GLOBAL OIL DEMAND 2024: +2.2 MBD

OPEC - 13 Gebruary 2024 - OPEC MONTHLY OIL MARKET REPORT

Oil Market Highlights

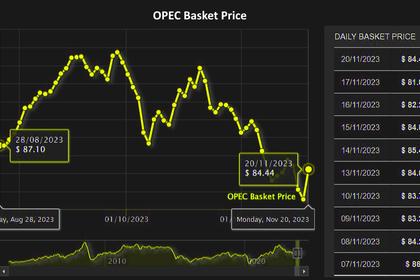

Crude Oil Price Movements

The OPEC Reference Basket (ORB) rose by $1.04, or 1.3%, m-o-m in January to average $80.04/b. Oil futures prices increased, with the ICE Brent front-month contract rising by $1.83, or 2.4%, m-o-m to $79.15/b, and the NYMEX WTI front-month contract rising by $1.74, or 2.4%, to average $73.86/b. The DME Oman front-month contract increased by $2.12, or 2.8%, m-o-m, to settle at $78.95/b. The front-month ICE Brent/NYMEX WTI spread further widened in January by 9¢ to average $5.29/b. The market structure of oil futures prices strengthened, with the front of forward curves for all major benchmarks flipping into backwardation. Selling pressure in oil futures markets eased, and money managers rebuilt part of their bullish positions in ICE Brent.

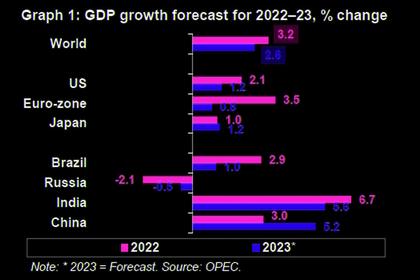

World Economy

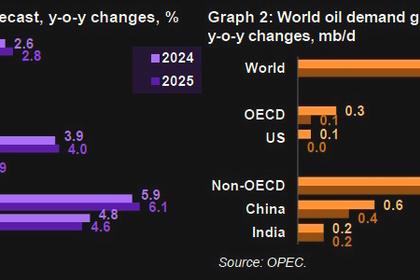

The world economic growth forecast now stands at 2.7% for 2024 and 2.9% in 2025, following slight upward revisions for each year compared with the previous month’s assessment. US economic growth for 2024 is revised up to 1.6%, as healthy momentum from 2H23 is expected to continue. The forecast for 2025 is also revised up from the previous assessment to 1.7%. The economic growth forecast for the Eurozone remains at 0.5% for 2024 and 1.2% for 2025, while Japan’s economic growth forecast is unchanged at 0.9% in 2024 and 1% in 2025. China’s economic growth forecast remains at 4.8% in 2024 and 4.6% in 2025. Meanwhile, India’s economic growth forecast remains at 5.9% for 2024 and 6.1% in 2025. Brazil’s economic growth forecast for 2024 is revised up to 1.5%, while the forecast for 2025 stays unchanged at 1.9%. Russia’s economic growth forecast for 2024 is revised up to 1.7%, with growth in 2025 unchanged at 1.2%.

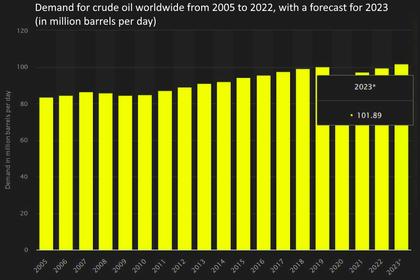

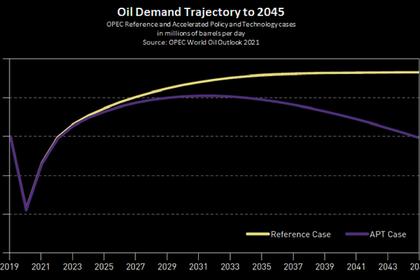

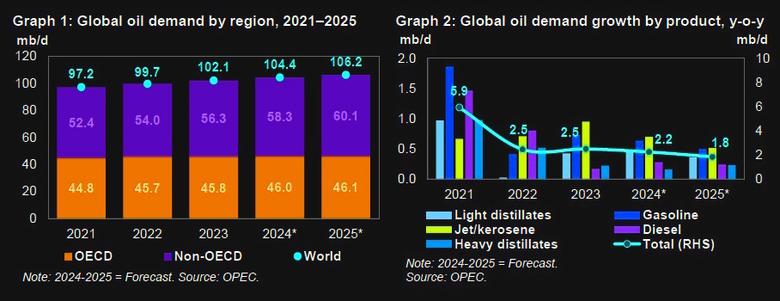

World Oil Demand

The global oil demand growth forecast for 2024 remains unchanged from last month’s assessment at 2.2 mb/d. A slight upward adjustment to the US forecast has been made given the improving expectation for the US economy, which will have a positive impact on oil demand. This offsets the downward revision made in OECD Europe. The OECD is projected to expand by around 0.3 mb/d and the non-OECD by about 2.0 mb/d this year. In 2025, global oil demand is expected to see a robust growth of 1.8 mb/d, y-o-y, unchanged from the last month's assessment. The OECD is forecast to grow by 0.1 mb/d, while demand in the non-OECD is forecast to increase by 1.7 mb/d.

World Oil Supply

Non-OPEC liquids production in 2024 is expected to grow by 1.2 mb/d, revised down from the previous month’s assessment. The main drivers for liquids supply growth in 2024 are expected to be the US, Canada, Guyana, Brazil and Norway. The forecast for non-OPEC liquids supply growth in 2025 stands at 1.3 mb/d, unchanged from the previous month, mainly driven by the US, Brazil, Canada, Norway, Kazakhstan and Guyana. Separately, OPEC natural gas liquids (NGLs) and non-conventional liquids are forecast to grow by around 64 tb/d this year to average 5.5 mb/d, followed by a growth of 110 tb/d in 2025 to average 5.6 mb/d. OPEC-12 crude oil production in January decreased by 350 tb/d, m-o-m, to average 26.34 mb/d, according to available secondary sources.

Product Markets and Refining Operations

In January, refinery margins showed solid gains on the US Gulf Coast (USGC), as reductions in product supplies caused by weather-related refinery outages constrained product stock builds ahead of the heavy maintenance season. In Singapore, gains were considerably more limited, as refinery maintenance in the region restricted product output, despite considerable growth in naphtha stocks. However, in Rotterdam, margins declined, with seasonal overall product market weakness having offset the bullish market sentiment derived from slower middle distillate imports amid ongoing geopolitical tension. Global refinery intake declined in January following a sharp upward trend witnessed over the previous two consecutive months to show a 1.1 mb/d decline in January, averaging 80.8 mb/d, compared with 81.9 mb/d the previous month. Nevertheless, January intake was still 1.1 mb/d higher relative to the same time a year earlier.

Tanker Market

Dirty freight rates rose in January, amid trade flow disruptions that further increased tonnage-mile demand. VLCC spot freight rates on the Middle East-to-West route increased by 24%, m-o-m, while a more modest gain of 5% was seen on the Middle East-to-East route. Suezmax rates on the USGC-to-Europe route increased by 34%, m-o-m, while Aframax rates around the Mediterranean rose by 26%, m-o-m, with gains reflecting tightening availability lists. Clean rates saw mixed movement. East of Suez rates surged by 45%, as trade disruptions triggered some rebooking, while West of Suez rates fell by 10%.

Crude and Refined Products Trade

Preliminary data shows that US crude imports averaged 6.2 mb/d in January, while US crude exports remained steady at strong levels in January, averaging 4.2 mb/d. China's crude imports averaged 11.4 mb/d in December, representing an increase of 1.1 mb/d, m-o-m. Gains came as the government provided advanced crude import quotas for 2024, allowing refiners to boost inflows in the final weeks of the year. India's crude imports in December reached a six-month high of 4.7 mb/d, supported by seasonal trends. Japan's crude imports averaged 2.7 mb/d in December, representing a decline of more than 10% compared with December 2022. OECD Europe crude imports are estimated to fluctuate around the turn of the year with inflows strengthening in December before falling back in January.

Commercial Stock Movements

Preliminary data for December 2023 shows total OECD commercial oil stocks down by 22.6 mb, m-o-m. At 2,767 mb, they were 159 mb below the 2015-2019 average. Within the components, crude and product stocks fell by 11.3 mb, m-o-m, each. OECD commercial crude stocks stood at 1,342 mb in December. This was 86 mb lower than the 2015–2019 average. OECD total product stocks stood at 1,425 mb. This was 73 mb below the 2015–2019 average. In terms of days of forward cover, OECD commercial stocks dropped by 0.4 days, m-o-m, in December, to stand at 60.6 days. This is 1.7 days less than the 2015-2019 average.

Balance of Supply and Demand

Demand for OPEC crude in 2024 stands at about 28.4 mb/d, which is 1.0 mb/d higher than the estimated level for 2023. Demand for OPEC crude in 2025 is expected to reach about 28.8 mb/d, an increase of about 0.5 mb/d over the forecast 2024 level.

-----

Earlier: