SOLAR, WIND UNPREDICTABILITY

By Hugo Stappers Global Sales Leader - Energy Portfolio Management, Hitachi Energy

ENERGYCENTRAL - Nov 6, 2024 - As the global energy sector undergoes rapid transformation, energy companies find themselves grappling with unprecedented challenges. The rise of distributed renewable energy sources, shifting demand dynamics, and market volatility all contribute to a complex environment for managing a portfolio of demand- and supply-side assets. Furthermore, digitalization has accelerated, generating vast amounts of data that must be processed and analyzed in real time. These forces are reshaping how energy businesses plan, invest operate, and trade, pushing many to reevaluate their systems and processes. In this dynamic landscape, Energy Portfolio Management (EPM) emerges as a crucial solution set - one that offers flexibility, modularity, and scalability to help companies enhance revenue streams while mitigating risk.

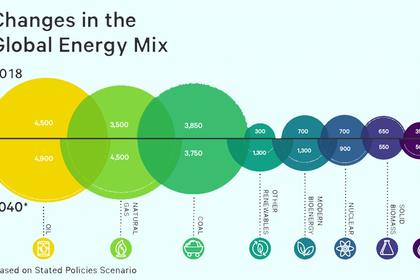

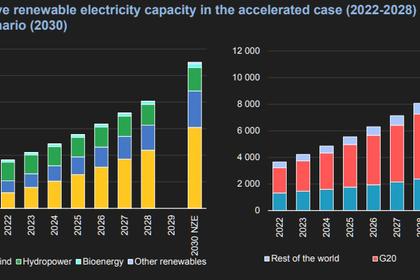

The Energy Transition: A New Landscape

The ongoing energy transition has reshaped the supply-demand equation. As renewable energy sources like solar and wind become more widespread, their inherent unpredictability introduces new challenges. Unlike traditional fossil fuel power plants, renewable generation is intermittent, making it harder to forecast production and balance the grid. This, coupled with increased market volatility and price fluctuations, demands sophisticated tools for forecasting, planning, and risk management.

Digitalization, meanwhile, has flooded energy companies with data. From smart meters to real-time market pricing and generator performance analytics, organizations are dealing with data at higher volumes and speeds than ever before. But many existing energy trading and risk management (ETRM) systems were not designed to handle this level of complexity or data flow. Legacy systems and support approaches that once sufficed are now showing their limitations, leaving energy firms at a crossroads.

The Role of Energy Portfolio Management

Energy Portfolio Management (EPM) provides a collection of composable, modular solutions akin puzzle pieces. These pieces can be assembled to cover the full range of energy operations, from renewable asset developers to wholesale electricity traders. This flexibility allows energy companies to implement solutions tailored to their unique needs, improving decision-making, operational efficiency, and profitability across an enterprise portfolio of assets.

EPM’s benefits are particularly relevant in the face of the growing complexities of today’s energy value chain. Whether dealing with generation, consumption, trading, or compliance, EPM offers specialized functionalities designed for more effective decision making to optimize each stage of the energy lifecycle.

Key Functionalities of EPM

Broadly speaking, these specialized functionalities, delivered as services or software, can be organized in three buckets, not unlike what you would do when sorting puzzle pieces to help you find the right piece. The key functionalities or puzzle pieces for Energy Portfolio Management could be found in the following ‘sorting trays’:

Analytics: harnessing data with predictive analytics

- Market Insights: One of the core components of EPM is its ability to deliver insights into fundamental market information, including market pricing, generator attributes, robust geospatial mapping, transmission data, utility investments, fuel sourcing, generator operations, system load, and weather impacts. To be successful, investors, operators, developers and traders must quickly access, understand and analyze this as each decision, each transaction, depends on having the right information at the right time at the right level of detail, all in ONE location.

- Forecasting: Load, production, and price forecasting are essential in a world where energy supply is becoming increasingly decentralized and weather dependent. AI-powered forecasting provides advanced capabilities, using historical data and machine learning algorithms to predict demand, production, and price fluctuations. The result is forecasting precision that significantly enhances the ability of energy traders and portfolio managers to anticipate market movements and adjust their strategies accordingly.

Commercial Enablement: automating business processes and decisions

- Asset Modelling: Accurate modelling of renewable and traditional energy assets is crucial for transmission operators and planners, renewable asset developers, marketers and traders. Studies and simulations allow them to find the most optimal site and size of transmission projects helping to optimize capital allocation and operational planning or to project future asset performance under different market and regulatory conditions thereby quantitatively comparing various outcomes and valuing complex PPA structures for optimal revenue and risk distribution.

- Asset Optimization: Once assets are modelled, and positions created, the next step is optimization. This requires the ability for decision-making around commitments and ensure lowest cost dispatch that minimizes total fuel burn and total production costs. It allows traders to evaluate bidding strategies, when to sell or not, to maximize profit when bidding in a competitive market.

- Energy Trading and Risk Management (ETRM): The heart of any energy trading operation is its risk management strategy. ETRM systems help energy companies maximize the value of their trades while mitigating financial exposure. Advanced analytics with what-If scenarios, can assess market risks, monitor positions, and provide risk metrics to support decision-making.

- Market Communications: Successful participation in wholesale markets requires timely, strategic bidding and offering. Market communication tools automate this process, ensuring that bids are optimized for profitability and compliance with market rules.

- Compliance Reporting: As regulations continue to evolve, maintaining compliance has become a more complex and time-consuming task. Whether wholesale trading regulatory reporting or for supporting ESG, EPM offers solutions to streamline compliance reporting by automating the collection and submission of necessary data, reducing administrative burden and ensuring adherence to market rules.

Advisory Services: leveraging deep domain expertise.

- Reference Case: When making investment decisions in energy markets, utilities, financiers, developers, and other energy market investors, need unbiased reports with third-party energy price data to develop an actionable business case reports that examine supply and demand fundamentals to produce integrated, internally consistent forecasts of hourly, monthly, and annual wholesale electricity prices, annual capacity prices, annual emission prices and renewable energy credit prices.

- Strategic Consulting: To provide experts with detailed knowledge of market development that know how to model and analyze them and leverage data services and software applications.

Driving Value with Data-Driven Decision Making

- Energy Portfolio Management (EPM) is essential for turning data into actionable insights. By integrating operational analytics with commercial operations, EPM provides a holistic view of the energy business. This transparency enables traders, portfolio managers, and planners to make more informed decisions, leading to better financial outcomes and reduced risk. Whether it’s forecasting market trends, optimizing asset performance, or managing trading positions and associated risks, EPM provides the tools necessary to thrive in today’s fast-moving energy landscape.

- A data-driven approach to energy management not only improves operational efficiency but also supports long-term strategic planning. Companies can analyze historical trends, simulate future scenarios, and adjust their portfolios in real time, ensuring that they remain agile and competitive.

Flexibility, Modularity, and Scalability: The Cornerstones of EPM

The true strength of EPM lies in its composability. Just as a jig-saw puzzle requires the right pieces to fit together seamlessly, energy companies need solutions that can be tailored to their specific needs. Traditional ETRM-system-only type solutions often lack the flexibility to accommodate new business models or technologies, leaving companies stuck with outdated tools that limit their ability to adapt.

In contrast, EPM offers a modular and scalable approach, allowing energy companies to select and connect the functionality they need today while leaving room for future growth. This ensures that the system can evolve as market conditions change, technology advances, or business priorities shift.

Solving the Energy Puzzle

In today’s rapidly evolving energy landscape, leading companies partner with technology software and services providers that offer end-to-end flexible solutions. Traditional software and support approaches no longer meet the demands of a complex, data-driven market. Energy Portfolio Management offers a forward-looking approach, providing the puzzle pieces necessary to automate the process of the entire cycle from market intelligence to market access thereby increasing efficiencies, improve revenue, reduce risk, and support business transformation.

By embracing next-generation EPM solutions, energy companies can bring their assets into their trading portfolios thereby unlocking value through improved decisions-making and navigate the energy transition with confidence. Whether managing renewable assets, optimizing trading strategies, or ensuring regulatory compliance, EPM provides the tools and insights needed to thrive in a world where flexibility, speed, and accuracy are more important than ever.

Just as solving a jig-saw puzzle requires finding the right pieces, managing an energy portfolio requires finding the right solutions. When all the pieces fit, the results are both satisfying and profitable.

-----

-----

Earlier: