pipelines through Sudan to export its oil. Collaboration between the two countries is crucial for sustaining production and opening up investment opportunities.

Investment Opportunities:

- Rebuilding and modernizing oil infrastructure.

- Exploration of untapped oil reserves in the northern and central regions.

- Joint ventures in oil field services and technology.

Key Takeaways for Investors

Exploration and Production: Countries like Mozambique, Senegal, and Uganda offer some of the most promising untapped reserves, especially in natural gas and deepwater oil.

Infrastructure Development: Tanzania, Uganda, and Mozambique are prime candidates for midstream investment, with significant infrastructure projects such as pipelines, LNG plants, and export terminals needing financing and expertise.

Political Stability and Regulatory Certainty: Countries like Ghana, Senegal, and Egypt stand out for their stable regulatory environments, providing more certainty for long-term investment.

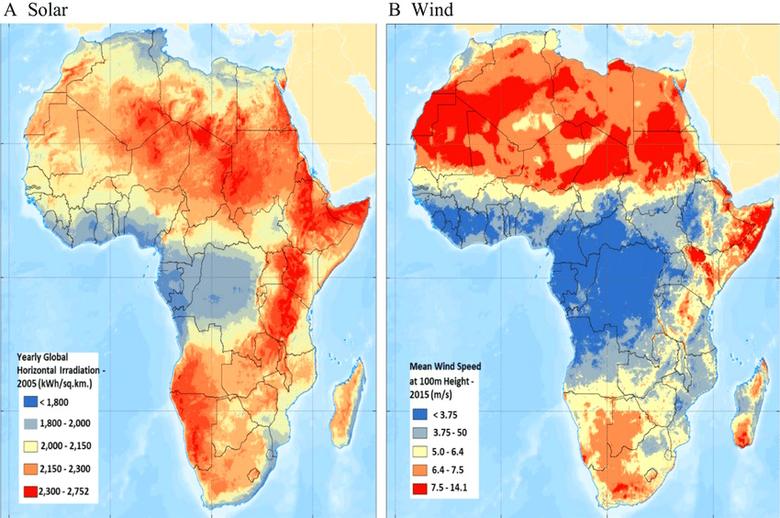

Natural Gas Potential: With the world transitioning towards cleaner energy, Africa's natural gas potential in countries like Mozambique, Tanzania, and Egypt makes them key areas of focus for investors looking at LNG and domestic energy projects.

So this rounds up our analysis of specific countries that present high-potential investment opportunities in the oil and gas sector. In my subsequent post, we are going to look into specific oil and gas projects in Mozambique, Senegal, Uganda, Tanzania, and Egypt, as well as market entry strategies for investors in these regions. So tomorrow if you are looking for drilling sites or hope to invest in the energy sector, These places hold huge untapped oil reserves. Thanks for reading.

-----

This thought leadership article was originally shared with Energy Central's Energy Collective Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Energy Collective Group today and learn from others who work in the industry.

-----

Earlier: