OIL PRICE: BRENT NEAR $79, WTI NEAR $74

REUTERS - Feb, 2024 - Oil prices rose in early trade on Friday following a decision by OPEC+ to keep its oil output policy unchanged, though benchmarks were headed for weekly losses amid unsubstantiated reports of a ceasefire between Israel and Hamas.

Brent crude futures climbed 37 cents, or 0.5%, to $79.07 a barrel at 0415 GMT, while U.S. West Texas Intermediate crude futures gained 30 cents, or 0.4%, to $74.12 a barrel.

On Thursday, two OPEC+ sources said the group has kept its oil output policy unchanged, and will decide in March whether or not to extend the voluntary oil production cuts in place for the first quarter.

The Organization of the Petroleum Exporting Countries (OPEC) and allies led by Russia, known as OPEC+, has output cuts of 2.2 million barrels per day (bpd) in place for the first quarter, as announced in November.

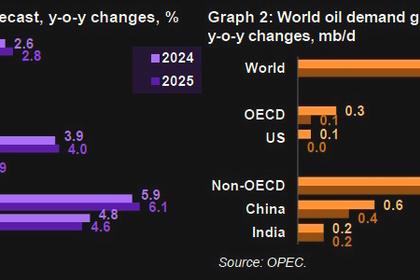

ANZ Research analysts said in a Friday note those production cuts should keep supply tight in the first quarter, with non-OPEC production increases set to normalise and U.S. output growth slowing in 2024 to 300,000 barrels per day (bpd) from 800,000 bpd last year.

Also supporting oil prices were the U.S. Federal Reserve's decision to keep the benchmark overnight interest rate in the 5.25-5.50% range and comments by Chair Jerome Powell who said interest rates had peaked and would move lower in coming months.

Lower interest rates would reduce consumer borrowing costs, which can boost economic growth and oil demand.

However, oil prices were headed for weekly losses of about 5%, as unsubstantiated reports of a ceasefire between Israel and Hamas capped gains and caused the contracts to settle more than 2% lower on Thursday.

"The recent reports on the progress toward an extended Israel-Hamas ceasefire, which could fizzle current geopolitical stress (are) keeping oil investors on the sidelines," said Priyanka Sachdeva, a senior market analyst at Phillip Nova.

Russian oil tankers have also continued to sail through the Red Sea, largely uninterrupted by Houthi attacks, contrasting with market beliefs of extensive disruptions to global oil supply flow, Sachdeva added.

In latest shipping tensions, the Iran-aligned group said on Thursday their naval forces had targeted an unidentified British merchant vessel in the Red Sea.

-----

Earlier: