RUSSIAN ECONOMY LANDING

BLOOMBERG - Sep 25, 2024 - The Bank of Russia sees early indications that policymakers’ nightmare scenario of high prices coupled with slow economic growth — elements of what is known as stagflation — risks becoming a reality for the country.

“There are signs of cooling domestic demand. However, there is no reduction in inflationary pressure,” a summary from the central bank’s Sept. 13 rate-setting meeting published Wednesday read. Price growth remains high as a result of the economy overheating in the first half of 2024, the bank said.

The Bank of Russia, which didn’t specifically refer to stagflation, said internal demand remained high, but supply-side constraints — such as a labor shortage — may be behind a slowdown, according to the report.

Bank of Russia Governor Elvira Nabiullina has previously warned that it’s “very important” to avoid stagflation. At a news conference in September after the bank hiked its benchmark by 100 basis points to 19%, she said that “all central banks” feared such a scenario.

Still, if the slowdown in domestic demand prevails, that should eventually help reduce inflation, the central bank said.

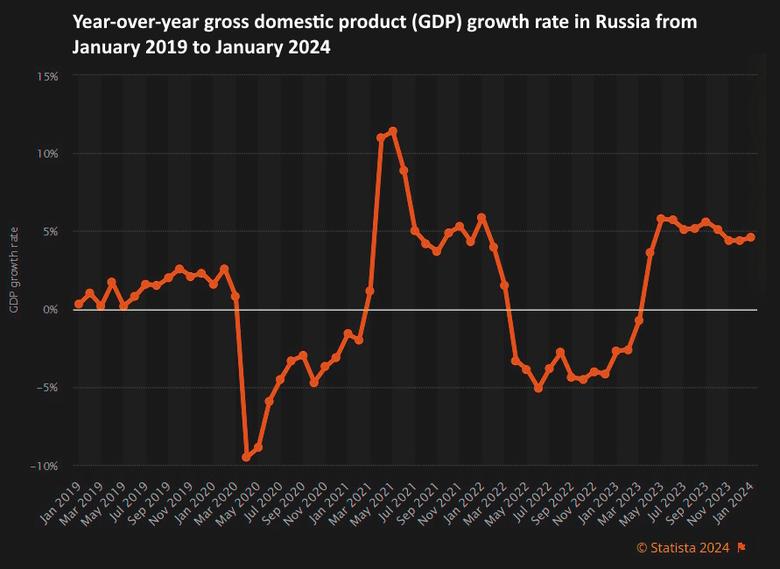

Russia’s economy expanded 4.1% year-on-year, the country’s statistics service said earlier this month. Annual inflation reached 8.59% as of the week ending Sept. 23, the Economy Ministry reported late Wednesday.

What Bloomberg Economics says...

The Bank of Russia’s statements indicate the central bank sees the economy on the cusp of stagflation. Despite sanctions and labor shortages binding output growth, corporations and consumers don’t expect price increases to slow. They also don’t perceive double digit borrowing rates as particularly restrictive. The central bank is right to be worried — we expect inflation to continue running above policymakers’ 4% target, while GDP growth is likely to slow to 1%-1.5% in 2025.

— Alex Isakov, Russia economist

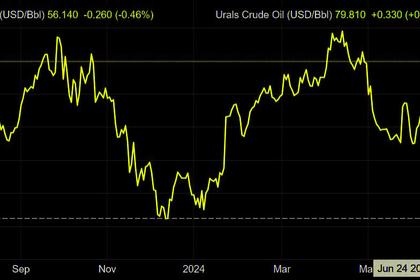

In addition to the labor shortage, the implementation of OPEC+ agreements to limit oil production are also constraining supply, the bank said. That’s “one of the factors in the slowdown in economic activity in recent months.”

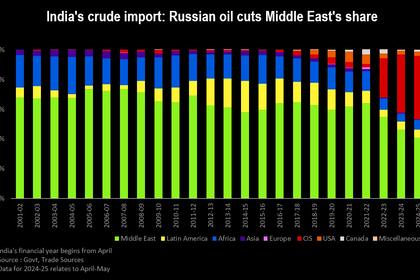

Weaker external demand amid a slowing global economy has held back growth in revenue from exports, used to finance imports. That, together with complications from sanctions, has made it hard to increase imports and negatively affected supply, the central bank said.

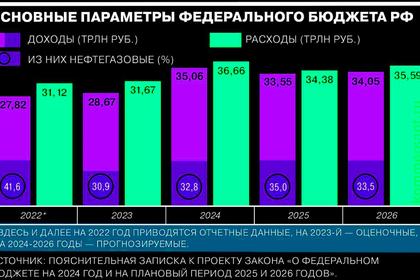

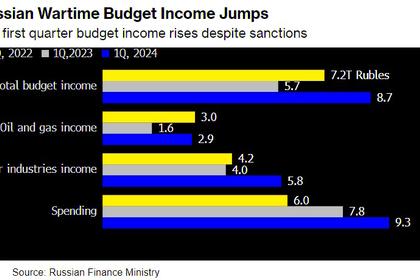

On Tuesday, the government published its draft budget, which maintains defense spending at a historic high in 2025 and shows only slight declines in the following two years. The central bank said it expects fiscal policy to gradually normalize, according to the summary.

While the draft budget speaks of a reduction in budget stimulus, a measure will be retained in 2025, and won’t “become completely neutral,” said Oleg Kuzmin, an economist at Renaissance Capital in Moscow.

Russia is now at a crossroads between a “soft” and “hard” economic landing next year, Kuzmin said. In both cases, growth will slow to 1.3% or 2.5%, but inflation should also decrease to levels around 5%, he said.

“Without a significant reduction in energy prices, we do not see the onset of stagflation in the foreseeable trend,” he said.

-----

Earlier: