OIL PRICE: BRENT NEAR $82, WTI ABOVE $76

РЕЙТЕР -

-----

Раньше:

2018, March, 14, 11:45:00

REUTERS - U.S. West Texas Intermediate (WTI) crude futures CLc1 were at $60.77 a barrel at 0753 GMT, up 6 cents, or 0.1 percent, from their previous settlement. Brent crude futures LCOc1 were at $64.62 per barrel, down just 2 cents from their last close.

|

2018, March, 7, 15:00:00

РЕЙТЕР - К 9.17 МСК фьючерсы на североморскую смесь Brent опустились на 0,85 процента до $65,23 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $62,07 за баррель, что на 0,85 процента ниже предыдущего закрытия.

|

2018, March, 7, 14:00:00

EIA - North Sea Brent crude oil spot prices averaged $65 per barrel (b) in February, a decrease of $4/b from the January level and the first month-over-month average decrease since June 2017. EIA forecasts Brent spot prices will average about $62/b in both 2018 and 2019 compared with an average of $54/b in 2017.

|

2018, March, 5, 11:35:00

РЕЙТЕР - К 9.28 МСК фьючерсы на североморскую смесь Brent поднялись на 0,33 процента до $64,58 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $61,44 за баррель, что на 0,31 процента выше предыдущего закрытия.

|

2018, March, 4, 11:30:00

МИНФИН РОССИИ - Средняя цена нефти марки Urals по итогам января – февраля 2018 года составила $ 65,99 за баррель.

|

2018, February, 27, 14:15:00

РЕЙТЕР - К 9.18 МСК фьючерсы на североморскую смесь Brent опустились на 0,15 процента до $67,40 за баррель. Фьючерсные контракты на американскую лёгкую нефть WTI к этому времени торговались у отметки $63,80 за баррель, что на 0,17 процента ниже предыдущего закрытия.

|

2018, February, 27, 14:05:00

МИНФИН РОССИИ - Средняя цена на нефть Urals за период мониторинга с 15 января по 14 февраля 2018 года составила $66,26457 за баррель, или $483,7 за тонну.

|

OIL PRICE: BRENT NEAR $82, WTI ABOVE $76

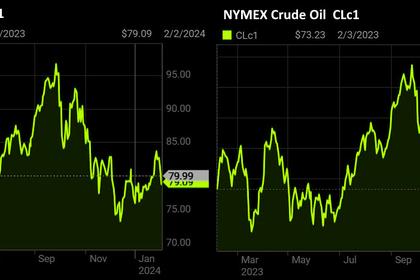

REUTERS - Feb 9, 2024 - Oil prices were little changed on Friday, staying on track for weekly gains, with tensions persisting in the Middle East after Israel rejected a ceasefire offer from Hamas.

Brent crude futures slipped 1 cent to $81.62 a barrel by 0334 GMT, while U.S. West Texas Intermediate crude futures rose 3 cents to $76.25 a barrel.

Both benchmarks rose about 3% in the previous session as Israeli forces bombed the southern border city of Rafah on Thursday after Prime Minister Benjamin Netanyahu rejected a proposal to end the war in the Palestinian enclave.

The tensions have kept oil prices elevated, with Brent and WTI both set to gain more than 5% for the week.

"The move yesterday seemed a bit excessive on the back of not very much at least in terms of fundamentals," ING's head of commodities research Warren Patterson said.

"I still expect the rangebound trading that we have become accustomed to recently will continue given the comfortable oil balance."

U.S. officials made their most pointed criticism so far of Israel's civilian casualties in Gaza as it turned the focus of its offensive to Rafah.

A Hamas delegation arrived in Cairo on Thursday for ceasefire talks with mediators Egypt and Qatar.

While the conflict has propped up prices, there has been no impact on oil production.

Non-OPEC output from Norway and Guyana is increasing while Russia is exporting more crude in February than it planned following a combination of drone attacks and technical outages at its refineries that could undermine its pledge to curb sales under an OPEC+ pact.

Under the deal with the Organization of the Petroleum Exporting Countries and allies, called OPEC+, Russia committed to capping crude output at 9.5 million barrels per day (bpd). It is also voluntarily cutting crude exports by 300,000 bpd and fuel exports by 200,000 bpd from the average May-June level.

Deflation risks in China, the world's top crude oil importer, are also weighing on global oil prices, IG analyst Tony Sycamore said.

"I think the lower crude oil price in Asia is largely due to early weakness in China's equity markets and the fallout from yesterday's shocking CPI figure in China which has served to further undermine confidence ahead of the Lunar New Year celebrations," he added.

-----

Earlier:

2024, February, 7, 06:55:00

RUSSIAN OIL FOR INDIA

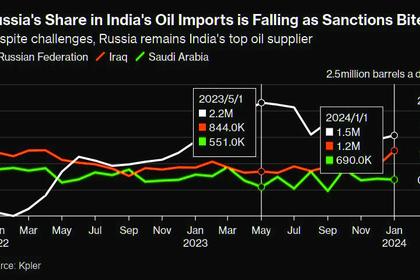

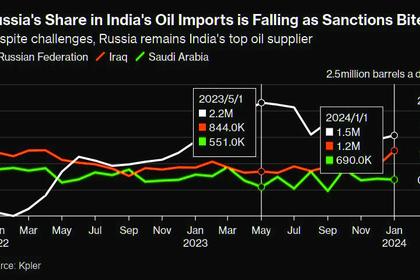

Oil imports from Russia, negligible before Moscow’s invasion of Ukraine, climbed steadily through 2022 and the first half of last year as India saw an opportunity to procure discounted barrels. Russia overtook traditional suppliers like Iraq and Saudi Arabia.

2024, February, 2, 06:55:00

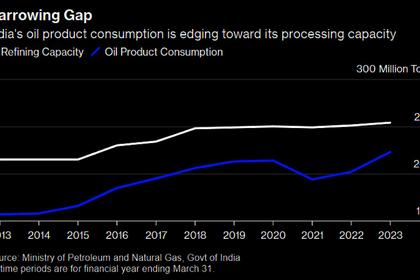

INDIA NEED OIL REFINING

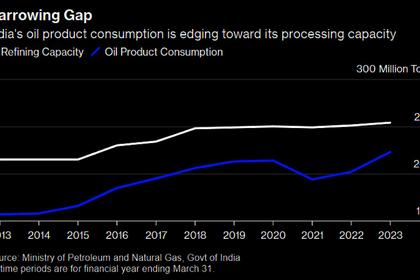

India’s refining capacity is projected to increase by 56 million tons by 2028, Junior Oil Minister Rameswar Teli said last month, without elaborating. That equates to an overall capacity boost of 22%, or 1.12 million barrels a day.

2024, January, 29, 06:40:00

CHINA NEED OIL & GAS

CNOOC expects production to continue growing over the next two years, with plans to reach 2.25 million boe/d in 2026.

2024, January, 24, 06:40:00

U.S., RUSSIA OIL SANCTIONS

In the last few months of 2023, the US ramped up enforcement of the price cap and imposed multiple rounds of sanctions on entities and ships that carried Russian crude oil above the price cap.

All Publications »

Tags:

OIL,

PRICE,

BRENT,

WTI,

OPEC,

RUSSIA,

SANCTIONS