EUROPEAN LNG UP TO 10.7 MT

PLATTS - 29 Jan 2024 - LNG imports delivered into Europe were at 10.7 million mt as of Jan. 29, up 2.59 million mt on the week, according to S&P Global Commodity Insights data.

Imports this month were around 95% of levels seen in December, which were the highest levels seen since May 2023.

The volumes for January were headed to the UK (1.91 million), France (1.73 million mt), Turkey (1.41 million mt), Spain (1.33 million mt), the Netherlands (1.15 million mt), Italy (880,000 mt), Belgium (630,000 mt), Germany (500,000 mt), Poland (240,000 mt), Portugal (240,000 mt), Greece (200,000 mt), Finland (170,000 mt), Lithuania (120,000 mt), Croatia (110,000 mt), Malta (70,000 mt) and Sweden (10,000 mt).

The US was the supplier of 56% of the total, with some 14% coming from Russia and 10% from Algeria. Notably, around 7% was also originating from Qatar and 4% from Nigeria.

Healthy imports

While prices reacted to news of an outage at Freeport LNG's train 3, prices remained weaker on the week with traders still seeing an overall bearish undertone in the market.

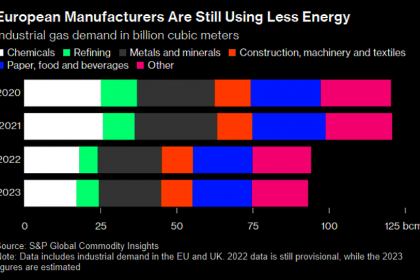

Although prices may continue to see short-term rises, market participants still suggest that the high inventories and relatively weak demand will cap any significant price hikes.

Platts, part of S&P Global, assessed the DES Northwest Europe Marker for March was assessed at $8.286/MMBtu Jan. 26, up 23.20 cents/MMBtu for the day but lower by 7.1 cents/MMBtu week on week.

"After Europe dominated the growth in non-long-term trade in 2022 (when every major European market saw a rise in spot LNG imports), trends were much more varied by individual markets within the region in 2023," Kelli Krasity, associate director at S&P Global said. "While [European import] deliveries were still well in excess of pre-2022 levels, the continent's relatively healthy storage position (especially in the second half of the year) and the startup of new import terminals allowed some markets to pull back on their spot purchases."

Kelli added that the UK and Turkey had the two largest declines in non-long-term imports, mirroring their drop in overall LNG purchases. Conversely, the single largest growth market for non-long-term LNG imports in 2023 was Germany, where three new regasification terminals started operations.

While LNG sources expect imports to have peaked for the remainder of this month, they are already seeing a strong import trend for February and even seeing interest growing for March.

-----

Earlier: