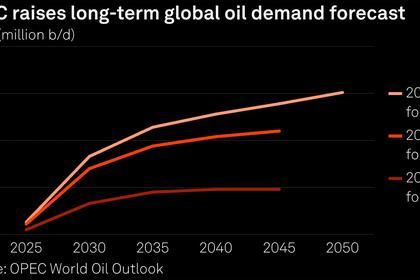

GLOBAL OIL DEMAND UP BY 1.8 MBD

OPEC - Nov 12, 2024 - OPEC Monthly Oil Market Report

Oil Market Highlights

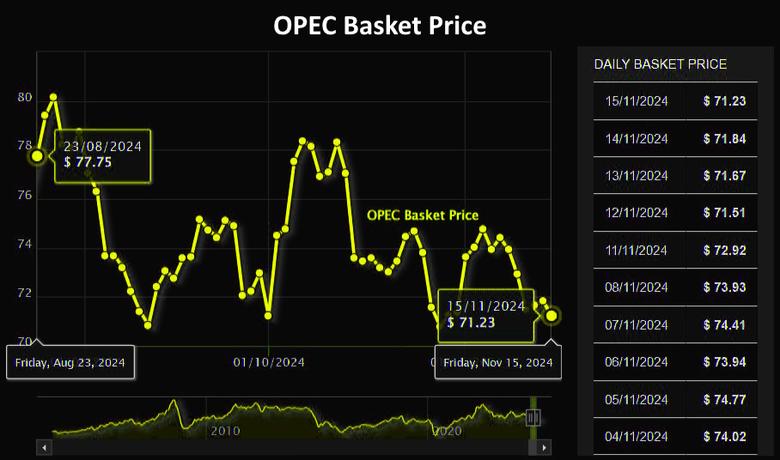

Crude Oil Price Movements

In October, the OPEC Reference Basket (ORB) value increased by 86¢, or 1.2%, m-o-m, to average $74.45/b.

The ICE Brent front-month contract increased by $2.51, or 3.4%, m-o-m, to average $75.38/b. The NYMEX WTI front-month contract increased by $2.19, or 3.2%, m-o-m, to average $71.56/b. The GME Oman front-month contract increased by $2.12, or 2.9%, m-o-m, to average at $75.03/b. The ICE Brent-NYMEX WTI front-month spread widened by 32¢, m-o-m, to average $3.82/b. The oil futures forward curves flattened in October but remained in backwardation. Hedge funds and other money managers showed mixed movements in their positions, contributing to volatility.

World Economy

The world economic growth forecast is revised up slightly to stand at 3.1% for 2024 and 3.0% for 2025. The US economic growth forecast for 2024 is revised up to 2.7%, reflecting robust growth in 2Q24 and 3Q24. For 2025, the US growth forecast is also revised up to 2.1%. Japan’s growth forecasts remain unchanged at 0.1% for 2024 and 0.9% for 2025. Similarly, the Eurozone’s economic growth forecasts remain unchanged at 0.8% and 1.2% in 2024 and 2025, respectively. China’s economic growth forecast for 2024 remains unchanged at 4.9%, however, the recently announced stimulus measures led to an upward revision of the economic growth forecast for 2025 to 4.7%. India’s economic growth forecasts remain unchanged at 6.8% for 2024 and 6.3% for 2025. The economic growth forecasts for Brazil are revised up to 2.9% for 2024 and 2.1% for 2025, on the back of ongoing robust dynamics which are expected to extend into 2025. Reflecting ongoing steady growth, Russia’s economic growth forecasts are revised up to 3.5% for 2024 and 1.7% for 2025.

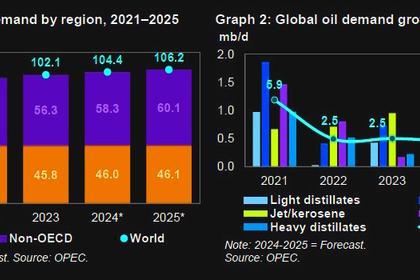

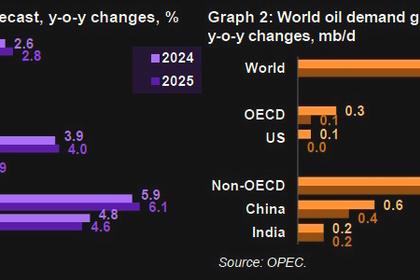

World Oil Demand

The global oil demand growth forecast for 2024 is revised down slightly by 107 tb/d from the previous month’s assessment to 1.8 mb/d, y-o-y. This minor adjustment is mainly due to updated data for 1Q24, 2Q24 and 3Q24. OECD oil demand is expected to grow by around 0.2 mb/d, while non-OECD demand is forecast to expand by close to 1.7 mb/d. In 2025, global oil demand growth is also revised down slightly by 103 tb/d from the previous month’s assessment to 1.5 mb/d, y-o-y. The OECD demand is expected to grow by 0.1 mb/d, y-o-y, while demand in the non-OECD is forecast to expand by 1.4 mb/d.

World Oil Supply

Non-DoC liquids supply (i.e. liquids supply from countries not participating in the DoC) is expected to grow by 1.2 mb/d, y-o-y, in 2024, unchanged from last month’s assessment. The main growth drivers are expected to be the US and Canada. For 2025, the non-DoC liquids supply growth forecast is expected to grow by 1.1 mb/d, y-o-y, also unchanged from last month. Growth is anticipated to be mainly driven by the US, Brazil, Canada, and Norway. Natural gas liquids (NGLs) and non-conventional liquids from countries participating in the DoC are forecast to grow by about 0.1 mb/d, y-o-y, to average 8.3 mb/d in 2024, followed by an increase of about 80 tb/d, y-o-y, to average 8.4 mb/d in 2025. Crude oil production by the countries participating in the DoC increased by 0.21 mb/d in October compared with the previous month, averaging about 40.34 mb/d, as reported by available secondary sources.

Product Markets and Refining Operations

In October, refinery margins increased following two consecutive months of losses, amid lower refinery product output in the Atlantic Basin due to heavy maintenance. On the USGC, an increasingly tight fuel oil market and solid diesel margin gains contributed to a lift in US refining margins. The seasonal product output constraint exerted downward pressure on product stocks, helping strengthen US product markets in October. This contrasted with the firm product stock builds and margin losses seen in the previous two months. In Northwest Europe, a contraction in total product availability led to a decline in product inventories at the Amsterdam- Rotterdam-Antwerp (ARA) storage hub, exerting upward pressure on product crack spreads. This was seen nearly across the barrel except for low-sulphur fuel oil. Most of the upturn in the region was attributed to HSFO and gasoline. In Singapore, improvements in regional product requirements, particularly from Indonesia, China, and Japan, backed refining economics. Regarding products, gasoil and jet/kerosene were the strongest margin drivers over the month, while a decline in Middle Eastern naphtha inflows and healthy naphtha demand from the regional petrochemical sector added to the upside in Asian product markets.

Tanker Market

Dirty spot freight rates rose across the board due to a strong start to the month before weakening in the second half of October, amid ample tonnage availability. An active US export market and geopolitical uncertainties were key drivers supporting rates early in the month. On the Middle East-to-East route, VLCC spot freight rates rose by 6%, m-o-m, in October, while rates on the West Africa-to-East route were up 5% over the same period.

In the Suezmax market, rates on the US Gulf Coast-to-Europe route jumped 36%, m-o-m. A surge in Aframax rates encouraged charterers to switch to the large Suezmax vessels, although ample availability limited gains, with Aframax spot rates on the Caribbean-to-US East Coast route surging 81%, m-o-m. The clean market was mixed according to the route, although on average rates fell both East and West of Suez. Soft demand for gasoline flows to the US limited activity in the Atlantic Basin.

Crude and Refined Product Trade

Preliminary data shows US crude imports fell to an almost two-year low of 6.0 mb/d in October, while exports returned above 4 mb/d for the first time in three months, supported by higher flows to Europe. US product imports fell further to 1.5 mb/d, led by lower inflows of gasoline, while product exports remained strong compared to the previous year at 6.4 mb/d, supported by a high distillate fuel exports. Preliminary estimates point to OECD Europe crude and product inflows increasing m-o-m in October, supported by US exports into the region. In September, Japan’s crude imports strengthened further to reach 2.4 mb/d, but remained 7% lower, y-o-y. Japan’s product imports edged down on declines in kerosene and diesel, while product exports rose 10% on higher outflows of most major products, especially fuel oil. Crude imports into China fell back 4% in September to average 11.1 mb/d, while product inflows remain strong on continued healthy inflows of fuel oil and LPG. India’s crude imports averaged 4.5 mb/d in September, remaining at the upper end of the latest five-year range for the month and representing a seasonal decline. India’s product exports jumped 30%, m-o-m, supported by higher outflows of diesel.

Commercial Stock Movements

Preliminary September 2024 data shows total OECD commercial oil stocks down by 3.0 mb, m-o-m. At 2,808 mb, they were 159 mb below the 2015–2019 average. Within components, crude stocks fell by 7.5 mb, m-o-m, while product stocks rose by 4.5 mb, m-o-m. OECD commercial crude stocks stood at 1,317 mb. This is 118 mb less than the 2015–2019 average. OECD total product stocks stood at 1,491 mb.

This is 41 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks fell in September by 0.2 days, m-o-m, to stand at 60.8 days. This is 1.8 days less than the 2015–2019 average.

Balance of Supply and Demand

Demand for DoC crude (i.e. crude from countries participating in the Declaration of Cooperation) is revised down by 0.1 mb/d from the previous month’s assessment to stand at 42.7 mb/d in 2024, which is around 0.5 mb/d higher than the estimate for 2023. Demand for DoC crude in 2025 is revised down by 0.2 mb/d from the previous month’s assessment to stand at 43.0 mb/d, around 0.4 mb/d higher than the estimate for 2024.

-----

Earlier: