INDONESIAN COAL EXPORTS UP

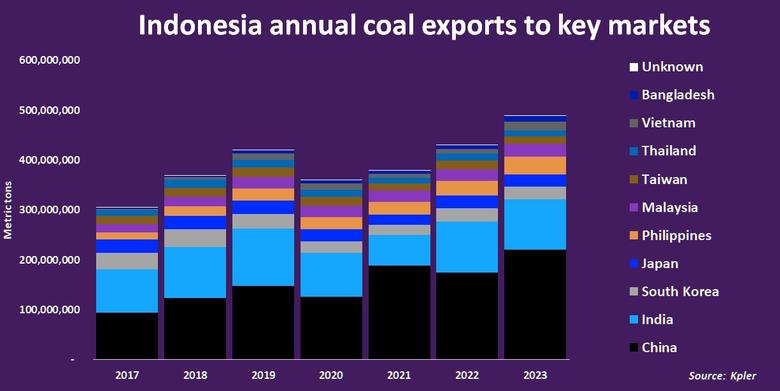

REUTERS - Feb 19, 2024 - The world's top exporter of thermal coal is on track to smash last year's record sales after projected shipments for the first two months of 2024 jumped nearly 25% from the same period in 2023.

Indonesian exports of thermal and thermal bituminous coal - used in power generation - are on track to top 90 million metric tons for January and February, up 24% from the same two months in 2023, ship tracking data from Kpler shows.

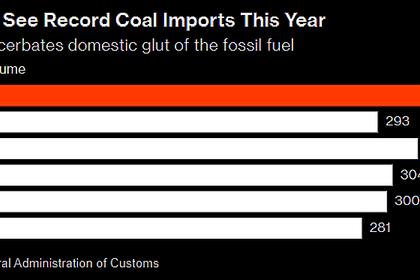

For 2023 as a whole, Indonesian exports scaled a new high of 504.6 million tons, so if the blistering pace of exports seen so far this year is sustained, 2024 will mark a new high for Indonesian exports of the high-polluting power fuel.

TOP DESTINATIONS & KNOWN UNKNOWNS

China, India, South Korea and the Philippines were the top markets for Indonesia coal so far this year, accounting for 33%, 15%, 5.8% and 5.1% respectively of the shipments so far.

Along with Japan, those markets were the top five destinations for Indonesian coal in 2023.

In volume terms, the 29.4 million tons shipped to China through February is nearly 9% less than shipped over the first two months of 2023.

However, Kpler ship-tracking data has assessed over 21 million tons of coal cargoes that have loaded or are being loaded but have yet to confirm their final destination on ship manifests.

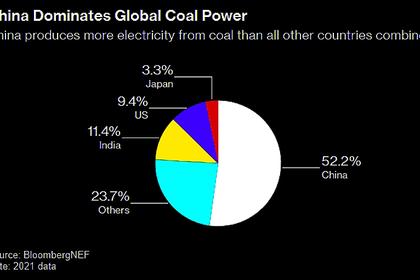

Many of those cargoes are likely bound for China, the world's largest coal consumer, but may not be confirmed until after the Lunar New Year break is over.

Shipments to India topped 13.5 million tons through February, which is the highest for that time slot since 2020.

India imported 100.85 million tons of Indonesian coal in total in 2023, and so far in 2024 Indonesian shipments are running around 3.5% ahead of the 2023 pace.

Exports to South Korea, Philippines, Japan and Malaysia were all slightly down from the same period in 2023, but are again likely to see upward revisions in those volumes towards the end of the month once ship manifests are updated.

A key driver of the extent of coal demand in those countries will be how well China's economy rebounds from the slump seen since 2022.

An enduring debt crisis across China's critical property arena has stifled activity in China's construction and heavy industry sectors. But Beijing is expected to unveil new stimulus measures at next month's parliamentary meetings aimed at reviving growth.

If successful, industrial activity and energy use will also pick up elsewhere in Asia as suppliers of materials and products to China also pick up steam.

Industrial activity and coal use are also expected to gather pace in Vietnam if China's economic growth improves.

Indonesian coal shipments bound for Vietnam are already on track to rise by close to 600,000 tons from the January-February period in 2023, to a record 2.15 million tons.

Vietnam imported a record 17.6 million tons in 2023 as a whole, so is already running well ahead of the pace needed to scale new highs in 2024.

If China's construction industry stages a recovery in 2024, that will spur increased demand throughout the construction materials and parts supply chain which extends into Vietnam in the form of cement and steel plants.

In turn, that could push Vietnam's total coal consumption levels up another gear as overall energy use rises in conjunction with industrial output, and help Indonesian coal exporters realize a fresh record sales total by the end of the year.

-----

Earlier: