OIL : CANARY IN THE COAL MINE

As we approaching closer to the U.S General Elections(33days),we have had mixed geopolitical events in occurrence. Majority of action being within the Oil rich complex of Middle East.Data with regards to supply disruptions are treated with a pinch of salt as we enter the holiday season mark.

With a mixed statement data on stockpiles within the U.S, Crude oil and distillate inventories fell last week while gasoline inventories rose,according to the API figures on Tuesday.

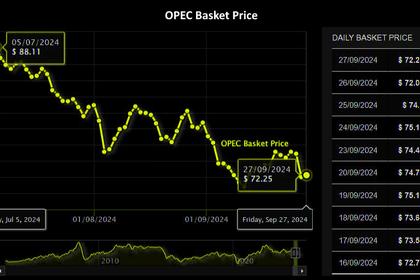

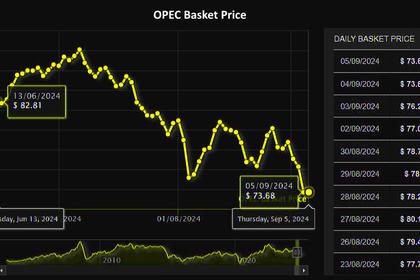

OPEC+ Group stated to start production ramp up as optimism builds with regards to the annual demand cycle and consumption levels.There is sufficient energy security within Russia.The lifting of the Libyan Oil Embargo,Saudi production data and Chinese stimulus is the canary in the coal mine.

Russian Deputy Prime Minister Alexander Novak expects oil prices' fluctuations will subside following volatility spurred by the tensions in the Middle East as geopolitical risks are already factored in.

This week we have seen energy sector jump with respect to Oil prices,ICE BRENT Crude trading at $74.56/bbl with a $75.80/bbl weekly ceiling & WTI CrudeOil trading at $70.85/bbl,also placing the pivot point right above the SPR replenishment pricing of $68.70/bbl.Monthly Crude oil imports in kbd chart explains the headwinds within the Oil Markets.OPEC Basket stands bearish at $71.34/bbl(-5.03%)

In a deep dive into the API Numbers,Inventories depleted at the second-fastest rate on record for the time of year and at almost twice the average rate of 28 million barrels in the last decade.

Most of the depletion occurred at refineries and tank farms along the Gulf of Mexico (-30 million barrels) and around the NYMEX futures delivery point at Cushing in Oklahoma (-11 million barrels).As a result, stocks data showed 14 million barrels (-3%/ -0.31 standard deviations) below the prior ten-year seasonal average on September 20, having been in a surplus of 6 million barrels (+1%/+0.12 standard deviations) three months earlier.Inflation-adjusted front-month WTI prices have averaged $70 per barrel (38th percentile for all months since 2000) in September down from $85 (55th percentile) in April and $92 (61st percentile) in September 2023.

We are in watch for the Natural Gas season as weather remains a very specific variable in play,currently trading at $2.92/mmBtu at mid Asia session.Prospects of colder weather has started to push TTF futures higher, with the November contract currently trading at €38 per MWh ($13.5 per mmBtu), just as the Old Continent’s LNG imports dipped to their lowest this year, posting 6.4 million tonnes in September.

On the Commodities & Precious Metals complex,we have seen sustainable moves especially across the Gold Market showing high prints($2700/oz)and cementing its place as a safe haven titan.Consolidation is however on the horizon with regards to the COT update as paper demand especially on the ETFs and Futures side are becoming passing clouds.Silver has been within the kerfuffle with retracement looking rather the pleasing option.

As the scroll continues to be unravelled,let us presume neutrality at the fulcrum as the focus shifts towards the focal points of life.You'll always strike the right note with bank notes.

Many blessings,

Andy Warr,

TophatFinanceGroup.

-----

Earlier: