OPEC UNCERTAINTY

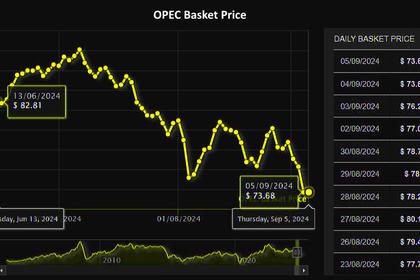

REUTERS - Sept 30, 2024 - Analysts have cut their 2024 oil price forecasts for a fifth consecutive month, citing weaker demand and uncertainty over OPEC’s plans, with prices expected to remain under pressure despite geopolitical risks, a Reuters poll found on Monday.

A Reuters poll of 41 analysts and economists conducted in the past two weeks projected Brent crude would average $81.52 per barrel in 2024, the lowest poll projection since February and down from $82.86 projected in August.

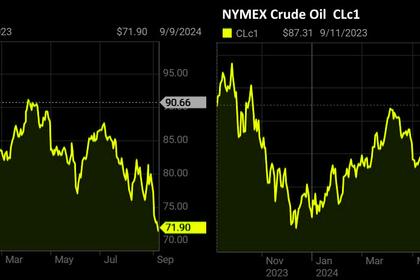

U.S. crude prices are expected to average $77.64, below last month’s forecast of $78.82.

"The recent weakness in oil prices is partly attributable to market concerns over how and when OPEC will return barrels to the market, alongside weaker Chinese demand indicators," said Roger Read, Senior Energy Analyst at Wells Fargo.

Global oil demand is now expected to grow by 0.9 to 1.2 million barrels per day (mbpd) in 2024, down from previous estimates of 1 to 1.3 mbpd, as per the poll.

Both OPEC and the International Energy Agency (IEA) have cut their forecasts, citing slower Chinese demand, with OPEC reducing its 2024 oil demand growth outlook for the second time.

"Slower economic growth in major economies such as China and Europe, coupled with expectations of weak demand, are pushing prices down despite geopolitical uncertainty," said Sehul Bhatt, Director of Research at CRISIL Market Intelligence and Analytics.

Most analysts believe that the war-related risk premium in oil prices has diminished due to plentiful supply, but some analysts said the premium could return if tensions escalate, particularly in the Middle East.

Florian Grunberger, senior analyst at data and analytics firm Kpler, said if hopes for a ceasefire (in Gaza) remain unfulfilled a higher risk premium for oil could return.

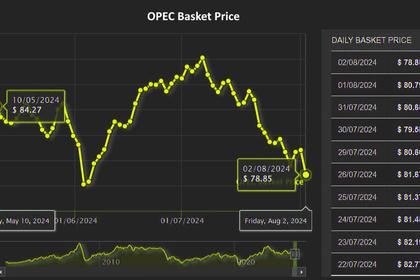

Oil prices surged past $90 a barrel in April, driven by Middle East tensions and OPEC+ supply cuts. But they have sharply reversed course, dipping below $70/bbl this month, as weak demand trends have led to an supply overhang.

OPEC+ is still expected to move forward with a planned production increase in December, but output cuts are needed first to address overproduction by some members.

"We expect OPEC+ to go ahead with a production increase in December," said Societe Generale commodity strategist Mike Haigh.

"However, given the disappointing demand outlook and rising OECD commercial stocks, the full cuts cannot be completely unwound as prices will begin to deteriorate."

Currently, OPEC+ is cutting output by 5.86 million bpd, or about 5.7% of global demand. Earlier this month, the group delayed its plan to boost output after oil prices hit a nine-month low.

-----

Earlier: