GERMANY'S RECESSION UP

BLOOMBERG - Feb 22, 2024 - Germany’s manufacturing downturn unexpectedly deepened in February, with activity declining at a faster pace amid falling demand at home and abroad.

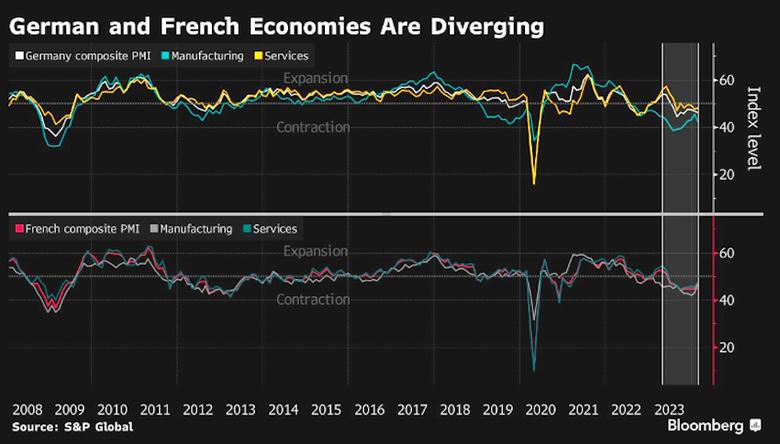

S&P Global’s purchasing managers’ index for the country’s industrial sector dropped to 42.3 from 45.5 the previous month – well below any economist estimate in a Bloomberg survey. Thanks to improving conditions in services, overall business activity only slipped to 46.1 from 47.

“After a glimmer of hope in recent months, the German industry is feeling pretty bleak now,” said Tariq Kamal Chaudhry, an economist at Hamburg Commercial Bank. The data reveal “a decline in output, alongside plummeting new orders both domestically and internationally.”

Thursday’s report comes amid heightened concerns about Germany’s economic performance, which is being weighed down by protracted weakness in its outsized manufacturing sector. The government on Wednesday slashed its growth forecast for this year to 0.2% from 1.3%, after a contraction in 2023.

Markets lowered their expectations for European Central Bank rate cuts after the PMI readings, with swap contracts reflecting less than 1 percentage point of reductions through year-end. The German 10-year bond yield traded about 3 basis points higher at 2.48%, pulling back from a jump to 2.51%, while the euro rose as much as 0.6% to 1.0888, its highest in more than two weeks.

Manufacturing companies also became more pessimistic about the future in February for the first time since November. The overall mood improved to a 10-month high due to services, where employment grew more quickly.

The picture was brighter in France, where the contraction eased much more than analysts had predicted. Companies reported improving demand while expanding their workforce.

“France’s economy is in recovery mode,” said Norman Liebke, an economist at Hamburg Commercial Bank. “Even if the economy continues to shrink, this is happening at a much slower pace.”

Services were the main inflation driver in both countries, due to higher costs for labor and energy. But at least in France, there were signs of a “significant slowdown” in the pace of increases, Liebke said.

A separate survey by French statistics agency Insee showed confidence in the country’s industrial sector improved in February, reaching the long-term average for the indicator for the first time since July.

PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP.

Euro-area PMI data later on Thursday are expected to indicate a ninth month of contraction, while earlier numbers from Australia and Japan pointed to slight expansion. UK and US figures are set to show continued growth.

-----

Earlier: