LOWER-COST GRID-EDGE DERMS

By Syd Bishop Sr. Content Specialist, Virtual Peaker

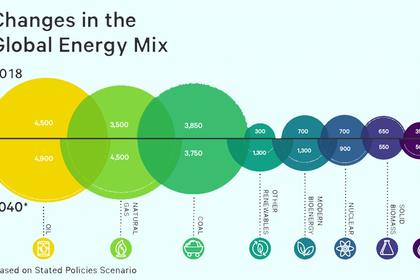

ENERGYCENTRAL - Sep 27, 2024 - While decarbonization and electrification efforts contribute to total demand, the increased occurrences of inclement weather and temperature extremes is driving higher customer rates. To meet increased demand, utilities employ load management programs like demand response, EV charging, BYOD programs, and more, all controlled through distributed energy resource management systems (DERMS). With so many opportunities to enhance grid resiliency and defray the high peak energy costs driving higher rates, how can grid operators pick and choose the best program in their area?

Defining DERMS

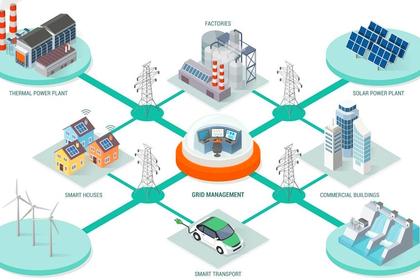

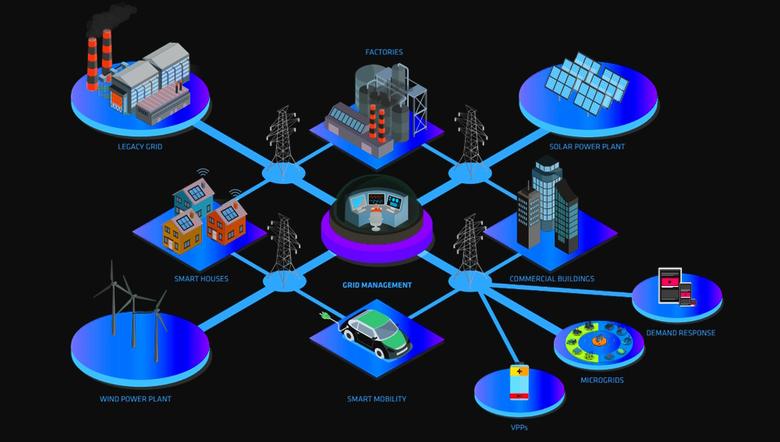

Distributed energy resources (DERs) like solar, battery storage, electric vehicles and EVSE chargers, and smart home devices like thermostats or water heaters each provide opportunities for grid operators to shift load to meet demand. DER assets are aggregated through the use of a distributed energy resource management system (DERMS). There are two types of DERMS:

- Grid DERMS – Grid DERMS are used to aggregate and manage utility-held DER assets, investments like solar or battery installations that the utility owns and manages.

- Grid-EDGE DERMS – A Grid-Edge DERMS aggregates behind-the-meter DER assets increasingly found in customer homes. This platform aggregates all behind-the-meter DER assets at the grid’s edge—residential, business, and commercial properties—and complements Grid DERMS.

Together, these two DERMS cover the entire scope of DER possibilities, whether they are owned and maintained by the utility, or found in customer homes. Between the two, any type of DER asset presents a possible load management solution, is useful in several of the aforementioned programs. If a single Grid-Edge DERMS can handle all DER assets after the appropriate development work on the APIs and integrations, and given budgetary restraints, why are utility operators purchasing demand flexibility programs a la carte?

Driving Interest: FERC 2222 & Regulatory Oversight

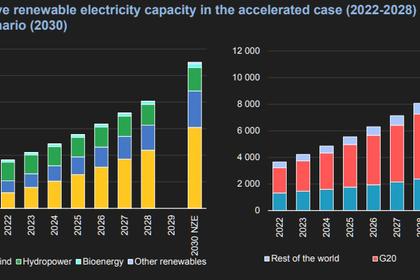

Before we dive into the specifics of program purchasing as compared to all source procurement, let’s examine some of the motivations that drive interest in demand flexibility and load management. The introduction of FERC 2222, which allows distributed energy resources (DERs) to participate in the energy market, marked a turning point for utilities to meet the rising demand. In the interim, consumer DER adoptions have increased, with analysts expecting DER penetration to nearly double by 2027. In fact, battery storage alone is expected to double in 2024 alone, a boon to utilities in need of increased energy flexibility. As part of the regulatory process, FERC 2222 enables the increasingly necessary expansion of virtual power plants. According to the DOE, between 80-160 GW of virtual power plant capacity is needed by 2030 to continue to meet demand.

For some utilities, meeting renewable energy goals is driven by these regulatory requirements, while others see the usefulness in demand flexibility initiatives, not simply as a customer outreach opportunity, but for the revenue and grid resiliency potential. Further complicating this, utilities can have different motivations by organizational type. Investor-owned utilities often emphasize regulatory compliance and maximizing shareholder value, while municipalities and cooperatives are often focused on reliability and affordability to better serve their members.

Across the board, each utility is focused in their way on affordability. Fortunately, legislation like the Inflation Reduction Act or the Bipartisan Infrastructure Law was designed to foster investments in renewable energy strategies. These funds have driven growth in the DER market, while also supporting the non-wires alternatives necessary to defray the high costs of grid upgrades and enhance grid resiliency. How can grid operators and program managers work together to keep costs down for both their own internal budgets and for ratepayers?

Internal Silos

Every utility is slightly different. For some, program managers and grid operators rarely interact; in some instances, demand response managers and EV charging managers, for example, do not even collaborate. In those cases, a demand response program manager may look into the appropriate solution to meet their specific use case, while EV managed charging program managers may turn elsewhere. Here, program managers could miss the opportunity to combine efforts and cut costs by employing a Grid-Edge DERMS solution that can aggregate devices of any type. In doing so, utilities can streamline their internal budgets, cutting development and recurring costs by minimizing solution purchases.

Risk Aversion: Putting Your Eggs In One Basket

Fiscal risk aversion is an understandable response for regulated utilities working within a fixed budgetary framework. In terms of demand flexibility programs, this may mean apprehension over relying on any one product, or any challenges that different vendors may present in terms of the user experience. These are logical concerns, albeit costly conclusions. By purchasing individual programmatic solutions, grid operators and program managers could inadvertently impose more complications, rather than less, all while incurring more recurring and development fees.

For example, customers may work with one utility that uses many vendors for their different programmatic offerings. In this example, each program solution will likely feature a different customer interface, meaning more things for customers to have to learn and navigate just to participate in a program. Ultimately, any barrier to customer engagement and enrollment is detrimental to the success of any program, which thrives with higher participation rates. Again, this example demonstrates both the increased costs associated with purchasing multiple program solutions, as well as the aggravation this may cause for ratepayers, who will require training and outreach for each potential program solution to participate.

Conclusion: Demand Flexibility All Source Procurement VS Individual Program Procurement

In 2022, U.S. IOU utilities spent $150.8b on capital investments alone, an annual fiscal process meant to generate revenue and address grid needs. As such, the behind-the-meter DER assets currently experiencing robust market penetration can be that capital investment for any utility, benefiting communities, creating equity, AND generating revenue/load management opportunities for utilities. Ultimately, an all-in-one Grid-Edge DERMS solution provides a lower-cost alternative to programs that are siloed, while also creating additional layers of complication for program managers and customers alike.

-----

This thought leadership article was originally shared with Energy Central's Load Management Community Group. The communities are a place where professionals in the power industry can share, learn and connect in a collaborative environment. Join the Load Management group today and learn from others who work in the industry.

-----

Earlier: