INDIA NEED OIL REFINING

BLOOMBERG- Jan 31, 2024 - The world is on the cusp of what’s likely to be the last big refining boom as India embarks on a capacity expansion to accommodate the country’s rising thirst for fossil fuels.

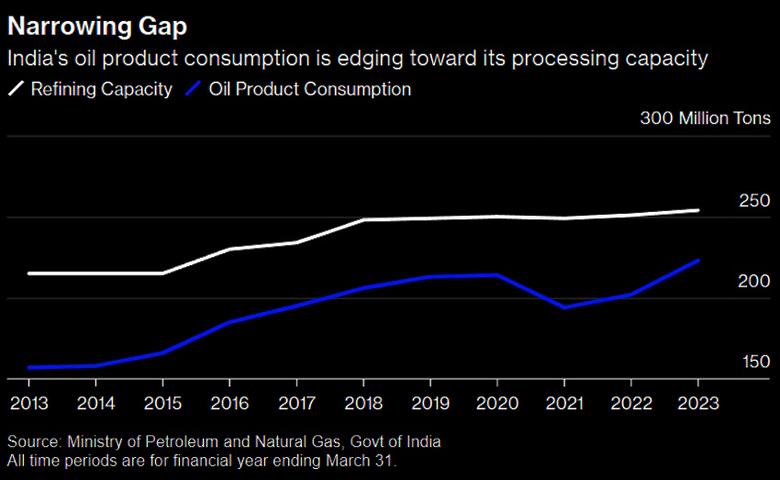

The South Asian nation has set in motion a building blitz at its oil refineries to raise production of traditional transport fuels such as gasoline and diesel, which could lift capacity by more than 20% over the next five years. Rystad Energy puts the cost of additions at around $60 billion.

It’s a rare boost for a global refining industry that’s in a state of decline in the US and Europe, while China’s massive sector is adjusting to Beijing’s green goals after years of development made it a processing powerhouse. By contrast, India’s growing transport demand and the slower adoption of electric vehicles will keep appetite for gasoline and diesel higher for longer.

“Expansions in the West are non-existent,” said Giovanni Serio, Vitol Group’s head of research. “Expansions continue to be based in the areas where demand is growing. India is the one where we see the continuation of a trend of growth of over 200,000 barrels a day between now and the next four or five years.”

India’s refining capacity is projected to increase by 56 million tons by 2028, Junior Oil Minister Rameswar Teli said last month, without elaborating. That equates to an overall capacity boost of 22%, or 1.12 million barrels a day.

The government has not provided details of how it will reach those lofty levels. By Bloomberg calculations, state-run refiners have announced about 50 million tons of expansions that could fit Teli’s timeline. Projects that account for almost 37 million tons have commissioning dates from 2024 to 2026, but completion of the remaining capacity remains unclear and includes planned additions that are under execution and a consideration stage.

The biggest is at Indian Oil Corp.’s Panipat plant in Haryana state, which is adding 10 million tons and is due to be commissioned at the end of next year. Hindustan Petroleum Corp.’s new Barmer refinery in the northwestern state of Rajasthan is the next largest at 9 million tons. Development is expected to be completed in 2024, with the facility to run at full capacity by 2025.

Smaller expansions are being conducted at the Visakhapatnam and Gujarat refineries, and the Barauni plant at Begusarai city in Bihar state.

Still, Vitol’s Serio says 56 million tons is not an absurd number. “Having said that, I think from our standpoint, when we look at the probability of these projects, we see roughly half of that more likely right now.”

State-run refiners will likely have to shoulder most of the responsibility. Reliance Industries Ltd. — the biggest private oil processor and owner of the giant Jamnagar complex — is seeking to replace gasoline and diesel with clean fuels to take advantage of a transition toward greener energy.

“India has been a laggard in adding new refinery capacity in the past, which requires some catch up if it wants to be more self-sufficient,” said Sushant Gupta, an oil analyst at Wood Mackenzie. The consultant sees the nation’s demand growing 1.3 million barrels a day by 2030.

The Asian nation is not only meeting its own demand requirements, it’s also playing an important role shipping fuels to other regions such as Europe after Russia’s invasion of Ukraine disrupted supply, most notably for diesel.

“Good opportunities are building up for exports,” said Kumod Kumar Jain, senior vice president of downstream research at Rystad Energy. “In Europe, a lot of refineries are getting closed and that’s what everybody in the market is trying to capture.”

Capacity Boost

The International Energy Agency estimates that India will add 1 million barrels a day of capacity over the six years to 2028, taking processing to 6.2 million barrels a day — a 19% increase to total refining. China is adding more daily volume but the overall capacity boost is 8%. The Middle East is around 9%.

While the percentage gain is big, India’s refining industry is still dwarfed by most other countries including the US and Europe, which are trimming capacity. China’s sector is over three times larger.

India’s planned additions include petrochemical complexes, but most of the capacity will be for transport fuels. The nation’s overall refining capacity was almost 254 million tons as of April 1, 2023, according to government data.

“Given that India is still a developing economy, it makes sense for the country to still focus heavily on traditional fuels investments while at the same time, putting in some groundwork for green energy transition,” said Dylan Sim, an oil analyst at FGE.

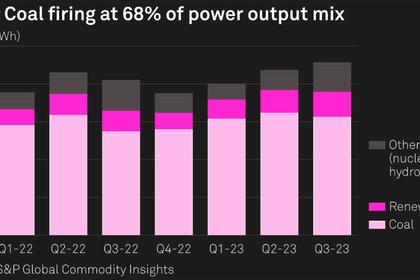

India also has plans to boost liquefied natural gas capacity and still heavily relies on coal for power generation, but the country is seeking to be part of the energy transition and has set itself a net-zero goal by 2070.

-----

Earlier: