GLOBAL RUSSIAN ENERGY & SANCTIONS

PLATTS - Feb 22, 2024 - Russia's invasion of Ukraine and intensifying western sanctions against Moscow have fractured the world of energy, and while both sides in the standoff claim to have adapted to shifting oil and gas flows, divisions have only deepened and risks intensified.

Two years since Russia launched its full-scale invasion, the shockwaves for the sector have spread far and wide, affecting investment, refining, shipping and trade.

The invasion of Ukraine "ended the global oil market... and led to a partitioned oil market where a large volume of oil now flows based on sanctions," S&P Global Commodity Insights vice president of research and oil markets Jim Burkhard said.

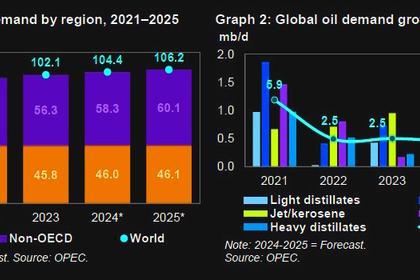

On the one hand, Europe can point to normalized oil and gas prices and healthy levels of stored gas despite the collapse of Russian supply, thanks to new LNG import terminals and reliable gas supplies by pipeline, from Norway in particular.

On the oil front, Europe's needs are being met partly by US shale oil, while the embargo on Russia's Urals has boosted demand for medium sour Norwegian grade Johan Sverdrup as a stand-in. Security of supply concerns have also given a boost to North Sea investment. And the relative attractiveness of projects far from the conflict in the Americas has increased, particularly for companies with operations close to geopolitical fault lines around Russia in Azerbaijan and Kazakhstan.

Russia has also successfully redirected exports east, with steady increases in loadings of ESPO (East Siberia Pacific Ocean) crude at Kozmino. And Urals crude loaded in Europe has made inroads into India's west coast, supported by Rosneft's ownership of the Vadinar refinery.

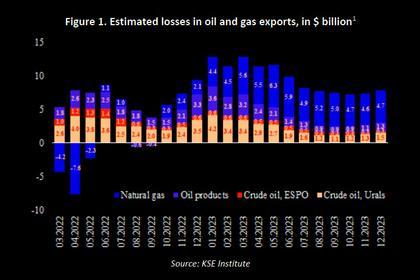

Urals delivered on India's west coast averaged a modest $4.75/b discount to the Platts Dubai benchmark in the six months to the end of January. ESPO crude has yet to regain its pre-war premia, but has traded at discounts to Dubai of less than $5/b since September.

President Vladimir Putin underlined the strength of recent alliances with the OPEC+ group on a visit to the UAE and Saudi Arabia in December, coinciding with COP28 climate talks. Rosneft also retains an overseas footprint, including at Egypt's prolific Zohr gas field.

Deputy Prime Minister and OPEC+ envoy Alexander Novak drove home the official line that sanctions make Russia stronger when he said in October, referring to the redirection of exports, "the main consumption of energy resources will in future be in [the Asia-Pacific] region... We would have to do this anyway. We just sped up a bit."

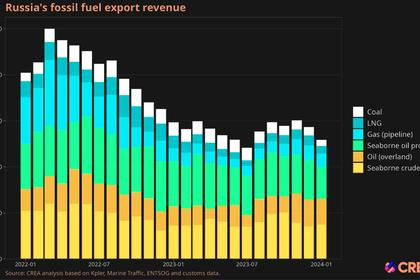

He later said 82% of Russia crude exports had gone to Asia-Pacific countries in 2023, or some 3.9 million b/d -- more than double the level in 2022, and a trend borne out by ship-tracking data. Russian crude exports dropped barely 3% in 2023 to 234 million mt (some 4.7 million b/d), Novak added. The expected start of exports from Novatek's Arctic LNG 2 project in the near future -- despite setbacks and delays -- will also support claims of resilience.

Resilience debate

Such arguments are echoed by international critics of sanctions, particularly the controversial price cap for ships carrying Russian crude, which has spawned a "shadow fleet" outside Western financing and insurance, potentially elevating safety risks. "It's proven already that it's not working," the CEO of the American Petroleum Institute, Mike Sommers, said of the cap in a January interview.

However, there are signs of difficulties for Russia. The collaboration with OPEC+ has struggled to achieve desired price gains in the face of rising US output and a weak Chinese economy. And while recent attacks on Red Sea shipping have hit just one tanker of Russian oil, they expose a downside of reliance on India.

Russian has also had difficulty discharging its Sokol crude grade -- produced in Sakhalin -- at Indian terminals, with delays attributed by market participants to sanctions and payment issues, although this is denied by Indian officials.

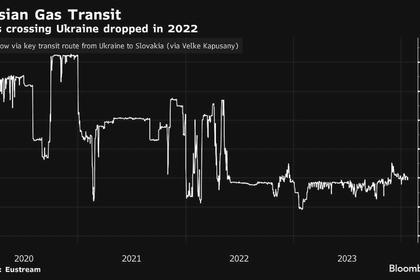

In the gas sector, Russia has yet to find a comparable outlet for its former supplies to Europe, with talks on expanding supply to China making little headway, and potential new shipments to neighbors in ex-Soviet Central Asia seen as less lucrative.

There are also signs of an impact on Russia's downstream sector due to the combined effect of Ukrainian drone attacks and sanctions on importing refining technology.

Recent suspected Ukrainian attacks have reached as far as Novatek's Ust-Luga condensate terminal near St. Petersburg, and the Tuapse export refinery on the eastern Black Sea coast. Oil product loadings from Ust-Luga took a month to be restored, with Energy Minister Nikolai Shulginov announcing their resumption on Feb. 20, while Tuapse – which was hit on Jan. 25 -- is expected to take at least three months to repair, he said.

Lukoil's Norsi refinery in Nizhny Novgorod is reportedly having trouble after a recent outage, with media reports blaming sanctions for problems restarting.

Higher up the value chain there is uncertainty over Russia's ability to source know-how and the most optimal technology for more advanced conventional production techniques such as multi-stage hydraulic fracturing, John Webb, director of S&P Global Commodity Insights' Eurasian Energy advisory service, says.

Russia could struggle to maintain exports through Kozmino and elsewhere at current levels, with a gradual decline in Russian oil exports expected from around 2025, Webb said.

He noted Rosneft plans to start redirecting oil currently produced at the Vankor cluster – part of the flagship Vostok Oil project -- away from Kozmino to a new terminal on the Kara Sea later this year, contributing to the politically symbolic expansion of the "Northern Sea Route" to Asia. The latter remains an official priority despite ice issues that dogged the route in 2023, but the imperative to redirect shipments could be a challenge for Kozmino if the Rosneft project ramps up as planned, Webb said, adding, however, the port will still retain its pre-eminence.

More volatility

The death of Russian opposition leader Alexey Navalny in prison in February and intensified western sanctions underline the volatility of the situation.

While Russia continues exporting crude and products through the Black Sea, drone attacks on its navy highlight the risks to shipping, not only for Moscow, but commodity shippers generally, including exporters of Kazakhstan's CPC Blend crude, which loads at Novorossiisk.

And the vulnerability of European infrastructure remains a concern, underlined by suspicions over the rupturing of the Balticconnector gas pipeline in the Gulf of Finland in October, which is still under investigation.

Asked about any prospects for an easing of such rifts, including in the event of a change of US leadership this fall, Burkhard, of S&P Global, said, "Europe's stance toward Russian energy is unlikely to change this decade, and perhaps even longer."

"Flows of oil and gas from Russia to Europe are definitively altered until there is a paradigm shift... and that does not appear to be on the horizon," he said.

-----

Earlier: