NATURAL GAS : BROKEN OARS

As all the focus begets the US Election Night,both parties finalising their rallies,we are seeing a flat or rather muted market moves especially on the broader scale.There have been moves in the Asia Markets,as most of the traders looking into the economic developments of the region as the Caixin PMI gauge rises to 52 in October,being the highest since July.This is from the economic stimulus that was mentioned as a canary for geopolitical play.

Focus is in refinancing hidden debt from the local government hence boosting foreign investment.

These two events are a somewhat joined at the hip as the play significant roles,as US Elections influence tariffs plays,technology & AI space, supply chain disruptions and geopolitics just to name but a few.

A vote for market clarity would help on the cyclical growth patterns would be my bias.

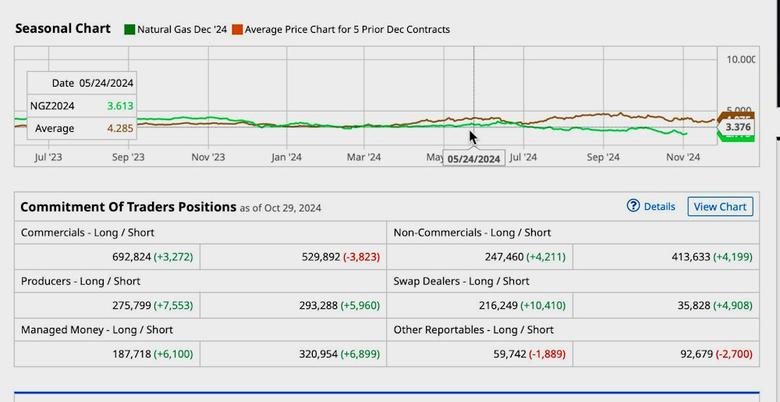

The murky waters are filled with Broken Oars for the start of the month in #NaturalGas as we enter the drastic weather changes season.There is a disparity of weather patterns from the 5-year average.

#NaturalGas is still hugely divergent from the seasonal average, which is at its 5-year historical seasonal low point.A look into the current production patterns and levels should provide a compass,also a critical variable within the risk basket is La Niña and shouldn't be swept under the carpet as the risk factor remains full to the brim.The consolidation triangle is at $2.82/mmBtu pricing average.

The Oil complex has bounced back after a sharp decline past week as October ended,majority of the move paring gains towards $75.04/bbl on the BRENT Crude and $71.41/bbl on the WTI(resistance level at 71.63/bbl on WTI for Bullish bets).

ARAMCO 3Q total dividend stands at $31.05B despite free cashflow number being at $22B hence bringing a question of sustainability within long-term drivers and energy needs.Buying power of India shouldn't be neglected in the long-run and their sentiments should be amplified.

The OPEC Basket standing a tad bit lower at $73.64/bbl after making highs of $78.50/bbl in the previous month.This is a precursor of the delay on the December output hike curbing oversupply as we wait on further clarity from the Ministerial meeting minutes scheduled for December 1st.

On the FX Markets for the monthly start,there are slight moves in the MXNs,CNHs and de-risking in treasuries.

Let us stay nimble and savour the success that is headed upon us,start dressing your pennies as nickles.

Earlier: